- United States

- /

- Healthcare Services

- /

- NYSE:DGX

Alzheimer's Blood Tests Breakthrough Might Change The Case For Investing In Quest Diagnostics (DGX)

Reviewed by Sasha Jovanovic

- On October 27, 2025, Quest Diagnostics announced that two of its blood-based tests for identifying Alzheimer's disease pathology were found to be highly accurate, with 91% sensitivity and specificity reported in a peer-reviewed study published in Neurology® Clinical Practice.

- This validation suggests Quest's new tests could potentially confirm Alzheimer's diagnoses without the need for traditional follow-up scans or cerebrospinal fluid testing, indicating a shift toward easier, less invasive diagnostic options for patients.

- As these findings position Quest Diagnostics to expand its presence in neurodegenerative disease testing, we'll examine how this could affect the company's investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Quest Diagnostics Investment Narrative Recap

To believe in Quest Diagnostics as a shareholder, you need to trust in the company's ability to expand its advanced testing capabilities and grow test volumes, especially in high-impact areas like neurodegenerative diseases. The recent Alzheimer's blood test announcement could be a significant short-term catalyst by supporting new revenue streams, but reimbursement policy changes remain the biggest near-term risk, potentially offsetting gains if not addressed; the overall impact on this balance will unfold over time.

Among recent company announcements, Quest’s collaboration with Guardant Health to offer an FDA-approved blood test for colorectal cancer screening stands out as most relevant. Like the Alzheimer’s initiative, this partnership highlights Quest’s focus on launching innovative, less invasive diagnostic tests in 2026, reinforcing the growth driver of expanding advanced and preventive testing within its portfolio.

Yet, even with new high-accuracy test launches, investors also need to consider the risk that, if PAMA reimbursement cuts proceed without reform...

Read the full narrative on Quest Diagnostics (it's free!)

Quest Diagnostics' outlook anticipates $11.9 billion in revenue and $1.3 billion in earnings by 2028. This scenario assumes a 4.1% annual revenue growth and a $355 million increase in earnings from the current $945 million.

Uncover how Quest Diagnostics' forecasts yield a $197.25 fair value, a 10% upside to its current price.

Exploring Other Perspectives

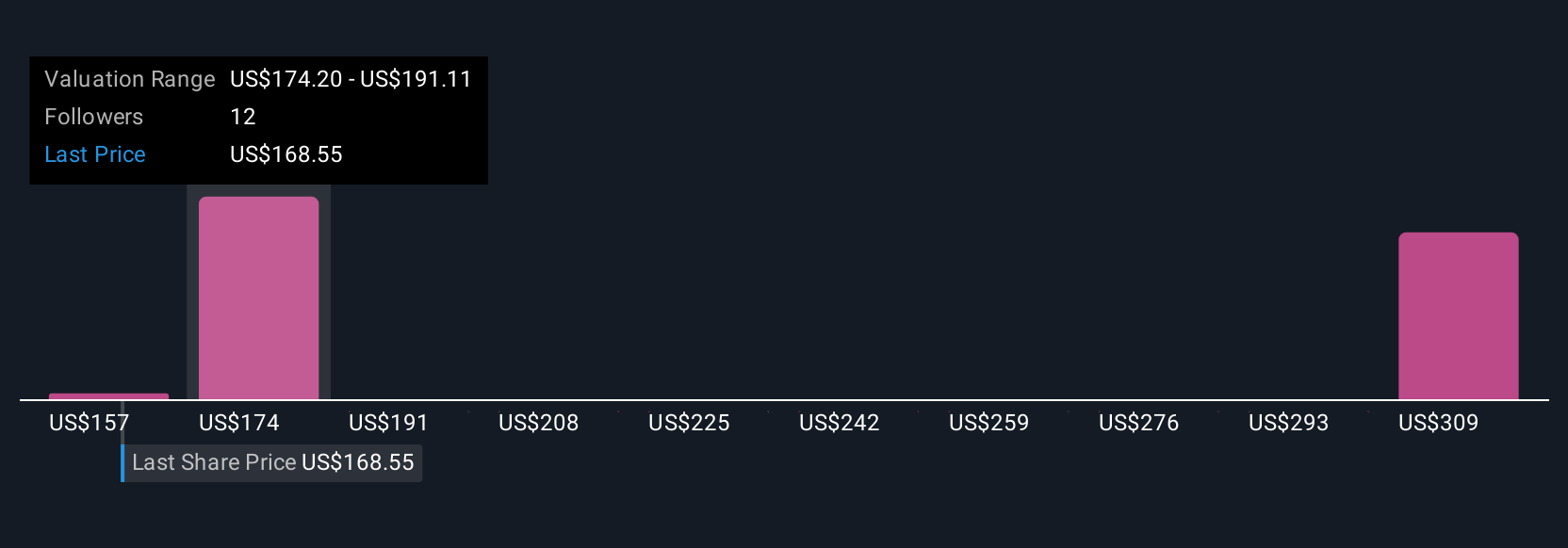

Simply Wall St Community members estimate Quest's fair value from US$157.30 to US$224.73 across three analyses. While consensus expects revenue catalysts from advanced testing, potential declines from shifts in healthcare policy could shape your outlook, so weigh several viewpoints.

Explore 3 other fair value estimates on Quest Diagnostics - why the stock might be worth as much as 25% more than the current price!

Build Your Own Quest Diagnostics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quest Diagnostics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quest Diagnostics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quest Diagnostics' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives