- United States

- /

- Household Products

- /

- NYSE:PG

Is There Now an Opportunity in Procter & Gamble After 2025 Sustainability Initiatives?

Reviewed by Bailey Pemberton

- Wondering if Procter & Gamble is a smart buy right now? You are not alone, as plenty of investors are re-evaluating its value as market conditions shift.

- The stock has seen mild downward movement recently, slipping 2.3% over the past week and 11.4% year-to-date. This could hint at shifting sentiment or new growth opportunities ahead.

- Recent headlines have focused on the company's strategic acquisitions and expanded sustainability initiatives, which add important context to the recent price moves. Broad market volatility and renewed interest in household staples have also kept Procter & Gamble in the spotlight for long-term investors.

- On our valuation checklist, Procter & Gamble scores 3 out of 6, landing right in the middle. For this reason, it is worth digging deeper into how we judge value, and at the end of this article, we will share a perspective on valuation you might not have considered.

Approach 1: Procter & Gamble Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those figures back to today’s dollars. This approach helps investors look past short-term fluctuations by focusing on a business’s core ability to generate cash over time.

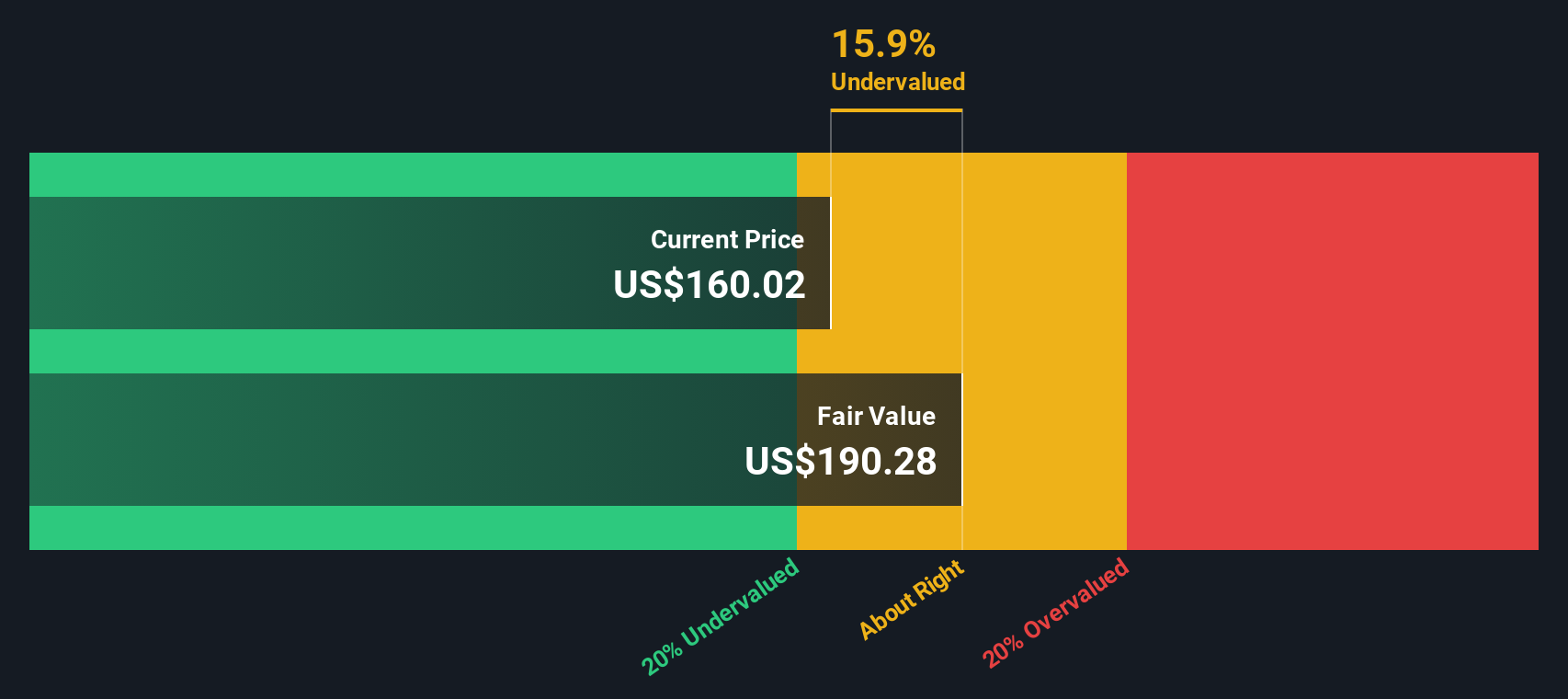

For Procter & Gamble, the current Free Cash Flow (FCF) is $15.40 billion. Analysts provide estimates for the next several years, with projections gradually increasing. The FCF for 2028 is estimated at $16.98 billion. Beyond that, Simply Wall St extrapolates further, with FCF expected to climb over $21.36 billion by 2035. All cash flows are measured in US dollars.

Using this two-stage Free Cash Flow to Equity model, the estimated intrinsic value for Procter & Gamble comes to $185.05 per share. This represents a 20.6% discount to the current share price, indicating the stock is notably undervalued based on its underlying cash-generating power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Procter & Gamble is undervalued by 20.6%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Procter & Gamble Price vs Earnings

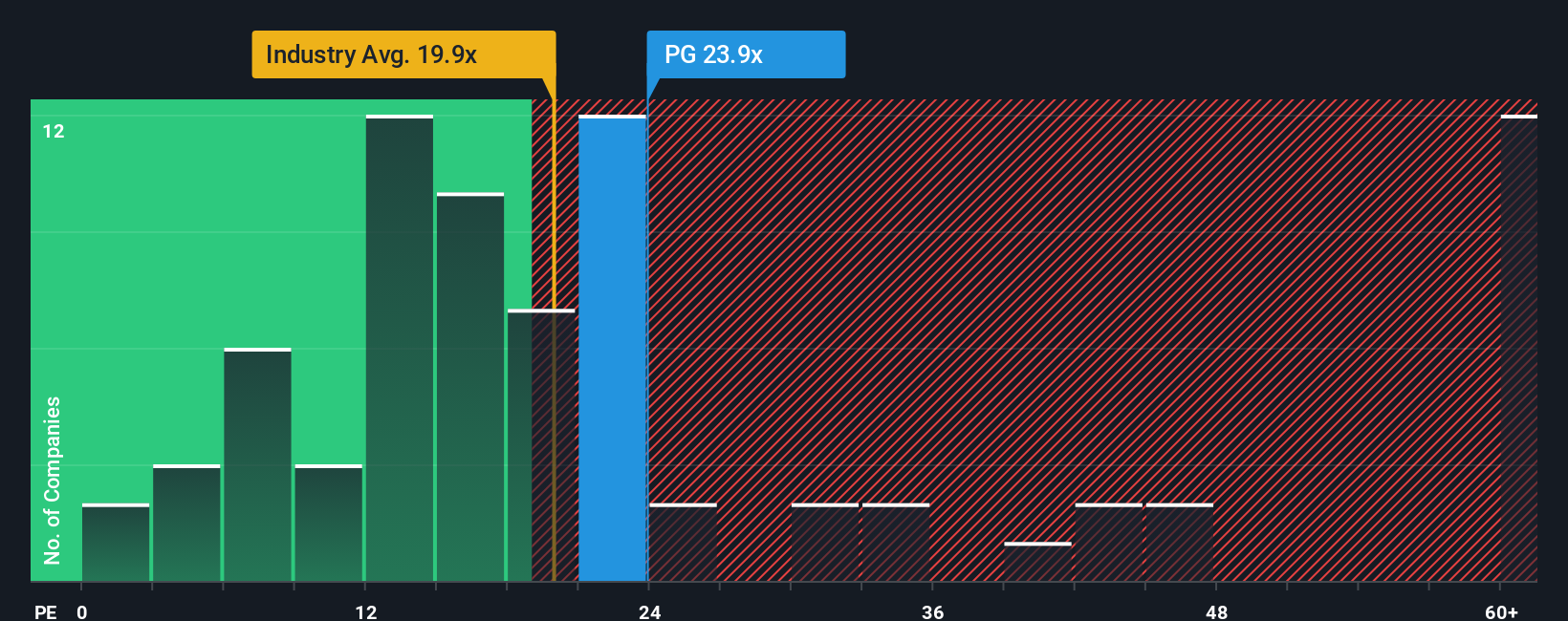

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it connects a company's share price directly to its bottom-line earnings. For well-established businesses like Procter & Gamble, a PE ratio offers a straightforward means to gauge whether the stock’s current price is justified by its ongoing profitability.

A “fair” or “normal” PE ratio, however, is not set in stone. It depends on market expectations around a company’s growth, the consistency of its earnings, and perceived risks. Fast-growing, stable businesses may warrant a higher PE, while lower growth or riskier companies tend to trade at a discount.

Procter & Gamble currently trades at a PE ratio of 20.8x. This is slightly higher than the average among industry peers at 20.6x and is well above the broader Household Products industry average of 18.1x. However, those comparisons only go so far. Simply Wall St's proprietary "Fair Ratio" method goes a step further by analyzing company-specific factors like future earnings growth, market cap, profit margins, and sector dynamics. For Procter & Gamble, the Fair Ratio is calculated at 25.7x, indicating that, when considering its strengths and outlook, a higher PE multiple would actually be justified.

Unlike simple comparisons to industry or peer averages, the Fair Ratio blends growth prospects and company quality into a balanced benchmark. This makes it a more reliable way to determine if a stock is cheap or expensive for what it offers.

With the actual PE at 20.8x and the Fair Ratio at 25.7x, Procter & Gamble’s shares currently appear undervalued based on this more nuanced analysis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Procter & Gamble Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a dynamic tool that puts your perspective front and center when evaluating a company like Procter & Gamble.

Narratives are simple. You lay out your view of the company’s story, then connect it to financial forecasts such as revenue, earnings, and margins, and ultimately to the fair value you believe is justified. Instead of just relying on averages or models, Narratives help you link the company’s reality and your expectations with what you are willing to pay, making your investment rationale personal and transparent.

Available on Simply Wall St’s Community page, Narratives are an accessible resource trusted by millions of investors. They update automatically as new information like earnings or news gets released, ensuring your investment story stays aligned with the latest developments.

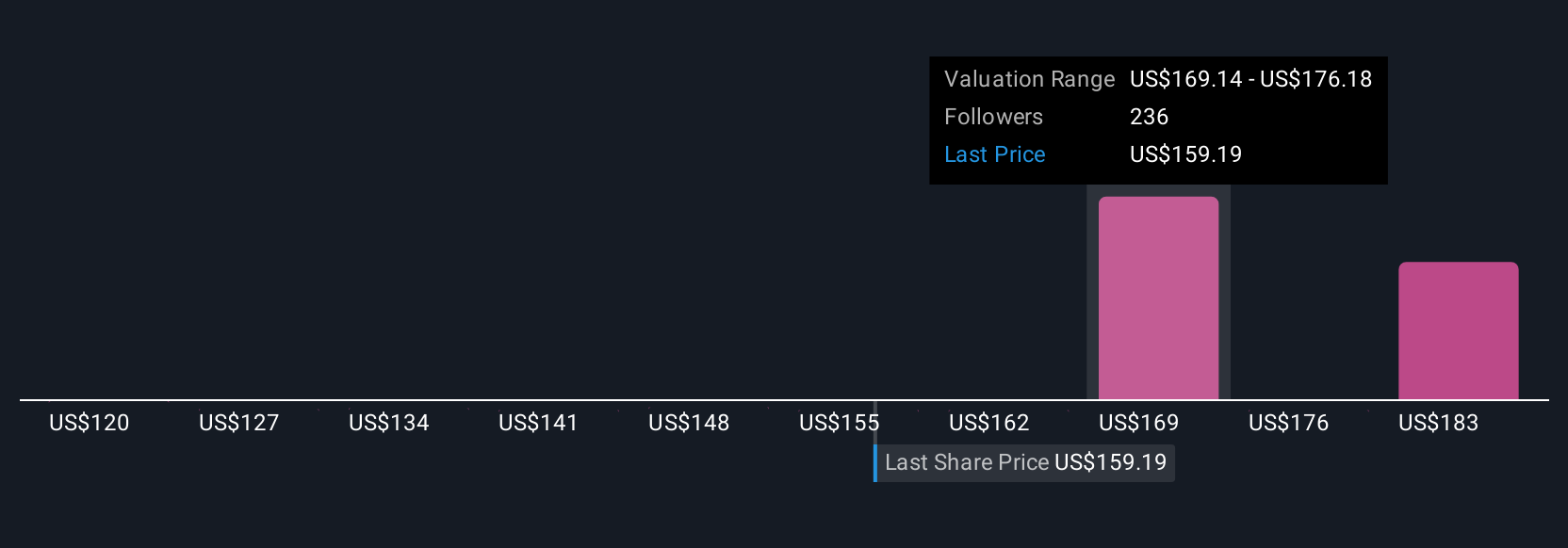

By comparing your Narrative’s fair value to the actual share price, you quickly see whether it might be time to buy, sell, or hold. For example, some investors believe Procter & Gamble is worth as much as $186 per share if its innovations deliver long-term growth, while others see fair value closer to $105, reflecting more cautious outlooks based on slower revenue expansion and rising costs.

For Procter & Gamble, however, we'll make it really easy for you with previews of two leading Procter & Gamble Narratives:

Fair Value: $169.05

Current share price is undervalued by 13.1%

Revenue Growth: 3.2%

- Investments in innovation and new product rollouts are expected to drive higher market share and revenue growth in coming years.

- Productivity and cost management initiatives are projected to support improved net margins and earnings, even amid challenging global conditions.

- Analysts' consensus price target is only modestly above the current share price, signaling they view the stock as close to fairly valued. It is important to validate these assumptions against your own expectations.

Fair Value: $119.81

Current share price is overvalued by 22.6%

Revenue Growth: 4.7%

- Procter & Gamble’s growth is expected to be modest, aligning more closely with inflation rates and risk-free returns as the company matures further.

- Multiple valuation approaches suggest the stock is currently trading above its intrinsic value, and significant upside is unlikely without material earnings surprises or margin expansion.

- The business remains a high-quality, stable dividend payer, but current prices may reflect a premium for its consistency rather than future growth potential.

Do you think there's more to the story for Procter & Gamble? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives