- United States

- /

- Healthcare Services

- /

- NYSE:GRDN

Guardian Pharmacy Services (GRDN): Evaluating Valuation Following 20% Rally Over the Past Month

Reviewed by Simply Wall St

Guardian Pharmacy Services (GRDN) has been catching some investor attention, particularly after its recent share price moves. Over the past month, the stock rallied by 20%, and it is now up 43% in the past 3 months.

See our latest analysis for Guardian Pharmacy Services.

After a stellar few months, Guardian Pharmacy Services continues to attract attention as momentum builds. The stock’s 1-month share price return of 20% stands out, adding to a robust year-to-date gain. The 1-year total shareholder return of roughly 36% confirms that the trend hasn’t gone unnoticed. Even after a slight pullback, investors seem to be reassessing growth prospects and risk, with recent moves hinting at renewed confidence in the company.

If this upswing has you thinking about where momentum could strike next, now’s the perfect time to discover See the full list for free.

With shares nearing analyst price targets and robust gains on the board, the big question is whether Guardian Pharmacy Services is still undervalued or if the market has already factored in all expected growth potential.

Price-to-Sales of 1.4x: Is it justified?

Guardian Pharmacy Services is currently trading at a price-to-sales ratio of 1.4x, which places it above both its peer average and the broader US Healthcare industry. At a last close of $28.49, the market is assigning this premium despite the company’s recent unprofitability and the lack of consistent positive earnings.

The price-to-sales (P/S) ratio provides a way to value companies that may not yet be profitable by comparing their share price to their total sales per share. For healthcare companies like Guardian Pharmacy Services, a higher P/S can point to expectations of future growth, but risks are higher when profitability has not been established.

Compared to the US Healthcare industry average P/S ratio of 1.3x, Guardian's higher multiple looks relatively expensive. When matched against its peer average of just 0.3x, the premium becomes even more pronounced. Additionally, regression analysis suggests that a fair P/S for Guardian might be closer to 0.6x, a level markedly lower than where it currently trades.

Explore the SWS fair ratio for Guardian Pharmacy Services

Result: Price-to-Sales of 1.4x (OVERVALUED)

However, slowing annual revenue growth and negative net income remain concerns. These factors could challenge the recent bullish momentum for Guardian Pharmacy Services.

Find out about the key risks to this Guardian Pharmacy Services narrative.

Another View: DCF Paints a Sharply Different Picture

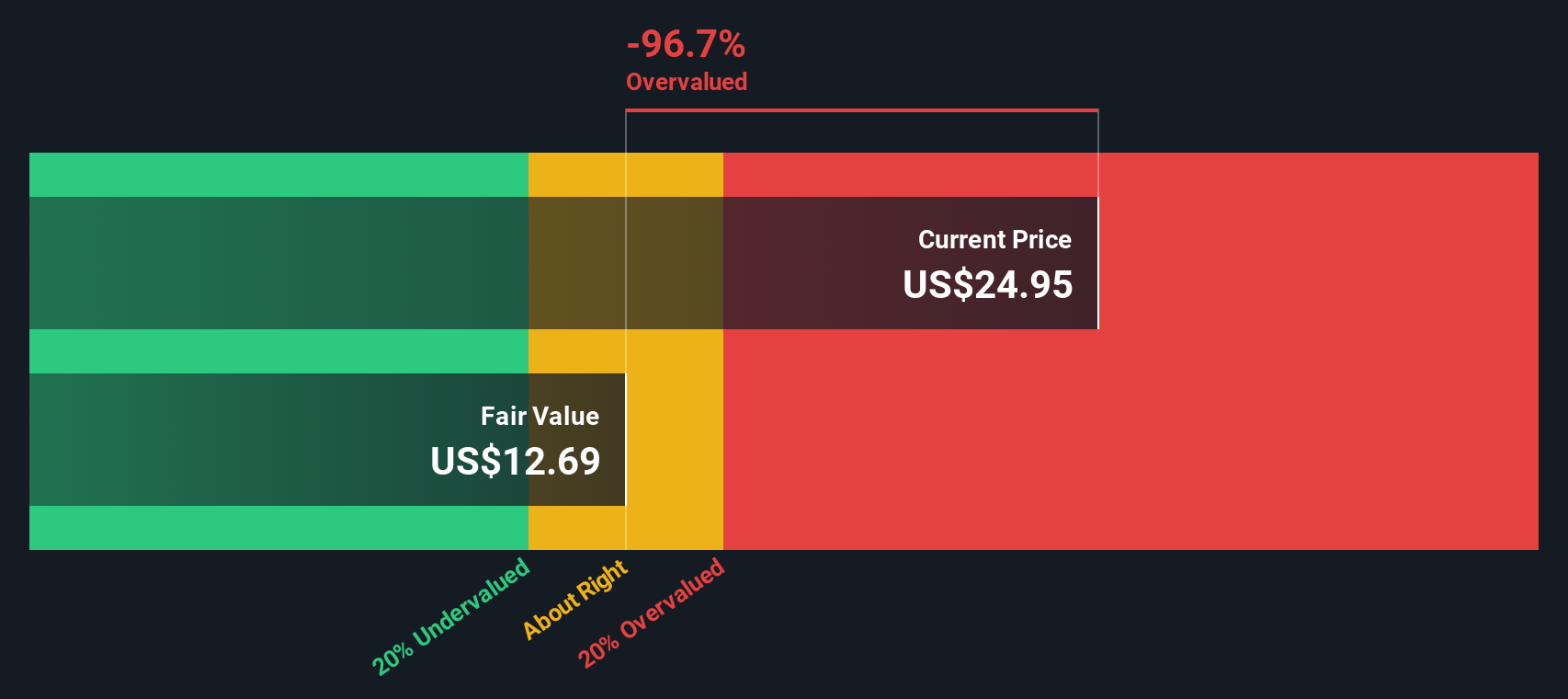

While the price-to-sales ratio signals overvaluation, our DCF model suggests Guardian Pharmacy Services could be even more overpriced. According to this method, shares are trading well above the estimated fair value of $12.73. The question remains: could the future growth that investors are betting on really justify such a large premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guardian Pharmacy Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guardian Pharmacy Services Narrative

If you see things differently, or want to dig into the numbers yourself, you can put together your own perspective and narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Guardian Pharmacy Services.

Looking for more investment ideas?

Smart investors never settle for just one path. Expand your opportunities and boost your portfolio potential by uncovering standout stocks across ground-breaking sectors.

- Uncover growth potential with these 860 undervalued stocks based on cash flows, which helps you spot companies that the market may have priced well below their true worth.

- Capitalize on next-generation breakthroughs by tapping into artificial intelligence trends through these 24 AI penny stocks, which are at the forefront of innovation.

- Boost your steady income with these 17 dividend stocks with yields > 3%, highlighting leading businesses offering attractive yields above 3% for reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRDN

Guardian Pharmacy Services

A pharmacy service company, provides a suite of technology-enabled services to help residents of long-term health care facilities (LTCFs) in the United States.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives