- United States

- /

- Healthcare Services

- /

- NYSE:HNGE

Hinge Health (HNGE): Exploring Valuation as Momentum Cools After Early-Year Rally

Reviewed by Simply Wall St

Hinge Health (HNGE) shares have edged up slightly, gaining around 1% over the past day. This movement comes as investors continue to weigh the company’s performance, particularly in light of recent shifts in the broader healthcare technology market.

See our latest analysis for Hinge Health.

After a strong start to the year, Hinge Health’s 1.02% uptick today stands out against a recent spell of volatility, including a 10.59% seven-day and 20.15% three-month share price decline. Still, the stock remains up 18.45% year-to-date, suggesting that while momentum has cooled lately, the longer-term optimism has not vanished entirely.

Looking for other potential movers in healthcare? Discover fresh opportunities with our healthcare stocks screener using See the full list for free.

With Hinge Health trading well below analyst targets and showing significant losses despite robust revenue growth, the question now is whether the current dip signals an attractive entry point or if future gains are already reflected in the price.

Price-to-Sales Ratio of 6.6x: Is it justified?

Hinge Health’s shares are trading at a price-to-sales ratio of 6.6x, well above both the US Healthcare industry average and peer group. This suggests a premium is being placed on the company’s growth potential.

The price-to-sales (PS) ratio is a popular valuation metric for unprofitable growth companies like Hinge Health. It reflects how much investors are willing to pay for each dollar of revenue. In healthcare technology, PS ratios are often elevated for companies demonstrating outsized revenue growth or strong future expectations as earnings remain negative.

Despite robust revenue increases, Hinge Health’s 6.6x PS multiple is significantly above the industry average of 1.3x and the peer average of 4.1x. This signals that the market is pricing in significant expectations, perhaps anticipating Hinge Health’s transition towards profitability and further revenue outperformance. Without a fair ratio benchmark available, the current premium may be difficult to justify based solely on fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales Ratio of 6.6x (OVERVALUED)

However, ongoing net losses and the risk of slower revenue growth could derail current optimism. This may impact the potential for a sustained share price recovery.

Find out about the key risks to this Hinge Health narrative.

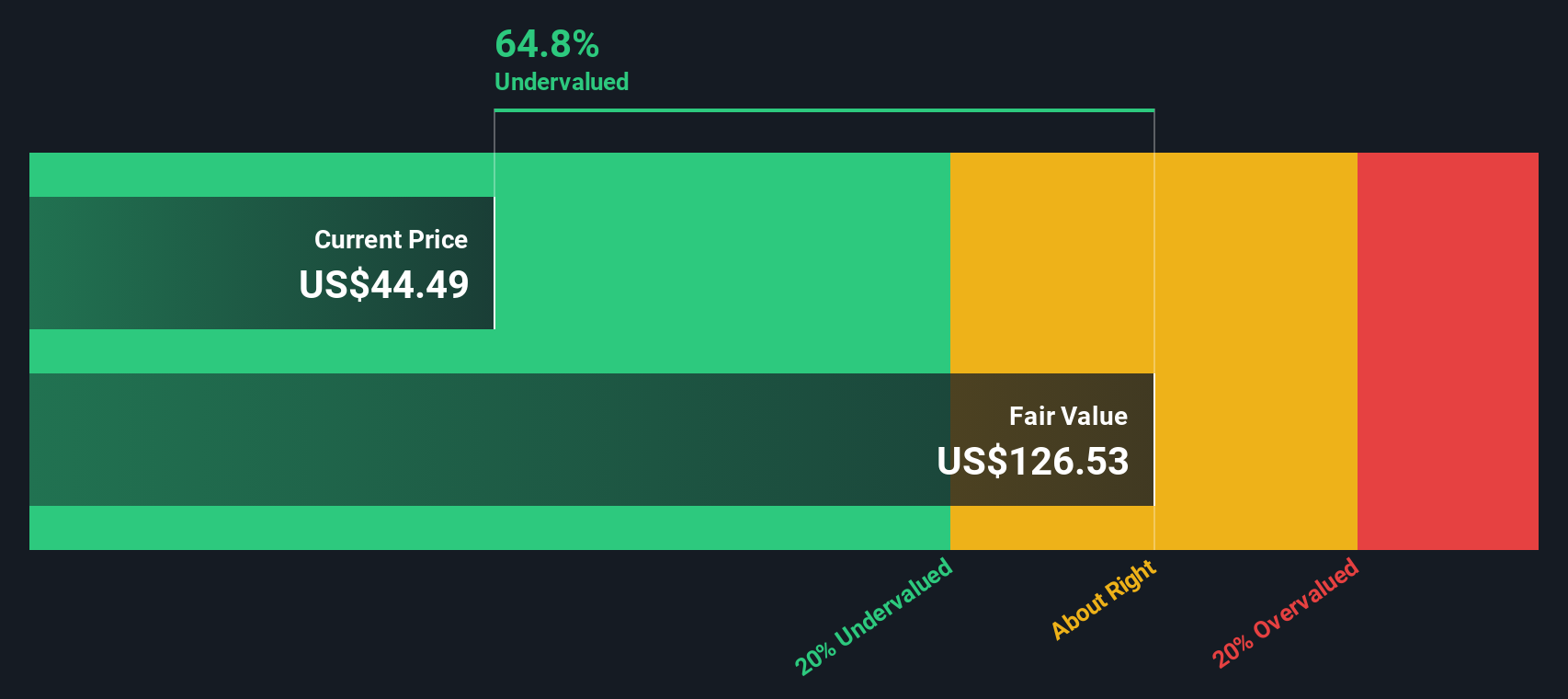

Another View: Discounted Cash Flow Signals Deep Value

While Hinge Health’s high price-to-sales ratio suggests the shares are expensive, our SWS DCF model offers a very different story. According to this cash flow-based approach, Hinge Health is trading about 65% below its estimated fair value. This points to a potentially significant undervaluation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hinge Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hinge Health Narrative

If you see the story differently, or prefer to dive into your own analysis, it's simple to build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Hinge Health.

Looking for more investment ideas?

Don't let your next winning investment slip by; there are unique opportunities just waiting for you at Simply Wall Street. Use our handpicked screeners to uncover stocks making waves in today's market.

- Capture reliable income streams by checking out these 16 dividend stocks with yields > 3% with yields above 3% for consistent returns regardless of market direction.

- Ride the AI revolution and see which companies are transforming industries. Start with these 25 AI penny stocks to spot tomorrow’s technology leaders today.

- Power up your strategy by analyzing these 28 quantum computing stocks and get in early on quantum computing breakthroughs that could redefine the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hinge Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNGE

Hinge Health

Focuses on scaling and automating the delivery of healthcare services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives