- United States

- /

- Insurance

- /

- NYSE:BRO

Should Brown & Brown's (BRO) Acquisition Focus and Pause on Buybacks Shift Investor Expectations?

Reviewed by Sasha Jovanovic

- Brown & Brown, Inc. recently announced its third quarter 2025 results, reporting revenue of US$1.61 billion and net income of US$227 million, alongside an active acquisition outlook according to their CEO's commentary on seeking both domestic and international deals.

- While revenue increased compared to the prior year, net income saw a slight decline and the company paused share repurchases for this period, completing earlier buybacks totaling over 16.5 million shares.

- Given the CEO's ongoing focus on acquisitions, we'll examine how this pursuit of expansion may reshape Brown & Brown's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Brown & Brown Investment Narrative Recap

To be a Brown & Brown shareholder, you need to believe in the company's strategy of disciplined growth through acquisitions, balanced by effective cost control and a diversified business model. The recent third-quarter results reinforced this approach with revenue growth and continued M&A ambition, while the pause in share repurchases and the dip in net income do not materially alter the short-term catalyst of acquisition-driven expansion, though they add some caution regarding earnings momentum and integration risk in the near term.

The most relevant recent announcement comes from CEO J. Brown, who signaled an active acquisition pipeline across both domestic and international markets, suggesting the company remains focused on external growth. This aligns directly with the company’s stated catalyst and supports the broader investment narrative, indicating acquisition activity may continue to shape Brown & Brown’s prospects even in periods of mixed profitability. For those watching closely, however, it’s worth noting that despite growing revenues, a sustained margin squeeze could eventually affect...

Read the full narrative on Brown & Brown (it's free!)

Brown & Brown's narrative projects $9.0 billion revenue and $1.6 billion earnings by 2028. This requires 21.9% yearly revenue growth and a $606 million earnings increase from $994 million today.

Uncover how Brown & Brown's forecasts yield a $97.08 fair value, a 24% upside to its current price.

Exploring Other Perspectives

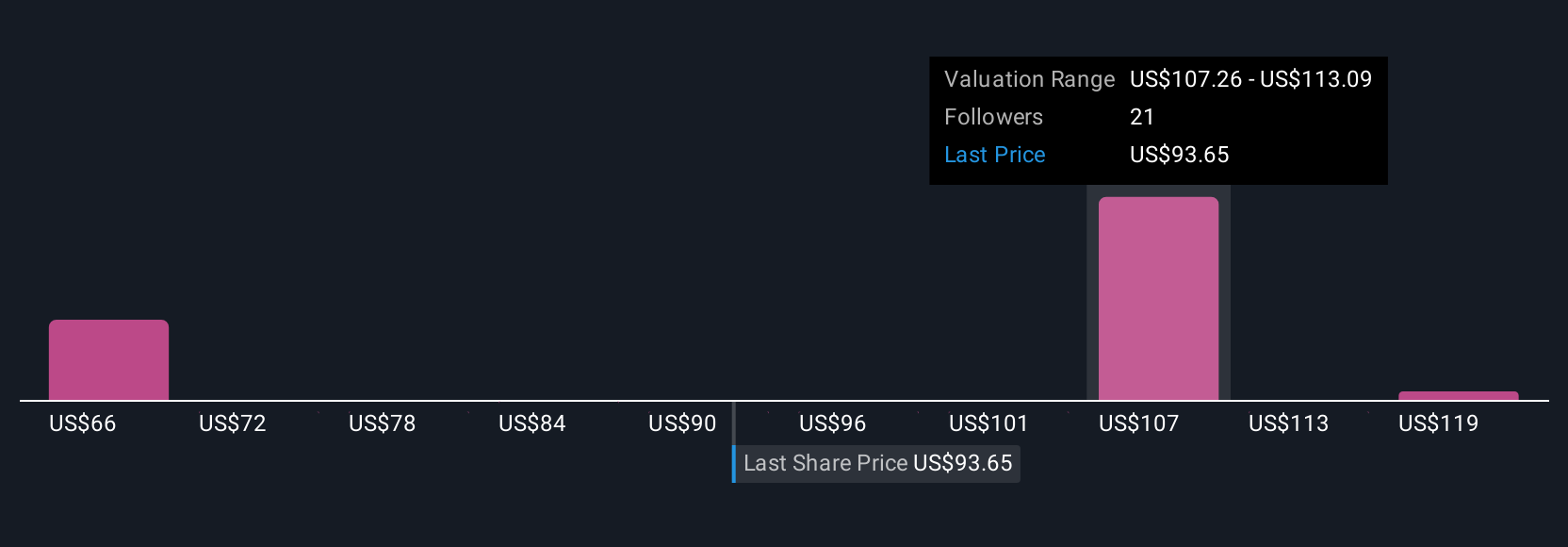

Five members of the Simply Wall St Community see fair values for Brown & Brown ranging widely from US$67.21 to US$120.18 per share. In light of ongoing acquisition plans, expectations around how successfully new businesses integrate could play a central role in shaping future shareholder returns and risk.

Explore 5 other fair value estimates on Brown & Brown - why the stock might be worth 14% less than the current price!

Build Your Own Brown & Brown Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brown & Brown research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brown & Brown research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brown & Brown's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives