- United States

- /

- Healthcare Services

- /

- NYSEAM:NHC

Exploring National HealthCare (NHC) Valuation After Q3 Results and Continued Dividend Commitment

Reviewed by Simply Wall St

National HealthCare (NHC) just reported its third quarter results, highlighting higher revenue but a dip in net income compared to last year. Along with its earnings, the company also reaffirmed its quarterly dividend for shareholders.

See our latest analysis for National HealthCare.

National HealthCare’s share price has shown impressive near-term momentum, climbing almost 27% over the past 90 days, even as its one-year total shareholder return remains slightly negative. Recent earnings and its consistent dividend track record have certainly caught the market’s attention, hinting at renewed optimism for the long term.

If strong dividend histories pique your interest, you might want to see what else is happening in the sector. Explore See the full list for free..

With shares rebounding sharply in recent months, investors are left to weigh whether National HealthCare is still trading at an attractive value, or if recent performance means the market is now fully pricing in future growth potential.

Most Popular Narrative: 29% Undervalued

According to DanielGC, the current share price is well below their calculated fair value, hinting at what could be a substantial opportunity if key assumptions play out. The gap between where the stock trades today and this bolder target sets up a compelling story for investors who look beyond the latest results.

This narrative explores the perspective that the market is mispricing NHC due to a short-term issue, creating an attractive entry point. We assume the company will recover its net income and the market will re-rate its valuation.

Curious which variables could ramp up NHC’s valuation fast? The key drivers behind this fair value are far from ordinary. Discover which much-anticipated financial milestones and market reratings could transform today’s price into a value that turns heads. Want the full story behind the math? Read on and see what might surprise you most.

Result: Fair Value of $179.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained drop in margins or tougher integration of acquisitions could challenge the revaluation story that investors are hoping for.

Find out about the key risks to this National HealthCare narrative.

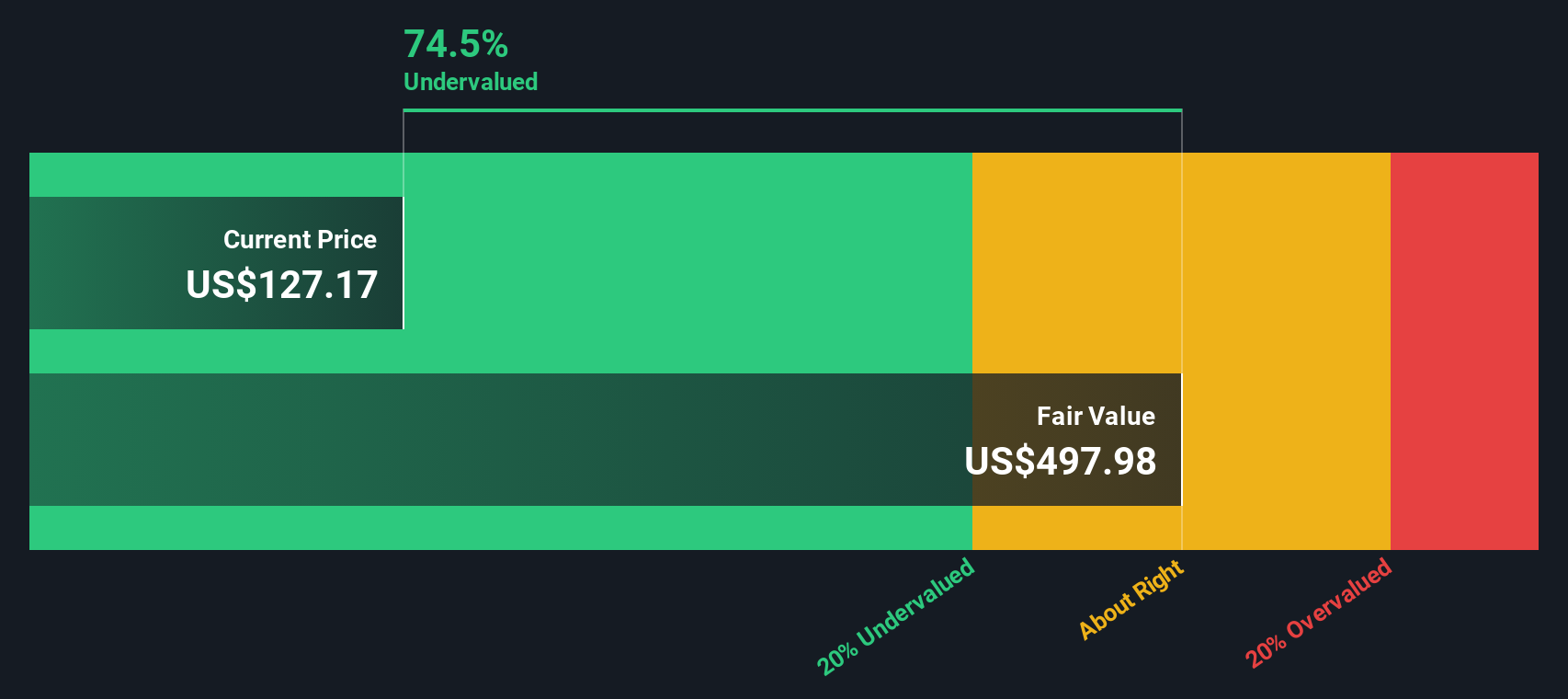

Another View: The DCF Perspective

While the multiples-based valuation presents National HealthCare as undervalued, our DCF model indicates the market might be overlooking an even larger gap. According to the SWS DCF model, NHC's shares are trading well below their fair value. Could this signal a deeper opportunity, or does it show just how widely opinions on fair value can differ?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own National HealthCare Narrative

If you’ve got your own perspective or like diving into the numbers firsthand, crafting a personal narrative takes just a few minutes, so why not Do it your way?

A great starting point for your National HealthCare research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t wait on the sidelines for the next big thing. Seize new opportunities that match your goals using these handpicked screens below.

- Uncover potential market mispricings by checking out these 870 undervalued stocks based on cash flows. Here, you’ll find companies that stand out based on strong cash flow fundamentals.

- Maximize your pursuit of income by targeting these 16 dividend stocks with yields > 3%, which offers reliable yields above 3% and historically consistent payouts.

- Tap into the surging world of artificial intelligence with these 24 AI penny stocks to spot emerging technology leaders before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National HealthCare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:NHC

National HealthCare

Engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives