- United States

- /

- Household Products

- /

- NYSE:SPB

Assessing Spectrum Brands Holdings (SPB) Valuation After Recent Share Price Recovery

Reviewed by Simply Wall St

Spectrum Brands Holdings (SPB) has seen its stock navigate several changes lately, with investors keeping a close eye on its performance. Over the past month, shares have gained 4%, offering a fresh look at the company’s recent trajectory.

See our latest analysis for Spectrum Brands Holdings.

Zooming out, Spectrum Brands Holdings’ 1-month share price return of 3.8% hints at a modest short-term rebound. However, the bigger story is its challenging run this year, capped by a one-year total shareholder return of -39.9%. That kind of drop suggests sentiment is still cautious, even though recent momentum has picked up slightly.

If you’re looking to broaden your perspective beyond recent movers in the household sector, now’s a perfect moment to discover fast growing stocks with high insider ownership.

With recent losses still fresh but valuation metrics hinting at a significant discount, the key question is clear: is Spectrum Brands Holdings now an undervalued opportunity, or is the market rightly cautious and already pricing in what is ahead?

Most Popular Narrative: 31.2% Undervalued

Spectrum Brands Holdings closed at $54.18, while the most popular narrative sees fair value at $78.71. This creates a large perceived gap, setting expectations for a potential turnaround if the assumptions hold true.

Restored supply chains and improved customer relationships support revenue growth. Ongoing cost reductions and diversification boost profitability and stability. Focus on pet care innovation and expanded home improvement offerings taps into strong consumer demand, increasing recurring revenue and market share.

Curious what could drive this sizable valuation difference? The narrative leans on forecasts of expanding earnings, higher margins, and a profit multiple generally associated with faster-growing sectors. Want to see which bold projections and market shifts power these assumptions? Unpack all the numbers driving that big fair value gap.

Result: Fair Value of $78.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent category softness and supply chain exposure in Asia could quickly challenge any bullish outlook if headwinds intensify in the coming quarters.

Find out about the key risks to this Spectrum Brands Holdings narrative.

Another View: What Do Valuation Ratios Say?

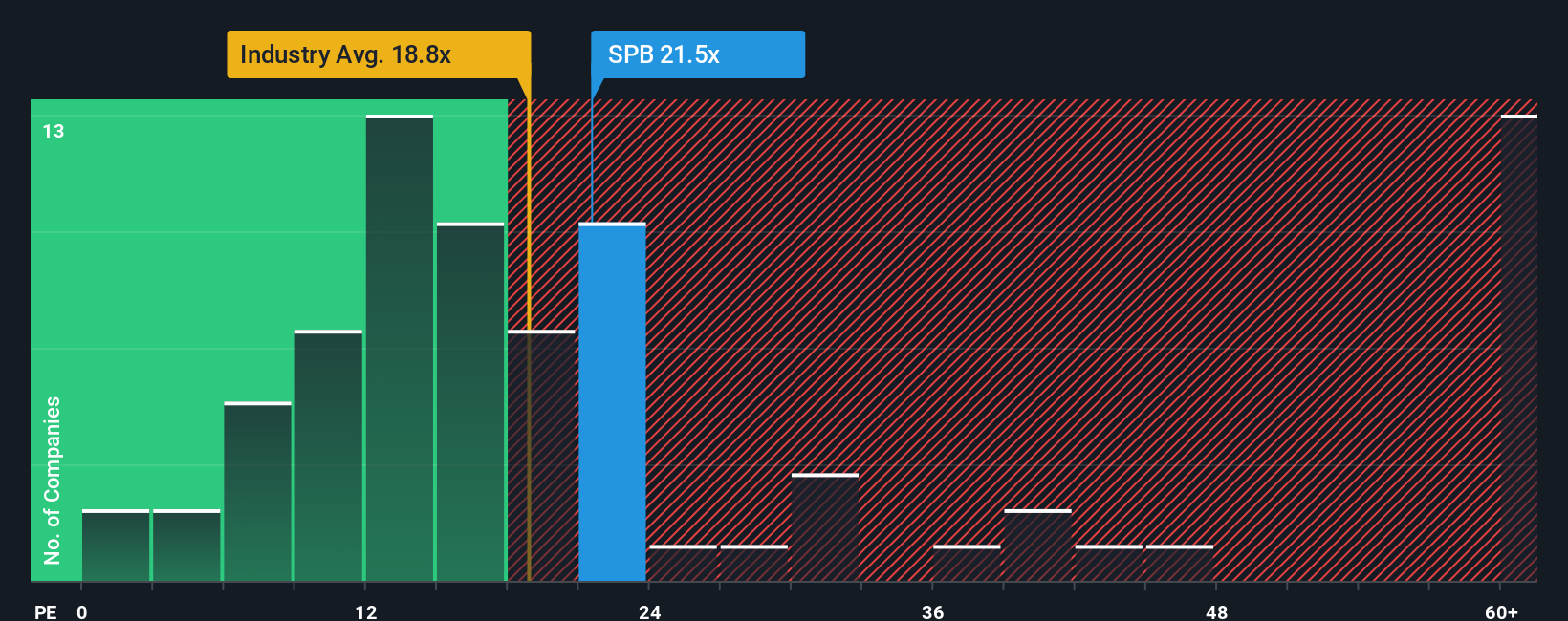

Looking at valuation ratios offers a different perspective. Spectrum Brands Holdings trades at a price-to-earnings ratio of 22.2x, which is higher than both its global industry average of 17.8x and its peer group at 16.6x. Even the estimated fair ratio is 18.7x, suggesting the stock is priced at a premium today. Does paying more reflect true underlying potential, or is the risk of disappointment growing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spectrum Brands Holdings Narrative

If you have a different take or want to dig deeper on Spectrum Brands Holdings, you can craft your own perspective using the latest data in just minutes. Do it your way.

A great starting point for your Spectrum Brands Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to take your investing further? The smartest moves often start with researching standout themes and opportunities others overlook. Don’t miss your chance to act on new ideas now.

- Spot potential before the crowd by checking out these 3587 penny stocks with strong financials offering strong financials and breakout potential in emerging sectors.

- Tap into the future of healthcare innovation by browsing these 32 healthcare AI stocks, where artificial intelligence is powering medical breakthroughs and better patient outcomes.

- Boost your passive income plan by searching for these 16 dividend stocks with yields > 3% that pay attractive yields over 3 percent and reward long-term investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPB

Spectrum Brands Holdings

Operates as a branded consumer products and home essentials company in North America, Europe, the Middle East, Africa, Latin America, and Asia-Pacific regions.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives