- United States

- /

- Healthcare Services

- /

- NYSE:THC

How Investors Are Reacting To Tenet Healthcare (THC) After Fitch Upgrades Outlook Following Major Debt Moves

Reviewed by Sasha Jovanovic

- In recent days, Tenet Healthcare Corporation completed a US$2.25 billion notes offering and secured a new US$1.9 billion senior secured revolving credit facility to refinance existing debt and extend maturities.

- Fitch Ratings responded by upgrading Tenet Healthcare’s outlook to positive, highlighting the company’s strengthened financial flexibility and enhanced liquidity profile.

- We’ll explore how improved access to credit facilities and a positive outlook from Fitch may influence Tenet Healthcare’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Tenet Healthcare's Investment Narrative?

To stand behind Tenet Healthcare as a shareholder, you’d need confidence in its ability to balance growth with operational resilience in a competitive, capital-intensive sector. The company’s recent US$2.25 billion notes offering and new US$1.9 billion credit facility are aimed squarely at refinancing debt and pushing out maturities, which makes the Fitch Ratings outlook upgrade noteworthy. This improved liquidity could meaningfully reduce near-term financial pressures, potentially shifting the focus for investors to operating performance and execution. Before this news, the key short-term catalysts were about delivering on raised earnings guidance and continued share buybacks, with main risks tied to high leverage, uneven profit margins and sensitivity to reimbursement rate shifts or regulatory changes. Now, the credit actions seem to mitigate immediate refinancing risks, but the heavy reliance on debt and profit margin compression remain in focus for anyone considering the stock. But while debt pressure may have eased, margin compression is still a risk for shareholders.

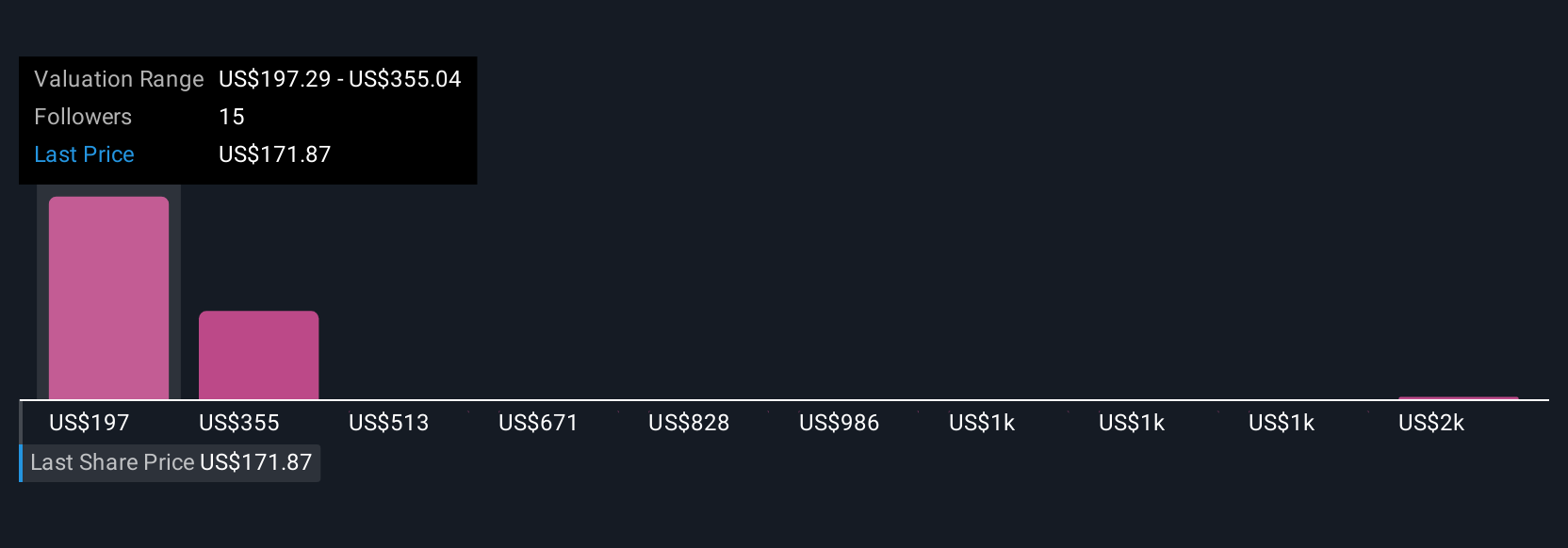

Despite retreating, Tenet Healthcare's shares might still be trading 48% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Tenet Healthcare - why the stock might be worth just $211.29!

Build Your Own Tenet Healthcare Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tenet Healthcare research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tenet Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tenet Healthcare's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THC

Tenet Healthcare

Operates as a diversified healthcare services company in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives