- United States

- /

- Healthcare Services

- /

- NYSE:SEM

Select Medical (SEM) Profit Margins Improve, Testing Bullish Outlook Versus Premium Valuation

Reviewed by Simply Wall St

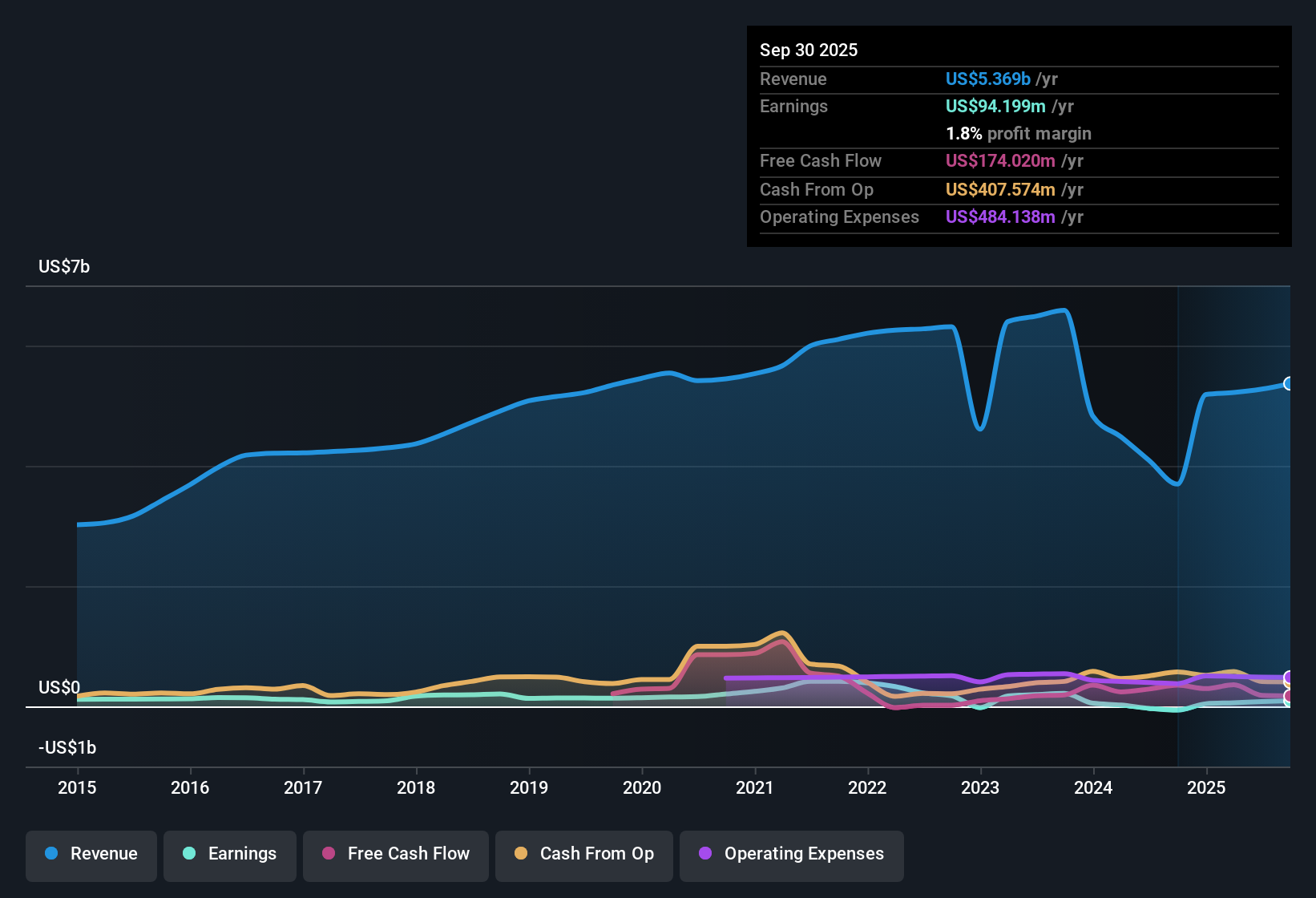

Select Medical Holdings (SEM) just turned a corner with improved net profit margins and has moved into profitability even as its earnings have dipped by 40.6% annually over the past five years. Looking ahead, analysts expect robust annual earnings growth of 35.4%, which is well above the broader US market's 15.9% forecast. However, revenue growth is projected at a slower 8.2% per year. The company’s strong margin improvement and reputation for high-quality earnings offer investors an operational momentum story, but the contrast between past declines and future growth targets creates a nuanced earnings backdrop.

See our full analysis for Select Medical Holdings.Now, let's see how these latest numbers stack up against the key market narratives and expectations at Simply Wall St. Some themes could get confirmed, while others may face fresh questions.

See what the community is saying about Select Medical Holdings

Share Price Lags Analyst Target

- The current share price of $13.83 sits 24.6% below the analyst consensus target of $18.33. This illustrates that the market is valuing Select Medical well under what consensus forecasts suggest is reasonable, given the anticipated earnings recovery and multiple compression by 2028.

- According to the analysts' consensus view, ongoing expansion, including new rehab hospitals and partnerships, should drive higher patient volumes and fuel sustained growth in both revenue and margins over the next three years.

- Consensus narrative notes the company’s push to scale operations and invest in operational efficiency aligns with projections of margins rising from 1.5% to 3.8% by 2028, while also expecting revenue to grow by 5.1% per year.

- Yet the notable gap between the stock’s current market price and the consensus target hints at either lingering market skepticism or an opportunity for a rerating if these improvements materialize.

Premium Valuation Versus Peers

- Select Medical trades at a price-to-earnings (PE) ratio of 29.4x, which is sharply higher than both the peer group average of 15.8x and the US healthcare industry’s average of 21.7x.

- Analysts' consensus view cautions that paying a premium valuation makes future returns more sensitive to the achievement of ambitious profit growth targets.

- Consensus narrative points to an expected need for Select Medical to achieve $233.8 million in earnings by 2028, which would require a dramatic turnaround from the current $81.1 million in order to justify today’s multiples.

- This valuation mismatch emphasizes that, even as the company demonstrates margin gains, actual delivery on forecasts is critical to sustaining or lifting the share price from current levels.

Margin Expansion Offsets Revenue Slowdown

- Profit margins are forecasted to expand from 1.5% to 3.8% over the next three years, while revenue is expected to grow at a slower annual rate of 5.1%.

- The analysts' consensus view suggests that operational improvements and healthcare policy trends are likely to support the company’s margin gains, even as revenue growth trails broader industry averages.

- As noted in the consensus narrative, strong demand fundamentals in the post-acute and rehabilitation markets, fueled by demographic shifts and ICU decompression needs, are anticipated to provide a stable base for long-term cash flow growth.

- Despite regulatory pressures and a shift toward home-based care, investments in system upgrades and efficiency initiatives are expected to bolster EBITDA margins across the expanding national footprint.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Select Medical Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on what the figures reveal? Share your viewpoint and craft a unique narrative in just a few minutes. Do it your way.

A great starting point for your Select Medical Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Select Medical's premium valuation relies heavily on ambitious profit growth targets. This makes it sensitive if margins or earnings fail to keep pace with projections.

If you want investments where the numbers support the price, check out these 834 undervalued stocks based on cash flows for stocks trading at more attractive valuations and stronger fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEM

Select Medical Holdings

Through its subsidiaries, operates critical illness recovery hospitals, rehabilitation hospitals, and outpatient rehabilitation clinics in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives