- United States

- /

- Insurance

- /

- NYSE:AJG

Is Revenue Growth and Acquisition Momentum Reshaping the Investment Outlook for Arthur J. Gallagher (AJG)?

Reviewed by Sasha Jovanovic

- Arthur J. Gallagher & Co. recently reported its third quarter 2025 results, showing revenue growth to US$3.37 billion and net income of US$272.7 million, alongside affirming a regular quarterly dividend of US$0.65 per share.

- The company also highlighted a series of acquisitions completed during the period, signaling an ongoing focus on expanding its global presence and strengthening its service offerings.

- We’ll consider how the combination of rising revenues and continued acquisition activity shapes Arthur J. Gallagher’s investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Arthur J. Gallagher Investment Narrative Recap

To be a shareholder in Arthur J. Gallagher, you need confidence in their ability to drive consistent growth by expanding globally through acquisitions, while carefully managing integration and market risks. The latest results highlight persistent revenue growth from ongoing M&A activity, but also reveal margin pressure with net income slightly lower year-over-year, a minor short-term catalyst shift, yet no material impact on the most significant risk: the challenge of integrating acquired businesses without eroding profitability.

Of the recent announcements, the completion of multiple acquisitions, including Dolphin TopCo and Woodruff Sawyer, during the quarter stands out. This continues to reinforce the company’s central growth catalyst: broadening its global footprint and deepening its service offerings, but also aligns closely with integration risk, as successful assimilation of these acquisitions is crucial to delivering expected benefits.

Yet, unlike the encouraging revenue gains, investors should pay close attention to how ongoing acquisition integration risk could potentially undermine...

Read the full narrative on Arthur J. Gallagher (it's free!)

Arthur J. Gallagher is projected to reach $19.5 billion in revenue and $3.5 billion in earnings by 2028. This outlook assumes a 19.0% annual revenue growth rate and an increase in earnings of $1.9 billion from the current $1.6 billion.

Uncover how Arthur J. Gallagher's forecasts yield a $327.07 fair value, a 30% upside to its current price.

Exploring Other Perspectives

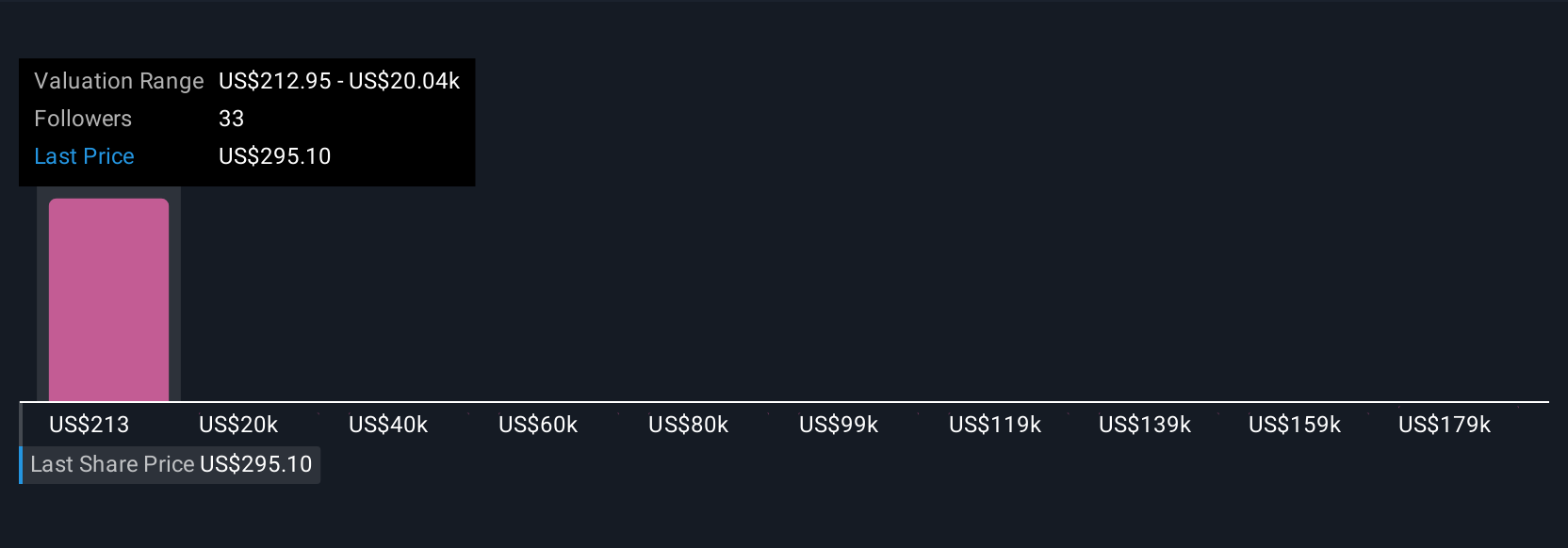

You’ll find six individual fair value estimates from the Simply Wall St Community, ranging from just US$239 to US$198,517. Given Arthur J. Gallagher’s consistent M&A-driven expansion, these differences underscore how personal outlooks on integration risk and growth prospects can dramatically affect performance expectations. Seek out varying viewpoints before making decisions.

Explore 6 other fair value estimates on Arthur J. Gallagher - why the stock might be worth just $239.00!

Build Your Own Arthur J. Gallagher Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Arthur J. Gallagher research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arthur J. Gallagher's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives