- United States

- /

- Medical Equipment

- /

- NYSE:SOLV

How Solventum’s (SOLV) Surging Q3 Earnings and Raised Guidance Will Impact Investors

Reviewed by Sasha Jovanovic

- Solventum reported third-quarter 2025 earnings with revenue of US$2.10 billion and net income of US$1.27 billion, significantly above the prior year, and raised its full-year earnings guidance.

- This considerable jump in net income relative to revenue signals that recent operational changes may be having a pronounced effect on profitability.

- We'll explore how Solventum's raised earnings guidance highlights a turning point for its operational efficiency within the investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Solventum Investment Narrative Recap

To be a shareholder in Solventum right now, you need conviction in the company's ability to sustain operational improvements and translate them into lasting earnings growth, despite a history of modest revenue expansion and ongoing transition risks from its separation with 3M. The recent third-quarter results, with a striking boost in net income and raised full-year earnings guidance, suggest that ongoing operational streamlining remains the most important short-term catalyst. However, the most significant risk still stems from persistent execution challenges tied to the multi-year ERP system implementation and associated supply chain complexities, neither of which appears materially changed by this quarter’s update.

Among recent announcements, the sale of Solventum’s Purification & Filtration business for US$4.0 billion stands out for its potential to strengthen the balance sheet and fund operational priorities. This move aligns with management’s stated focus on streamlined operations, supporting efforts to drive margin expansion, the very progress highlighted in the latest earnings. For investors, this transaction may remove a distraction and help management stay laser-focused on the efficiency gains now reflected in improved profit metrics.

But in contrast to near-term margin gains, investors should stay attentive to the risk that complications in ERP system rollout could...

Read the full narrative on Solventum (it's free!)

Solventum's narrative projects $8.2 billion revenue and $981.9 million earnings by 2028. This requires a 0.7% annual revenue decline and a $601.9 million earnings increase from $380.0 million today.

Uncover how Solventum's forecasts yield a $85.11 fair value, a 28% upside to its current price.

Exploring Other Perspectives

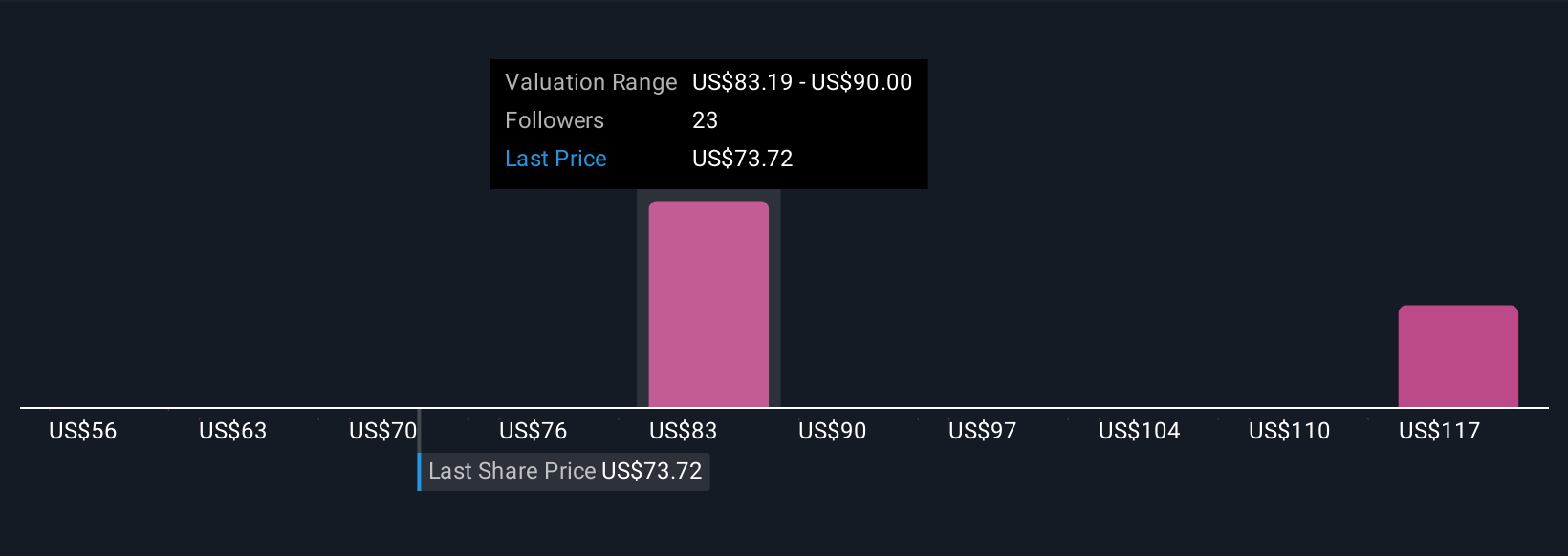

Three fair value estimates from the Simply Wall St Community span from US$55.96 to US$115.62 per share. While operational improvements are driving higher guidance, you may want to consider how ongoing transition risks could influence future outcomes.

Explore 3 other fair value estimates on Solventum - why the stock might be worth as much as 74% more than the current price!

Build Your Own Solventum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solventum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Solventum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solventum's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOLV

Solventum

A healthcare company, develops, manufactures, and commercializes a portfolio of solutions to address critical customer and patient needs in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives