- United States

- /

- Medical Equipment

- /

- NYSE:STE

A Look at STERIS (STE) Valuation Following Strong Q2 Results and Reaffirmed Growth Guidance

Reviewed by Simply Wall St

STERIS (STE) just released its second quarter results, reporting higher sales and net income compared to a year ago. In addition, management reaffirmed its revenue growth guidance for fiscal 2026, highlighting a steady outlook for investors.

See our latest analysis for STERIS.

Momentum has built quickly for STERIS this year, with its 1-month share price return of nearly 12% and a robust year-to-date climb of 30%. Recent buybacks and a solid dividend have also helped reinforce investor confidence. Looking further back, the company’s one-year total shareholder return of 20% and a standout 62% over three years point to a strong track record as management continues to guide for growth.

If STERIS’s steady performance inspires you, you might want to check out other leading names in the sector. See the full list of healthcare stocks advancing right now: See the full list for free.

With shares trading at record highs and management maintaining a positive outlook, the question for investors is whether STERIS is still undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: 5.2% Undervalued

With STERIS closing at $264.01 and the latest narrative fair value set at $278.38, the narrative points to a modest upside built into current analyst expectations. This framing puts the company’s forward prospects in direct focus for those weighing the stock’s potential beyond recent gains.

Continued expansion of STERIS's consumables and services segments, with high recurring revenue and margin visibility, positions the company to benefit from increasing healthcare expenditures and adoption of best-practice infection control standards. This supports both revenue and margin expansion.

What is powering this valuation? The answer includes a bold call on recurring revenue, margin resilience, and ambitious growth moves across the healthcare landscape. The narrative’s math is built on confident long-term assumptions. Find out what makes their outlook stand apart from the crowd.

Result: Fair Value of $278.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including sharp tariff hikes and tightening healthcare payment policies. Either of these factors could challenge STERIS’s growth and earnings outlook.

Find out about the key risks to this STERIS narrative.

Another View: Are Shares Expensive on Market Ratios?

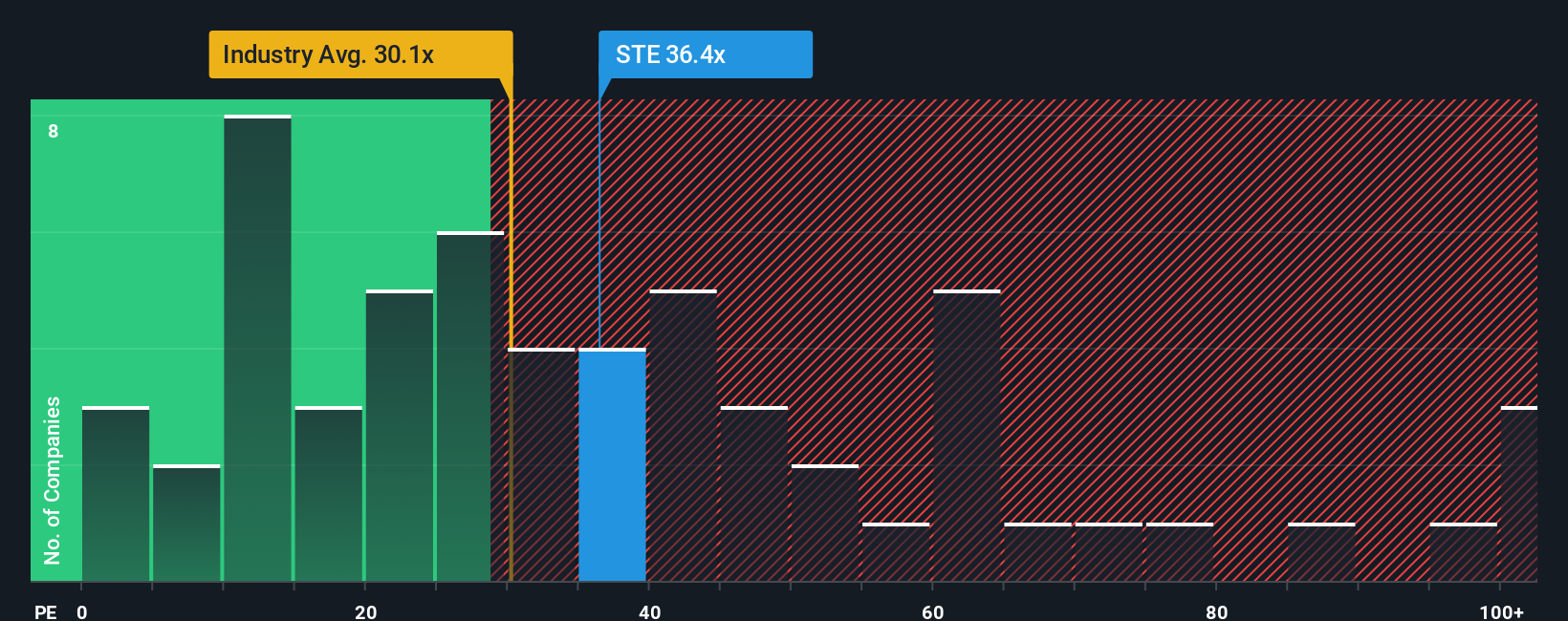

Looking at the price-to-earnings ratio, STERIS trades at 37.6x, which is well above both the US Medical Equipment industry average of 27.1x and the peer group average of 23x. Even when compared with an estimated fair ratio of 25.9x, the current multiple stands out as particularly high. This gap signals the market is pricing in a lot of optimism. Is this premium justified, or is there more downside risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STERIS Narrative

If you see things differently or want to dig deeper on your own, you can easily craft a personalized STERIS narrative from the data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding STERIS.

Looking for More Investment Ideas?

Seize the opportunity to spot tomorrow’s winners today. Use the Simply Wall Street Screener and never miss standout companies already making waves in the market.

- Boost your returns by tracking income picks with strong yields when you jump into these 16 dividend stocks with yields > 3% backed by solid fundamentals.

- Spot the next breakthrough by following these 24 AI penny stocks harnessing artificial intelligence in innovative ways across industries.

- Maximize value in your portfolio by tapping into these 874 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STE

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives