- United States

- /

- Insurance

- /

- NYSE:AXS

Why AXIS Capital Holdings (AXS) Is Up 6.3% After Strong Q3 Results and New Shelf Registration – And What’s Next

Reviewed by Sasha Jovanovic

- AXIS Capital Holdings Limited reported strong third quarter results with revenue of US$1,674.28 million and net income of US$301.86 million, followed by the filing of a universal shelf registration covering common shares, preference shares, depositary shares, debt securities, warrants, purchase contracts, and purchase units.

- This sequence of events positions the company to potentially access capital markets following improved earnings momentum, which could increase flexibility for future initiatives or investments.

- We’ll examine how the universal shelf registration can influence AXIS Capital Holdings’ investment narrative and future financial flexibility.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

AXIS Capital Holdings Investment Narrative Recap

AXIS Capital Holdings appeals to investors who believe in the company’s ability to grow specialty insurance offerings and maintain profitability by leveraging efficient underwriting and a strong capital base. The recent universal shelf registration gives AXIS potential access to additional capital, but it does not materially impact the most important near-term catalyst: accelerating demand for specialty insurance. Meanwhile, the biggest risk remains heightened exposure to evolving cyber risks, which is not directly affected by the filing.

Among recent announcements, the company’s third quarter results stand out, with revenue and net income both increasing year-over-year. This earnings momentum supports AXIS’s ability to pursue future investments or strategic shifts if capital markets access is needed, reinforcing its position among specialty insurers focused on margin and customer growth.

However, in contrast, investors should be aware that ongoing pricing pressure in key business lines could...

Read the full narrative on AXIS Capital Holdings (it's free!)

AXIS Capital Holdings is expected to reach $7.0 billion in revenue and $1.1 billion in earnings by 2028. This outlook is based on a forecast revenue growth rate of 3.9% per year and reflects a $238.5 million increase in earnings from the current $861.5 million.

Uncover how AXIS Capital Holdings' forecasts yield a $115.78 fair value, a 16% upside to its current price.

Exploring Other Perspectives

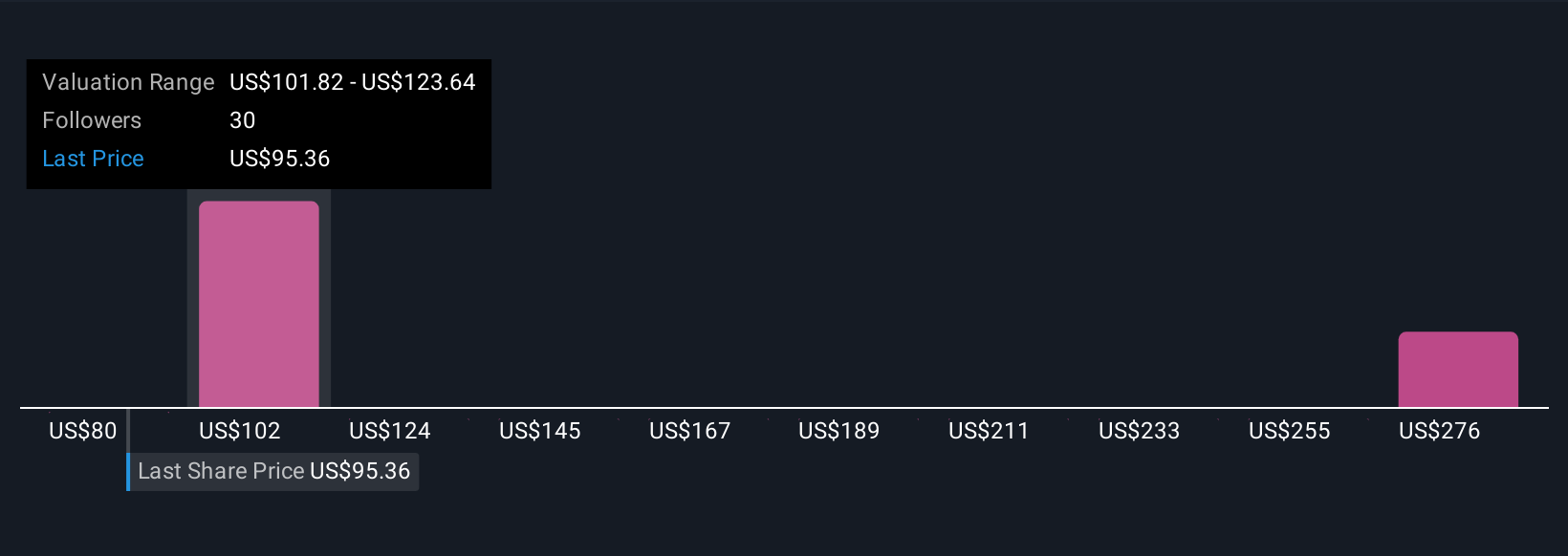

Three investors from the Simply Wall St Community placed fair values for AXIS Capital ranging from US$115.78 to US$316.94 per share. While many see upside, evolving cyber and ransomware risks remain a central concern that could shape results moving forward; explore more views from the community.

Explore 3 other fair value estimates on AXIS Capital Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own AXIS Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AXIS Capital Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AXIS Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AXIS Capital Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXS

AXIS Capital Holdings

Through its subsidiaries, provides various specialty insurance and reinsurance products in Bermuda, the United States, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives