- United States

- /

- Healthcare Services

- /

- NYSEAM:NHC

Should Rising Revenue and Lower Earnings Shape the Evolving Narrative for National HealthCare (NHC) Investors?

Reviewed by Sasha Jovanovic

- National HealthCare Corporation recently announced its third quarter and nine-month earnings, reporting revenue growth to US$382.66 million for the quarter and US$1.13 billion for the nine months ended September 30, 2025, compared to the respective periods last year.

- While revenue increased, the company experienced a slight dip in net income and earnings per share compared to the prior year periods.

- We'll explore how revenue gains paired with reduced net income may influence National HealthCare’s evolving investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is National HealthCare's Investment Narrative?

To get behind National HealthCare, an investor would need to see value in the company's consistent revenue growth, reliable dividends, and long-tenured management despite recent board and executive retirements. The latest earnings report, showing revenue gains but a modest decrease in net income and earnings per share, could soften the appeal of short-term profit growth as a key catalyst. However, the impact of this news appears limited for now, especially as the share price has held up positively in the weeks following the announcement. Risks around leadership transition have become more immediate, as another influential executive retires soon, but the company's operational track record and seasoned board provide some reassurance. Expansion into behavioral health remains a potential growth lever, though profit margins will be watched closely after this earnings dip.

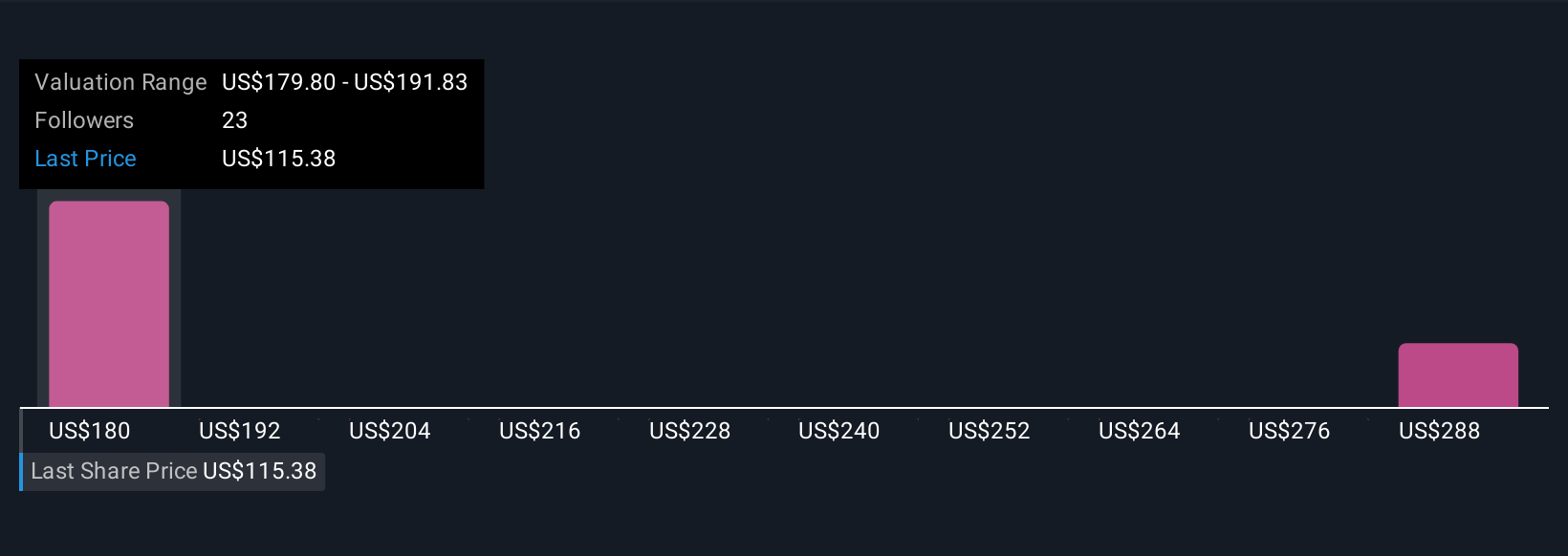

On the other hand, the combination of shrinking net profit margins and upcoming management changes is something investors should look out for. National HealthCare's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on National HealthCare - why the stock might be worth just $122.63!

Build Your Own National HealthCare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National HealthCare research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free National HealthCare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National HealthCare's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National HealthCare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:NHC

National HealthCare

Engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives