- United States

- /

- Healthcare Services

- /

- NYSE:ELV

Is Elevance Health, Inc.'s (NYSE:ELV) Recent Performance Tethered To Its Attractive Financial Prospects?

Elevance Health's (NYSE:ELV) stock up by 2.9% over the past three months. Since the market usually pay for a company’s long-term financial health, we decided to study the company’s fundamentals to see if they could be influencing the market. Particularly, we will be paying attention to Elevance Health's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Elevance Health

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Elevance Health is:

15% = US$6.2b ÷ US$41b (Based on the trailing twelve months to March 2024).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.15 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Elevance Health's Earnings Growth And 15% ROE

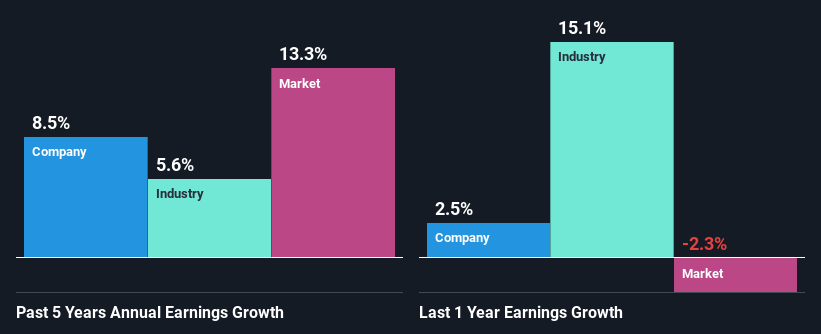

At first glance, Elevance Health seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 11%. This probably laid the ground for Elevance Health's moderate 8.5% net income growth seen over the past five years.

As a next step, we compared Elevance Health's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 5.6%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Elevance Health fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Elevance Health Efficiently Re-investing Its Profits?

Elevance Health has a low three-year median payout ratio of 21%, meaning that the company retains the remaining 79% of its profits. This suggests that the management is reinvesting most of the profits to grow the business.

Moreover, Elevance Health is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 16% over the next three years. The fact that the company's ROE is expected to rise to 21% over the same period is explained by the drop in the payout ratio.

Summary

In total, we are pretty happy with Elevance Health's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Undervalued with adequate balance sheet.