- United States

- /

- Insurance

- /

- NYSE:AIZ

Assurant (AIZ): Evaluating Valuation After Strong Q3 Growth, Upgraded Outlook, and Strategic Partnerships

Reviewed by Simply Wall St

Assurant (AIZ) reported strong third-quarter earnings, driven by growth in its Global Housing and Global Lifestyle segments. In addition to positive financial results, the company raised its 2025 outlook and announced new strategic partnerships.

See our latest analysis for Assurant.

Assurant’s upbeat earnings, raised outlook, and active buyback program have generated fresh optimism. This is reflected in a 3.46% one-day share price return and a solid 8.74% total shareholder return over the past year. With momentum building on the back of strategic partnerships and consistent long-term gains, investors are taking notice as the company continues to reward shareholders.

If strong execution and capital returns like these are on your radar, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But does Assurant’s recent earnings strength, ongoing buybacks, and raised outlook mean the stock is still undervalued, or has the market already priced in these bright prospects? Could there still be a compelling buying opportunity?

Most Popular Narrative: 8.8% Undervalued

Assurant’s most widely followed narrative puts its fair value above where shares last closed, suggesting an optimistic path ahead. The stage is set for rapid transformation, powered by evolving business models and tech-focused expansion.

Assurant is capitalizing on the proliferation of connected devices and increasing device protection needs, demonstrated by 2.4 million net new device protection subscribers, international acquisitions expanding repair capabilities, and strong new partnerships. This positions the company for sustained revenue growth and improved recurring earnings in its Lifestyle segment.

Curious about the surprising financial projections that underpin this narrative? The secret is that the valuation hinges on bold expectations for margin growth and future profits. Find out what’s fueling analysts’ confidence and see which quantitative leaps drive the price target.

Result: Fair Value of $246 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory scrutiny in Global Housing or rising digital competition could quickly challenge the current momentum and put pressure on future growth estimates.

Find out about the key risks to this Assurant narrative.

Another View: What Do the Multiples Say?

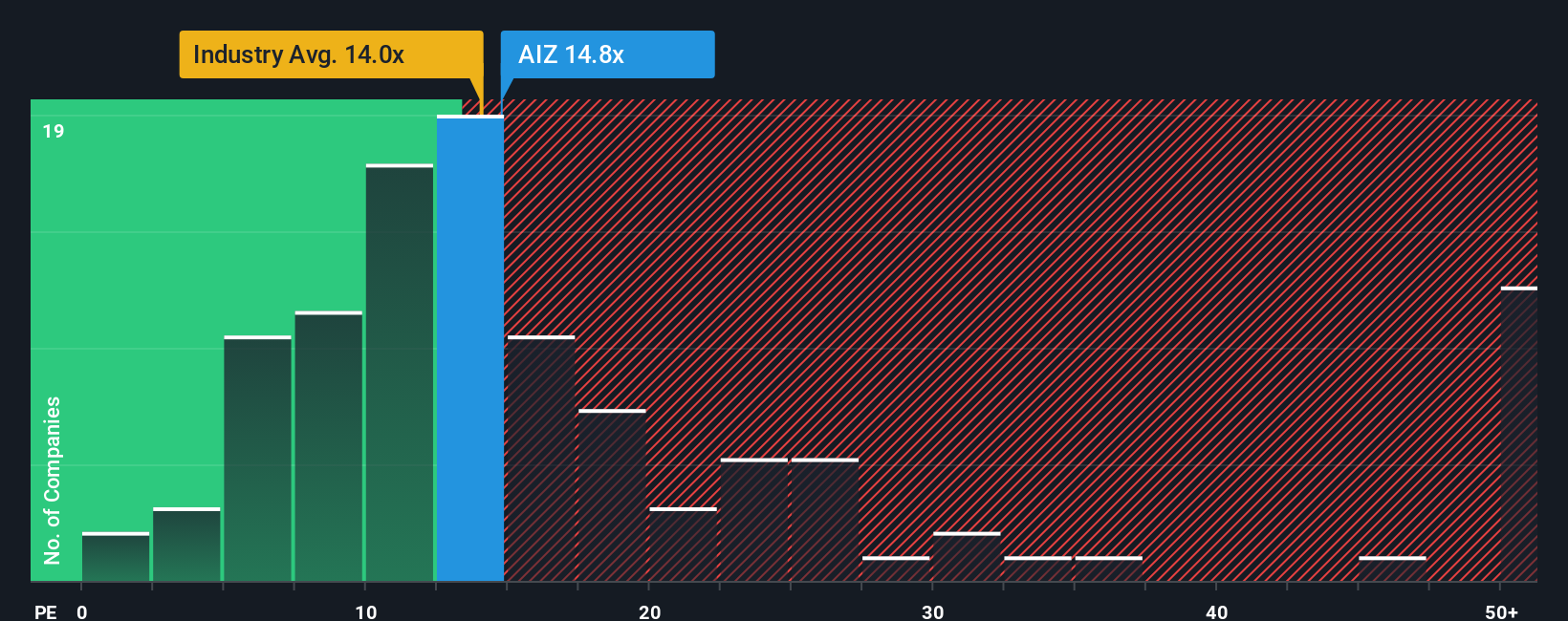

Looking at valuation through earnings multiples reveals a more cautious picture. Assurant currently trades at 13.2 times earnings, which is nearly identical to the US Insurance industry average and just above its peer group average of 13.1x. Interestingly, this is slightly below what our analysis suggests is a fair ratio for the stock (14x). This may hint at limited upside if the market shifts toward this benchmark. Does this leave much room for major price gains, or is the opportunity already reflected?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Assurant Narrative

If you see the story differently, or want to dig into the numbers yourself, it takes under three minutes to build your own narrative. Do it your way

A great starting point for your Assurant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Thousands of investors are already snapping up tomorrow’s winners using our unique screeners. Take action now so you’re not left behind when new opportunities break out.

- Tap into long-term wealth by checking out these 16 dividend stocks with yields > 3%, which highlights top picks paying yields above 3% for steady income growth.

- Ride the next technological revolution with these 25 AI penny stocks and see which AI-driven names could be set for extraordinary gains.

- Get ahead of the market using these 876 undervalued stocks based on cash flows to spot stocks currently trading below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives