- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Is Bausch + Lomb's Revenue Recovery Strengthening Its Investment Case After Last Year’s Recall (BLCO)?

Reviewed by Sasha Jovanovic

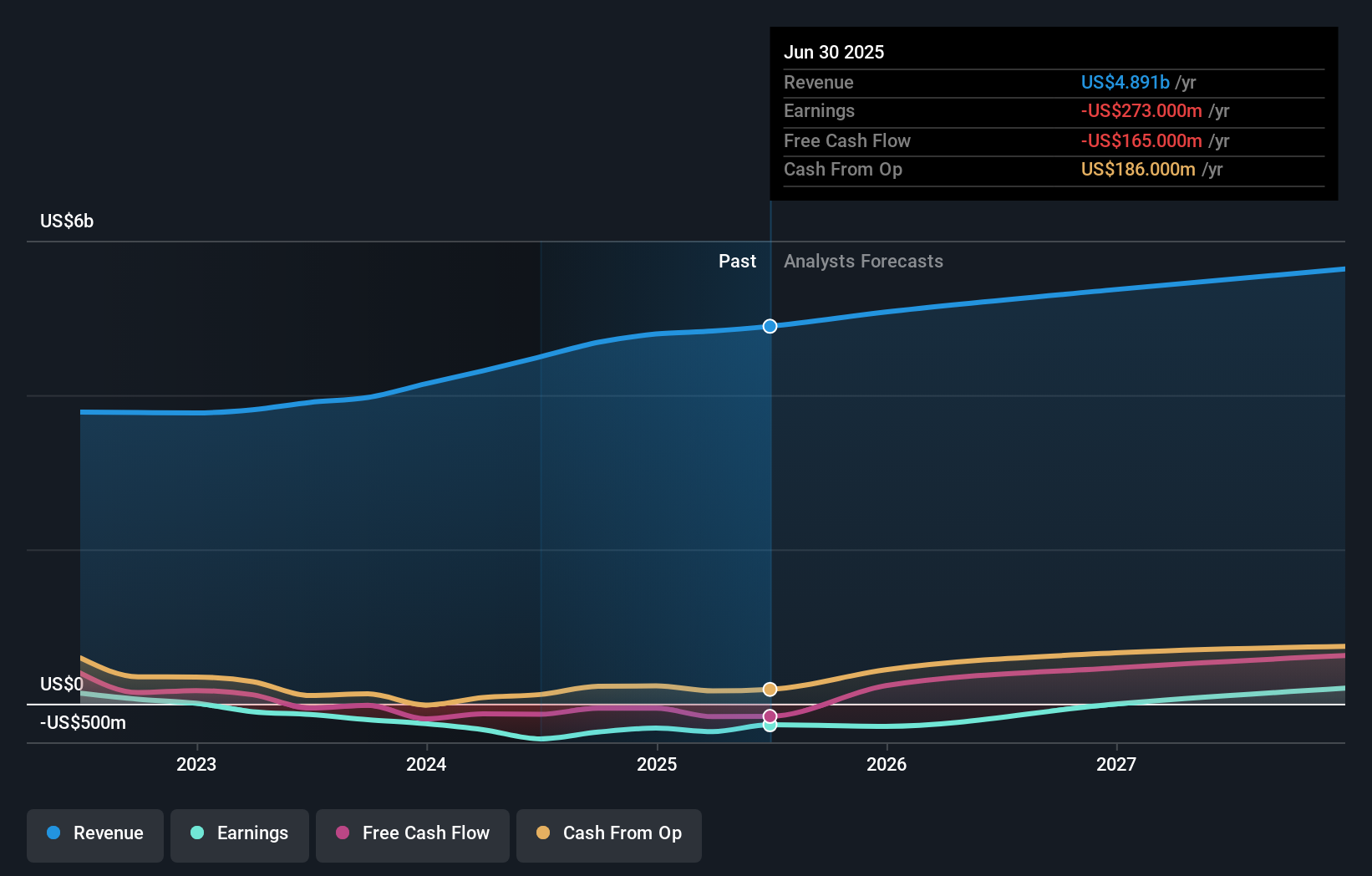

- Bausch + Lomb reported third-quarter 2025 earnings, with revenue rising to US$1.28 billion from US$1.20 billion a year earlier, fueled by growth across all major business segments and strong results in Pharmaceuticals.

- Robust demand for premium intraocular lenses and revitalized consumer brands contributed to a recovery following last year’s recall, while management highlighted ongoing margin improvement initiatives.

- We'll explore how sustained momentum in key product lines may influence Bausch + Lomb's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Bausch + Lomb's Investment Narrative?

To own Bausch + Lomb stock, an investor needs to believe in the company’s ability to execute on top-line growth and margin improvement while progressing toward eventual profitability. The latest earnings showed quarterly revenue hitting US$1.28 billion, a healthy increase that reassures on core demand across segments, but persistent net losses, US$28 million for the quarter, remain a key hurdle. Recent product launches, the strong rebound in intraocular lens sales, and management’s reiterated full-year revenue guidance highlight momentum in crucial business drivers. However, the unchanged pattern of operating losses, even as revenue rises, may refocus attention on cost structure, R&D spending, and the path to sustained profitability. While the news supports existing catalysts such as ongoing product innovation and market recovery post-recall, it also sharpens near-term risks tied to achieving profitable growth at scale, especially if margin improvements take longer than hoped. But concerns about the ability to turn higher sales into lasting profits remain front and center for investors.

Bausch + Lomb's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Bausch + Lomb - why the stock might be worth just $16.30!

Build Your Own Bausch + Lomb Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch + Lomb research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bausch + Lomb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch + Lomb's overall financial health at a glance.

No Opportunity In Bausch + Lomb?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives