- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): Evaluating Valuation Following Recent 12% Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Arthur J. Gallagher.

After a strong run over the past few years, Arthur J. Gallagher’s recent 12% dip from its highs reflects growing caution around its valuation, even as broader momentum gradually fades. While the company has delivered an impressive 161.6% total shareholder return over five years, the past twelve months saw a 5.4% drop in total return. This highlights a shift from long-term outperformance to more muted recent results.

If you’re weighing your next move given recent volatility, this could be a great moment to broaden your search and uncover fast growing stocks with high insider ownership

With the recent pullback and solid long-term performance, investors are left asking whether Arthur J. Gallagher’s current share price reflects an undervalued opportunity or if the market has already accounted for its future growth potential.

Most Popular Narrative: 21% Undervalued

With Arthur J. Gallagher closing at $267.50 and the most-followed narrative putting its fair value above $320, there is a sizable valuation gap grabbing attention. The latest analysis points to bold assumptions for future revenues and margins that could unlock outsized returns if delivered.

Broader adoption of digital tools, enhanced data analytics, and early-stage AI projects within the company's operations are producing measurable efficiency improvements and margin expansion. This is positioning net margins and overall profitability for continued long-term growth.

Want a peek behind the curtain on this aggressive fair value? At the core are huge top-line growth, improving profit margins, and a future earnings multiple most companies only dream about. What concrete projections power this bullish outlook? Find out in the complete narrative.

Result: Fair Value of $339.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a prolonged downturn in property insurance rates or integration challenges from ongoing acquisitions could quickly undermine these upbeat projections and valuation assumptions.

Find out about the key risks to this Arthur J. Gallagher narrative.

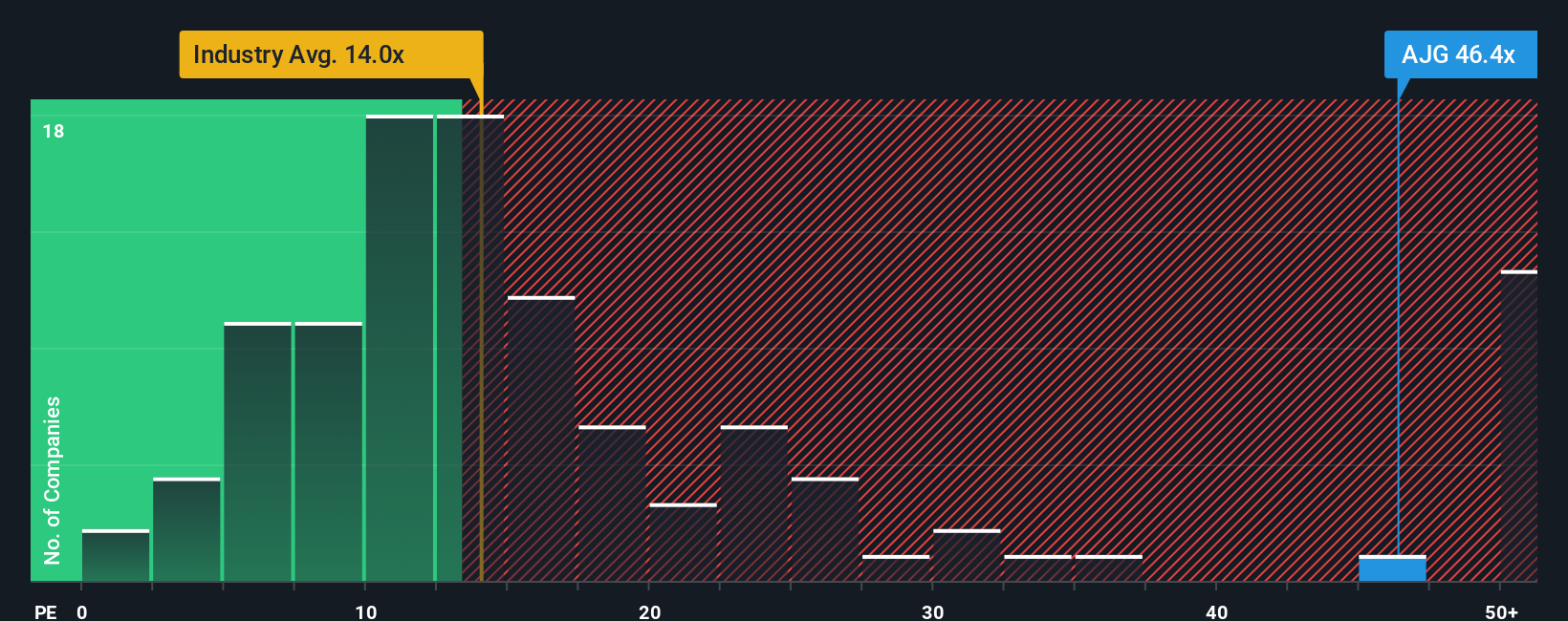

Another View: Trading Multiples Paint a Cautious Picture

While the fair value approach signals Arthur J. Gallagher is undervalued, looking through the lens of price-to-earnings reveals a different story. The company trades at 41.8 times earnings, nearly triple the US Insurance industry average of 13.5 and well above its fair ratio of 20.7. This sizable gap could mean the market is optimistic, or simply ignoring risks. Is the business strong enough to justify such a premium, or is sentiment ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If you see things differently or prefer hands-on research, you can dive in and shape your own perspective on Arthur J. Gallagher’s outlook in just minutes. Do it your way

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not let opportunity pass by when standout stocks could be just a click away. The best moves often come from thinking beyond the usual suspects. Use these powerful screeners to give your portfolio an edge before trends take off.

- Supercharge your potential income by tapping into these 21 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3%.

- Tap into the future of healthcare by researching these 34 healthcare AI stocks, packed with trailblazing firms using artificial intelligence to disrupt medical science.

- Boost your search for value by targeting these 864 undervalued stocks based on cash flows, where you can find companies the market might be undervaluing based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives