- United States

- /

- Insurance

- /

- NYSE:AIZ

Assurant (AIZ) Is Up 6.0% After Beating Q3 Earnings and Raising Its 2025 Outlook Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Assurant announced in early November 2025 that it exceeded third-quarter earnings expectations, with revenue rising to US$3.23 billion and net income reaching US$265.6 million, driven by growth across its Global Housing and Global Lifestyle segments and lower catastrophe losses.

- The company also raised its full-year outlook and continued its share buyback program, highlighting confidence in ongoing operational strength and shareholder returns.

- We'll explore how Assurant's strong segment results and higher outlook may influence its future investment appeal and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Assurant Investment Narrative Recap

To be a shareholder in Assurant, you need to believe in the company’s ability to drive steady growth by expanding protection services in connected devices, homes, and vehicles, leveraging innovation and recurring partnerships. The company’s recent earnings beat reinforces confidence in operational execution, and the raised outlook addresses short-term catalysts around earnings momentum; the primary risk of regulatory scrutiny in its lender-placed insurance business remains largely unchanged for now.

One particularly relevant announcement is Assurant’s update on its share buyback program, having repurchased US$108.3 million worth of shares last quarter and completing 4.43% of its total buyback authorization. This continued commitment to returning capital provides further support for the short-term earnings catalyst reflected in the outlook upgrade, though it does not materially alter the regulatory risk profile.

However, while earnings and buybacks stand out, investors should remain alert to regulatory developments in lender-placed insurance, as...

Read the full narrative on Assurant (it's free!)

Assurant's outlook anticipates $14.2 billion in revenue and $1.2 billion in earnings by 2028. This is based on an assumed 4.9% annual revenue growth rate and an earnings increase of $483 million from the current earnings of $717 million.

Uncover how Assurant's forecasts yield a $246.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

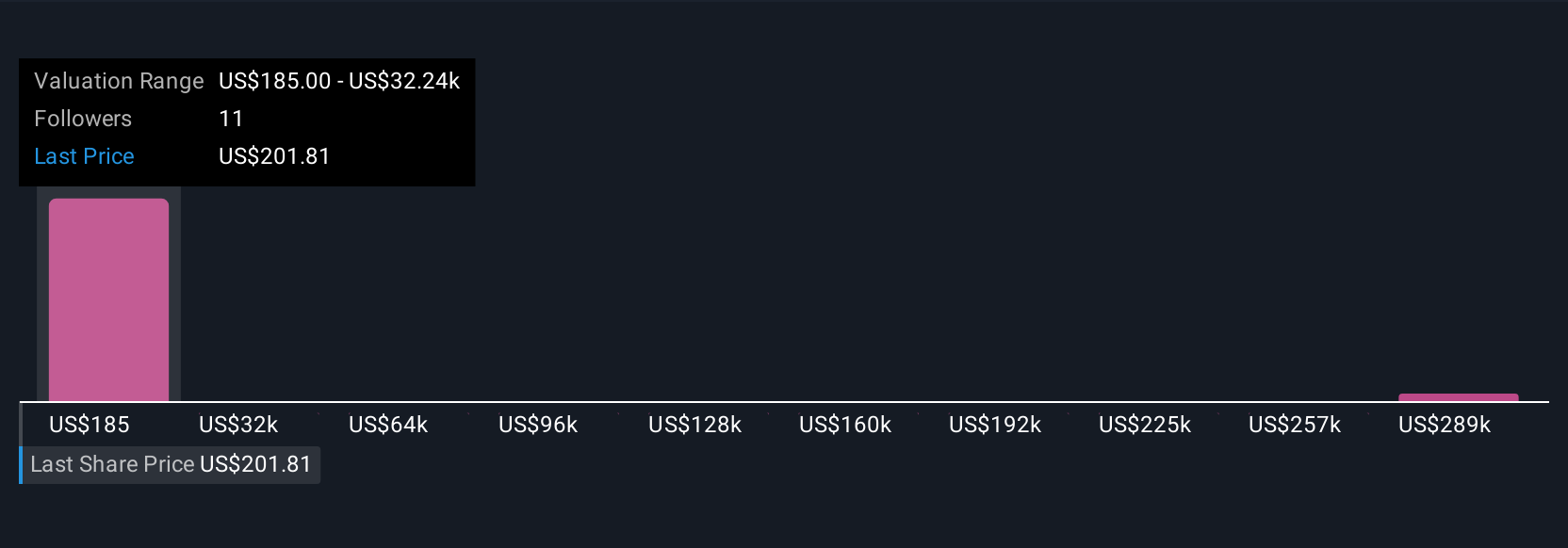

Simply Wall St Community fair value estimates for Assurant range from US$185 to US$320,700 across four viewpoints, revealing extreme differences in outlook. With heightened regulatory risks remaining in focus, you will find several alternative perspectives on what drives the company’s long-term trajectory.

Explore 4 other fair value estimates on Assurant - why the stock might be worth 18% less than the current price!

Build Your Own Assurant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assurant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Assurant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assurant's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives