- United States

- /

- Insurance

- /

- NYSE:MMC

Marsh McLennan (MMC): Exploring Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

Marsh & McLennan Companies (MMC) stock saw a modest move in recent trading, and investors are weighing how its performance fits into longer-term trends. Shares are down about 13% over the past month, even though company fundamentals have remained steady.

See our latest analysis for Marsh & McLennan Companies.

Despite the recent slump, Marsh & McLennan’s 1-year total shareholder return of -18.8% stands in sharp contrast to the company’s impressive 71% five-year total return. Short-term momentum continues to fade as investors reassess risk and valuation. After this run, the latest share price sits at $180.05, reflecting cautious sentiment even as the underlying business remains steady.

If you’re looking to broaden your investing perspective beyond insurance, now's a fitting moment to see what’s trending among fast growing stocks with high insider ownership.

With shares now trading nearly 19% below analyst price targets and more than 30% below some intrinsic value estimates, investors must ask whether today’s weakness reveals a true buying opportunity or if the market has already priced in growth for the future.

Most Popular Narrative: 16% Undervalued

With Marsh & McLennan Companies last closing at $180.05, the most widely followed narrative points to a fair value that is meaningfully higher. This storyline relies on specific business catalysts and forward-looking assumptions that could drive a re-rating, setting the stage for a pivotal outlook.

Strategic investments in digital transformation, advanced analytics, and AI (such as proprietary data tools for risk modeling and agentic interfaces) are expected to enhance operational efficiency and improve product and service offerings. These developments could enable margin expansion and net earnings growth through improved client retention and lower cost to serve.

Want to see what’s sparking this sharp valuation gap? The full narrative hints at a transformative digital shift and bold assumptions about future profitability. Could an ambitious margin target and new revenue streams be the secret sauce? Do not miss the inside story that recalibrates expectations for this insurance giant.

Result: Fair Value of $214.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a persistent decline in insurance pricing or faltering returns from large acquisitions could quickly challenge this undervaluation thesis and shift sentiment.

Find out about the key risks to this Marsh & McLennan Companies narrative.

Another View: Are Multiples Sending a Different Signal?

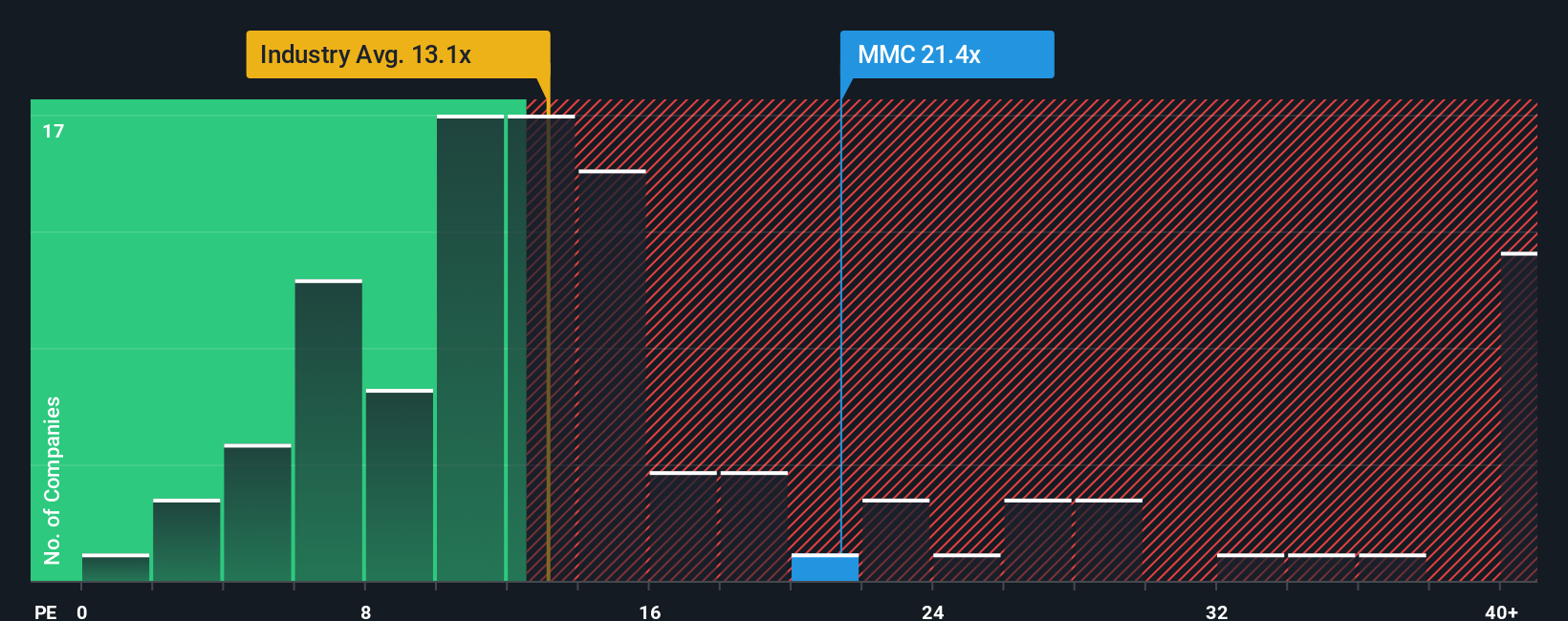

While the narrative-driven fair value points to MMC being undervalued, traditional price-to-earnings ratios paint a riskier picture. At 21.4x, MMC trades significantly above the US Insurance industry average of 13.2x, as well as the fair ratio of 15.3x. This gap means the stock is priced for higher growth or quality. What happens if the market narrows that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marsh & McLennan Companies Narrative

If you see the numbers differently or want to craft your own outlook, you can create a personalized Marsh & McLennan story with just a few clicks. Do it your way.

A great starting point for your Marsh & McLennan Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Do not let great ideas slip through your fingers. Use these powerful search tools to seek out dynamic market leaders or hidden gems before the crowd catches on.

- Tap into stable cash flows and future growth potential by browsing these 875 undervalued stocks based on cash flows offering exceptional value based on their underlying fundamentals.

- Seize the potential of biotech and digital medicine by reviewing these 32 healthcare AI stocks making breakthroughs with AI-driven healthcare solutions.

- Accelerate your hunt for unconventional gains with these 82 cryptocurrency and blockchain stocks pushing the boundaries of blockchain and digital finance innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMC

Marsh & McLennan Companies

A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives