- United States

- /

- Medical Equipment

- /

- NYSE:PEN

Penumbra (PEN): Assessing Valuation as Momentum Lifts Shares and Analyst Targets Signal Upside

Reviewed by Simply Wall St

Penumbra (PEN) shares have been performing steadily in recent weeks, with the stock up about 17% over the past week and around 3% for the month. Investors are watching closely to see if this momentum continues as the broader healthcare sector evolves.

See our latest analysis for Penumbra.

Momentum has definitely picked up for Penumbra lately, with the share price jumping over 17% in the past week and adding to a healthy year-to-date gain. Even after some ups and downs, Penumbra’s 12.6% total shareholder return over the past year signals solid progress for long-term holders.

For anyone interested in how healthcare stocks are evolving, this is a great moment to discover the full list on our See the full list for free..

With shares tracking higher and analyst targets suggesting further upside, the question now is whether Penumbra remains undervalued at current levels or if expectations have already caught up with its growth trajectory, leaving little room for surprise gains.

Most Popular Narrative: 13% Undervalued

With Penumbra last closing at $266.19 and the most widely followed narrative assigning a fair value of $306.74, there is a notable gap between current pricing and what analysts project. The following excerpt reveals just what might tip the balance in Penumbra’s favor going forward.

The soon-to-be-released STORM-PE randomized trial is poised to provide Level 1 evidence comparing Penumbra's thrombectomy technology to standard anticoagulation for pulmonary embolism. A positive outcome could expand guideline adoption, significantly accelerate procedure volumes, and drive substantial revenue growth by rapidly increasing penetration in a very underpenetrated, large market.

Curious why the narrative tags Penumbra with such a premium? The secret sauce includes aggressive growth assumptions, margin expansion bets, and a future earnings multiple rarely seen outside high-growth sectors. Want the full valuation blueprint? See the inside story powering this ambitious fair value.

Result: Fair Value of $306.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition or negative results from upcoming clinical trials could quickly challenge Penumbra’s bullish outlook.

Find out about the key risks to this Penumbra narrative.

Another View: Price Ratios Signal Caution

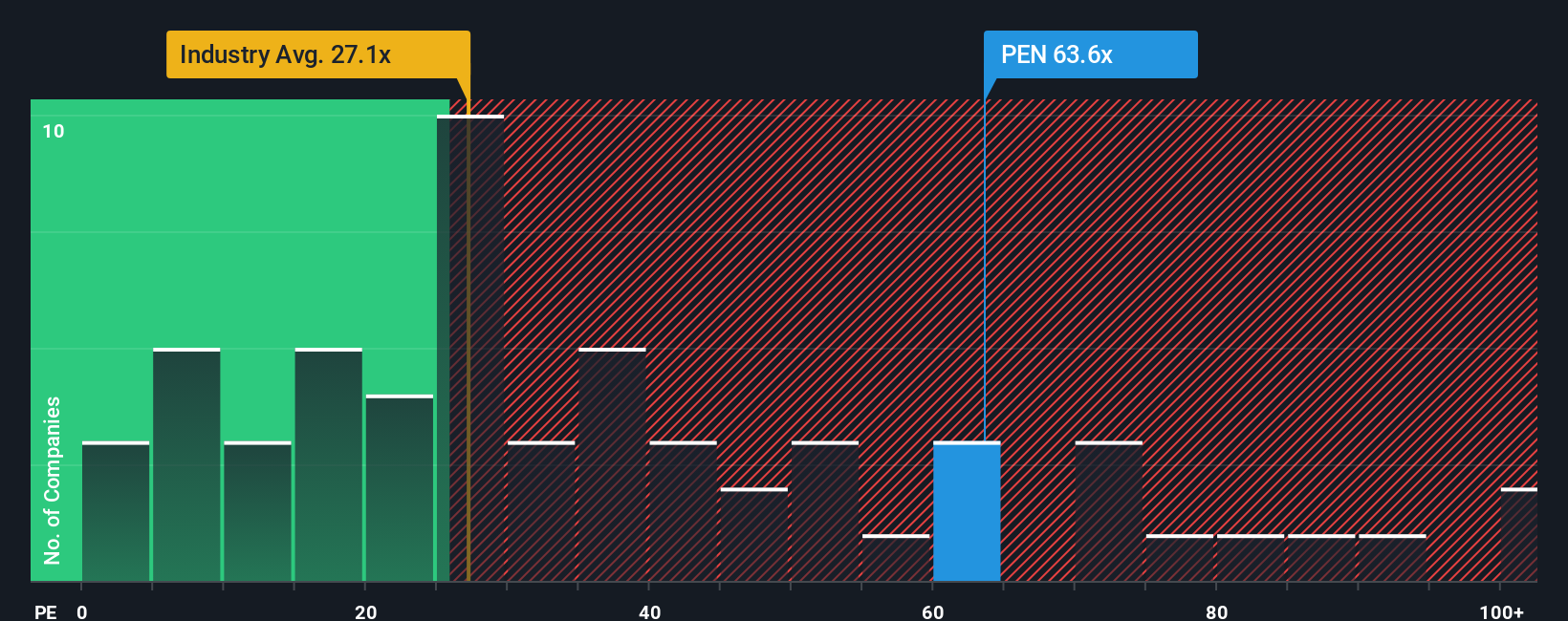

While analyst forecasts suggest Penumbra is undervalued, a look at its price-to-earnings ratio paints a different picture. At 63.6x, Penumbra trades well above both its peer average of 26.8x and a fair ratio of 28.3x. This hints at high valuation risk if expectations shift. Are growth hopes running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penumbra Narrative

If you want to see the story from your own perspective or prefer hands-on research, you can craft your own take in under three minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Penumbra.

Looking for More Investment Ideas?

Don’t let exciting opportunities pass you by. Expand your horizons and spot potential winners using these handpicked ideas from Simply Wall Street’s screener tools.

- Uncover high-yield opportunities and start earning passive income from these 16 dividend stocks with yields > 3% with yields over 3%.

- Catch the next wave in artificial intelligence by sifting through these 24 AI penny stocks that are shaping the future of automation and smart tech.

- Step into the cutting edge of finance and tech with these 82 cryptocurrency and blockchain stocks as it makes strides in blockchain innovation and digital currencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEN

Penumbra

Designs, develops, manufactures, and markets medical devices in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives