Stock Analysis

- United States

- /

- Healthcare Services

- /

- NYSE:LH

Laboratory Corporation of America Holdings' (NYSE:LH) P/E Is On The Mark

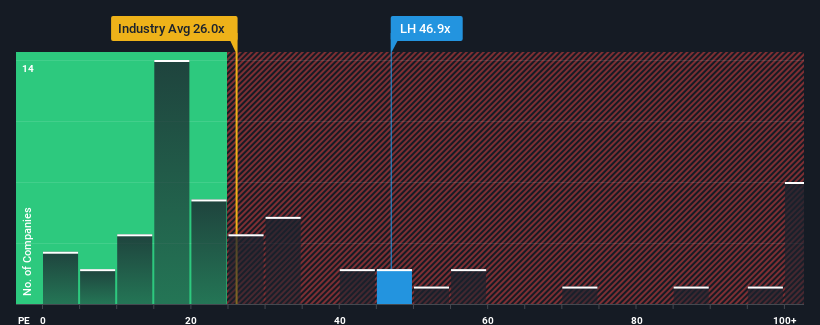

Laboratory Corporation of America Holdings' (NYSE:LH) price-to-earnings (or "P/E") ratio of 46.9x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Laboratory Corporation of America Holdings has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Laboratory Corporation of America Holdings

Is There Enough Growth For Laboratory Corporation of America Holdings?

In order to justify its P/E ratio, Laboratory Corporation of America Holdings would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 60%. As a result, earnings from three years ago have also fallen 72% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 50% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Laboratory Corporation of America Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Laboratory Corporation of America Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Laboratory Corporation of America Holdings you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Laboratory Corporation of America Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LH

Laboratory Corporation of America Holdings

Laboratory Corporation of America Holdings operates as a life sciences company that provides vital information to help doctors, hospitals, pharmaceutical companies, researchers, and patients make clear and confident decisions.

Moderate growth potential with mediocre balance sheet.