- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Why Hims & Hers Health (HIMS) Faces New Questions on Pricing Power After Third-Quarter GLP-1 Updates

Reviewed by Sasha Jovanovic

- Earlier this month, Hims & Hers Health announced updated financial guidance, reported third-quarter earnings, and addressed the upcoming reduction in GLP-1 drug prices as a result of new agreements between pharmaceutical companies and the U.S. government.

- An important development is the company's ongoing negotiations with major drug manufacturers to maintain access to branded weight-loss treatments amid increasing price competition in the telehealth sector.

- We’ll explore how government-driven pricing changes in the weight-loss drug market could influence Hims & Hers Health’s investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hims & Hers Health Investment Narrative Recap

To own shares of Hims & Hers Health, investors need to believe in the platform’s ability to consistently grow by expanding into large, addressable health markets like weight loss through direct-to-consumer and telehealth offerings. The recent government-brokered reductions in GLP-1 drug prices may narrow the company’s pricing advantage in weight-loss treatments, but the most important near-term catalyst, consumer adoption of new specialty services, remains intact, while pricing pressure is the biggest risk; the impact so far does not appear immediately material.

Among recent updates, the announcement of narrowed full-year revenue guidance stands out, as it reflects the company’s acknowledgment of evolving industry and pricing conditions. This adjustment is closely tied to short-term catalysts and investor focus on whether Hims & Hers can preserve revenue growth as the competitive environment in GLP-1 weight-loss drugs changes.

However, what investors should really keep an eye on is that while consumer demand is strong, these new pricing deals could start to erode crucial profit margins if...

Read the full narrative on Hims & Hers Health (it's free!)

Hims & Hers Health is projected to reach $3.3 billion in revenue and $261.3 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 18.3% and an earnings increase of about $67.7 million from current earnings of $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $46.67 fair value, a 14% upside to its current price.

Exploring Other Perspectives

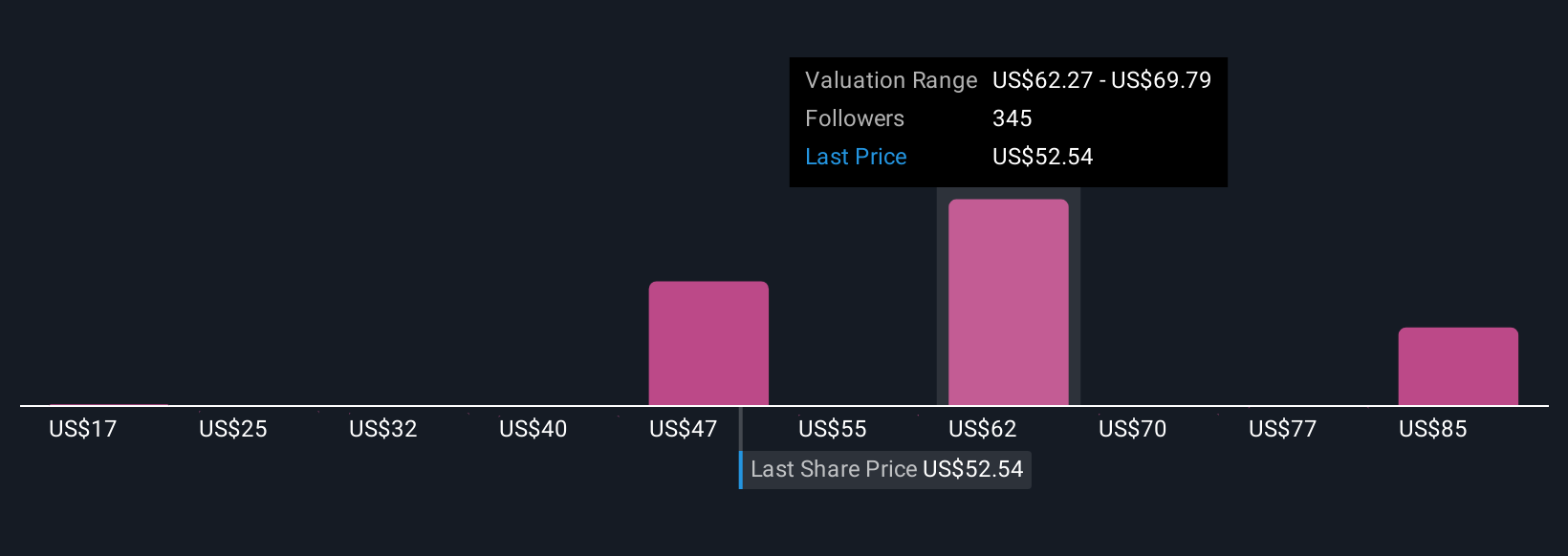

Thirty-seven community members valued Hims & Hers between US$37.21 and US$98.31 per share. With pricing changes in weight-loss drugs introducing volatility for key revenue streams, reader opinions can differ widely, explore several viewpoints to inform your own decision.

Explore 37 other fair value estimates on Hims & Hers Health - why the stock might be worth 9% less than the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives