- United States

- /

- Healthcare Services

- /

- NYSE:MD

Pediatrix Medical Group (MD): Has Profit Growth and Raised Guidance Shifted the Valuation Outlook?

Reviewed by Simply Wall St

Pediatrix Medical Group (MD) delivered third-quarter results that beat forecasts, showing a sharp jump in profitability thanks to stronger collections, higher-acuity patients, and a friendlier payor mix. Management also raised full-year adjusted EBITDA guidance, citing continued operational strength.

See our latest analysis for Pediatrix Medical Group.

The latest results fueled a dramatic shift in sentiment, with Pediatrix Medical Group’s share price surging over 52% in the past three months. This reflects renewed investor confidence following the beat-and-raise quarter. Momentum is now running strong, especially given the company’s impressive 67% year-to-date share price return. Its one-year total shareholder return stands at 36%, highlighting both near-term upside and improving long-term performance.

If leadership changes and robust earnings have you rethinking your healthcare plays, you might want to discover See the full list for free.

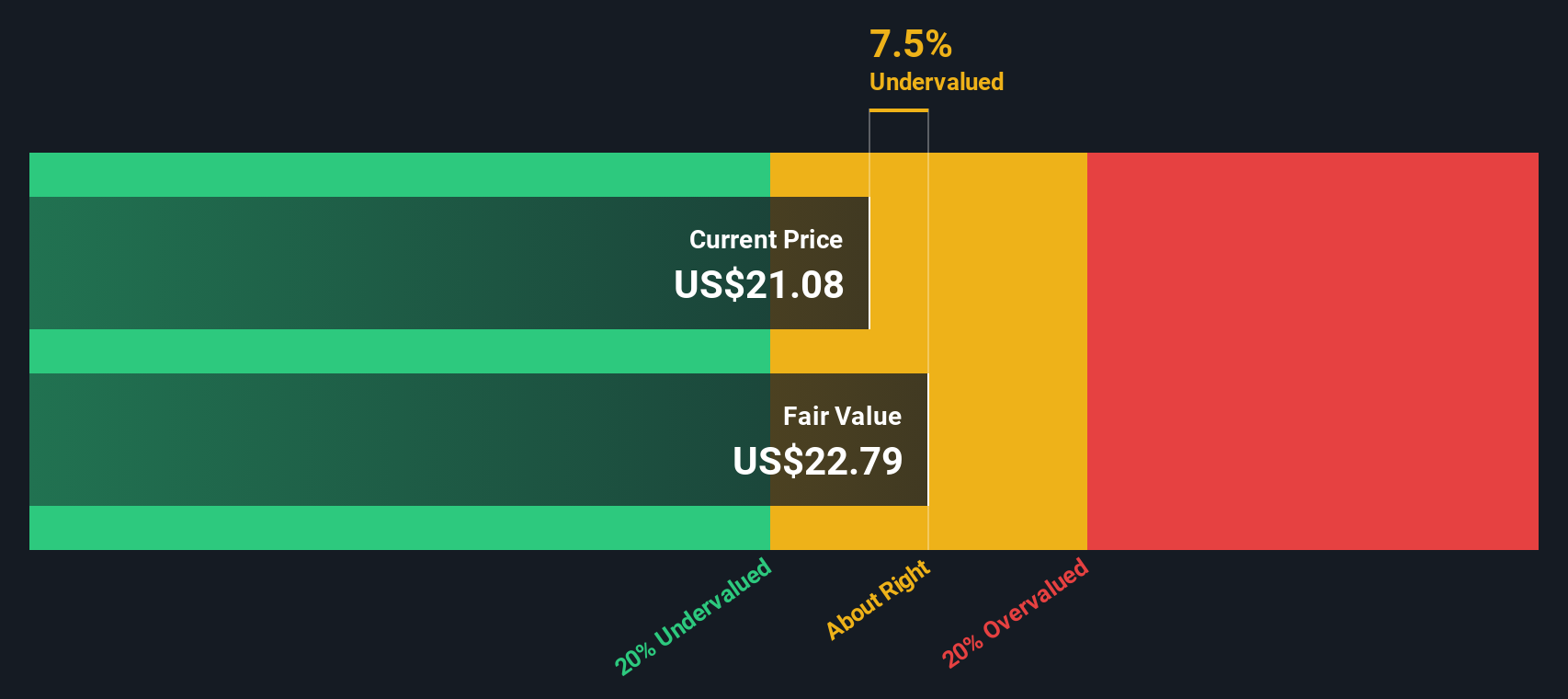

With shares soaring and financial results outperforming expectations, is Pediatrix Medical Group’s stock still undervalued, or has the recent rally already priced in the company’s future growth potential?

Most Popular Narrative: 10% Overvalued

With Pediatrix Medical Group trading at $21.82, the most widely referenced narrative assigns a fair value of $19.92, which is roughly 10% below the last close. This creates an intriguing debate about whether the recent share price surge has gone too far, given the company’s updated growth outlook and profitability assumptions.

Ongoing operational improvements, such as enhancements in revenue cycle management and tightly controlled salary expenses, are improving working capital efficiency and holding down expense growth. This supports higher net earnings and cash flow conversion. A strong balance sheet and cash position (with potential for buybacks, debt paydown, or strategic acquisitions) provide optionality for future earnings growth, margin improvement, and increased shareholder value in a consolidating healthcare landscape.

Think the real story is just in the headline numbers? There is a strategic mix of financial levers and operational shifts behind this narrative. Unpack which forecast changes are most responsible for this valuation leap, as one assumption could change everything. Ready to see what drives the model?

Result: Fair Value of $19.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing portfolio restructuring and persistent reimbursement pressures could threaten Pediatrix Medical Group’s revenue stability and margin expansion if these challenges are not carefully managed.

Find out about the key risks to this Pediatrix Medical Group narrative.

Another View: Our DCF Model Says Overvalued

While the market may see Pediatrix Medical Group as a bargain based on earnings multiples, our SWS DCF model takes a longer-term look at future cash flows and reaches a different conclusion. This perspective suggests the current share price of $21.82 is above our fair value estimate of $15.22, raising questions about the recent rally.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pediatrix Medical Group Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can quickly craft your own take using our platform in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pediatrix Medical Group.

Looking for more investment ideas?

Unlock the next level of your portfolio by scanning the market’s hidden gems, future-focused innovators, and yield-boosters before others spot them. These opportunities won’t wait.

- Uncover overlooked potential by targeting these 849 undervalued stocks based on cash flows that are positioned for strong upside as markets shift.

- Catch the momentum in breakthrough tech by jumping into these 25 AI penny stocks that are reshaping everything from automation to smart healthcare.

- Elevate your returns by tapping into these 17 dividend stocks with yields > 3% that are designed to deliver reliable income alongside growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, and other pediatric subspecialty care services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives