- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (WTW): Assessing Valuation After Profit Turnaround and Major Share Buyback

Reviewed by Simply Wall St

Willis Towers Watson (WTW) released third quarter results that showed a swing from heavy losses to positive net income. The company also wrapped up a major share buyback this past quarter. Investors are watching closely.

See our latest analysis for Willis Towers Watson.

The strong third quarter turnaround and robust buyback seem to have encouraged investors, with the stock finishing at $326.05 and posting a 4.14% 7-day share price return. Momentum has been steadier rather than spectacular, but long-term performance stands out, with a 44.95% total shareholder return over three years and nearly 69% over five. Willis Towers Watson has rewarded patient holders.

If you’re curious what other stocks have been building momentum, it’s an ideal moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares already rebounding and trading near long-term highs, investors may wonder if Willis Towers Watson is still attractively valued or if the market has fully accounted for its future growth potential and buyback boost.

Most Popular Narrative: 12.3% Undervalued

Willis Towers Watson’s widely followed narrative estimates a fair value of $371.61, a notable premium over the last closing price of $326.05. This sets the stage for a deeper dive into the assumptions driving the valuation story.

“Several bullish analysts have raised their price targets, citing improving free cash flow conversion rates and expectations for continued adjusted EBITDA margin expansion through 2027. Organic revenue growth in the risk and broking segment remains above average. Management engagement is reinforcing confidence in sustained expansion and superior execution.”

Want to see the engine behind this bold price target? There is a crucial mix of margin improvements and revenue assumptions shaping this narrative. Curious about what future performance the analysts are considering? Explore how optimistic financial projections set the scene.

Result: Fair Value of $371.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as increased industry competition and regulatory pressures could reduce margins and create challenges for Willis Towers Watson's current growth trajectory.

Find out about the key risks to this Willis Towers Watson narrative.

Another View: Multiples Tell a Different Story

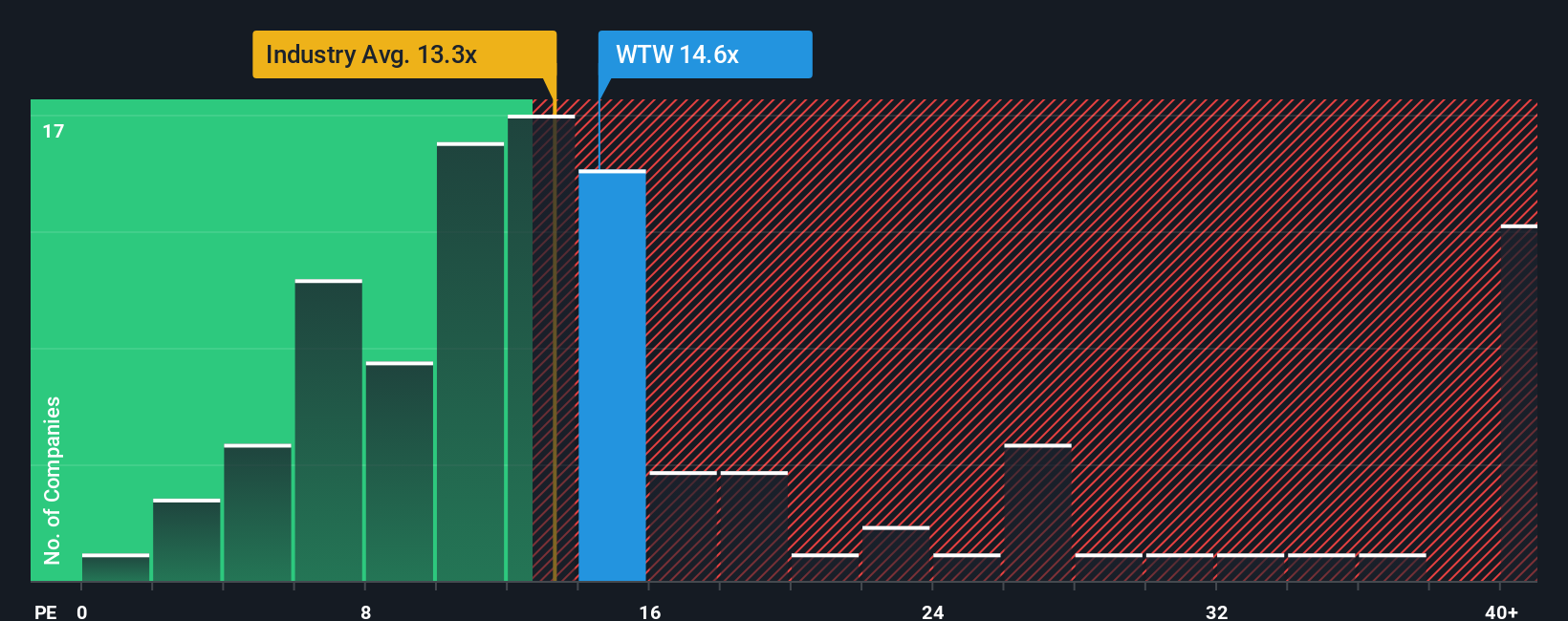

While analysts see Willis Towers Watson as undervalued based on future earnings and growth, market pricing gives a different perspective. Its price-to-earnings ratio stands at 14.8x, higher than the US Insurance industry average of 13.2x and well above a fair ratio of 9.9x. This suggests the shares could be expensive in the current context. Is the market overestimating WTW’s premium, or is there more upside left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willis Towers Watson Narrative

If you see things differently, or want to dig deeper into the numbers on your own, it takes just a few minutes to build a narrative from your own perspective. Do it your way

A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Make your next smart move by checking out unique investment ideas you may not have considered. These timely opportunities could spark your portfolio’s next growth story. Don’t wait for the crowd to catch up.

- Grow your passive income stream and see which companies pay steady, attractive yields through these 16 dividend stocks with yields > 3%.

- Tap into the digital wave by reviewing these 82 cryptocurrency and blockchain stocks, gaining traction as blockchain disrupts more industries each day.

- Spot tomorrow’s winners trading at a bargain by analyzing these 875 undervalued stocks based on cash flows, backed by robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives