- United States

- /

- Healthtech

- /

- NYSE:TDOC

Teladoc Health (TDOC) Is Down 5.3% After Narrowed Full-Year Loss Guidance and Q3 Results - What's Changed

Reviewed by Sasha Jovanovic

- On October 29, 2025, Teladoc Health reported third quarter results showing sales of US$626.44 million and a net loss of US$49.51 million, and also provided guidance targeting fourth quarter revenues of US$622 million to US$652 million with a projected full year net loss between US$220 million and US$194 million.

- An interesting detail is that, despite a year-over-year dip in quarterly sales and a wider quarterly net loss, Teladoc's year-to-date net loss improved dramatically from the previous year's very large loss, suggesting improved cost containment or reduced one-off expenses.

- We'll examine how the company's narrowed full-year loss guidance influences the outlook for Teladoc Health's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Teladoc Health Investment Narrative Recap

Shareholders of Teladoc Health need to be confident in the long-term potential for virtual care growth and Teladoc’s ability to translate its user base into sustainable revenue. The company’s latest results and slightly narrowed net loss guidance are a modest positive but do not materially affect the biggest short-term catalyst, restoring BetterHelp revenue growth, nor do they reduce the substantial risk of ongoing margin pressure as the business shifts toward lower-margin insurance revenue. One closely related announcement is Teladoc’s lowered full-year net loss forecast despite flat revenue projections, reflecting a visible focus on operating expense control. This trend, while encouraging for cost efficiency, needs to be weighed against the ongoing challenge of maintaining top-line growth and competitive positioning in both core and emerging segments. However, investors should also be aware that profit margins remain under pressure as Teladoc transitions its BetterHelp business to insurance-based models...

Read the full narrative on Teladoc Health (it's free!)

Teladoc Health's narrative projects $2.7 billion revenue and $235.6 million earnings by 2028. This requires 1.9% yearly revenue growth and a $443 million increase in earnings from -$207.4 million today.

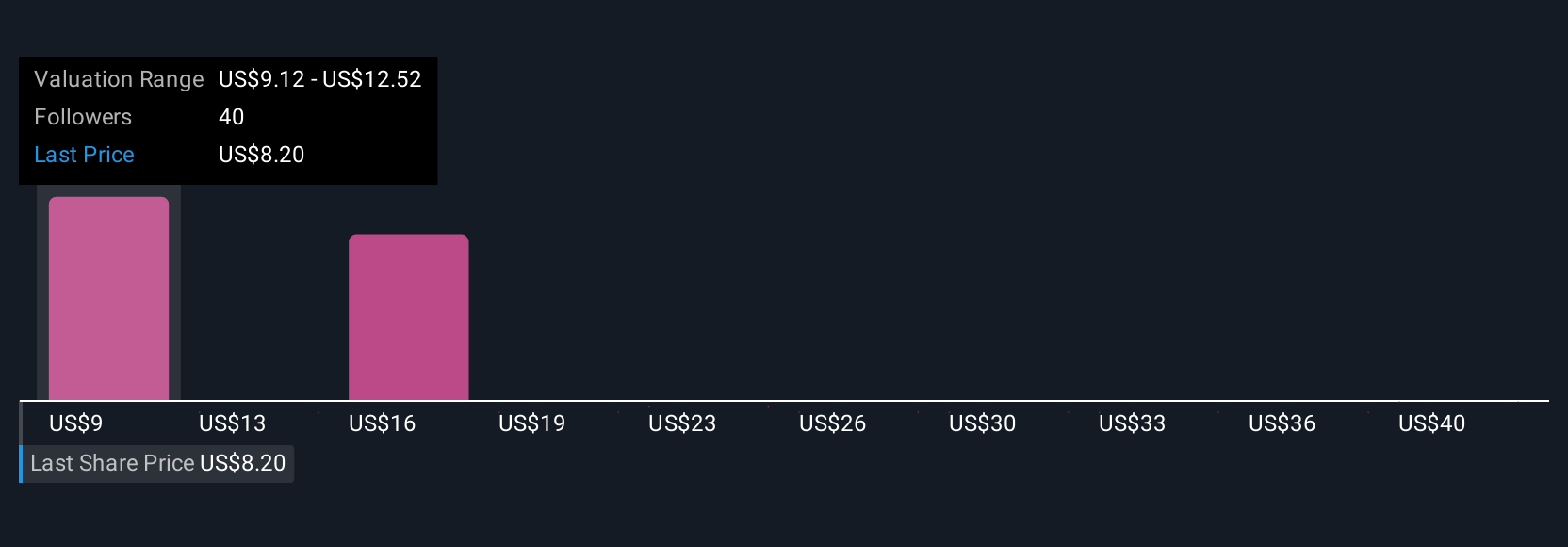

Uncover how Teladoc Health's forecasts yield a $9.12 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values between US$9.12 and US$42.04 based on five unique forecasts. Many highlight gross margin pressure as a critical headwind that could shape Teladoc Health’s fortunes, explore the spectrum of market views for a fuller picture.

Explore 5 other fair value estimates on Teladoc Health - why the stock might be worth just $9.12!

Build Your Own Teladoc Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teladoc Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teladoc Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teladoc Health's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teladoc Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDOC

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives