- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Bausch + Lomb (NYSE:BLCO): Assessing Valuation After Q3 Revenue Growth and 2025 Guidance Update

Reviewed by Simply Wall St

Bausch + Lomb (NYSE:BLCO) released its third quarter earnings, reporting higher revenue than last year but also posting a net loss for the period. The company also updated its full-year 2025 revenue guidance.

See our latest analysis for Bausch + Lomb.

After a rough start this year, Bausch + Lomb’s recent 15.98% gain over the past 90 days signals that momentum may be shifting as investors digest stronger revenue and the latest guidance update. Still, with a 1-year total shareholder return of -21.91%, longer-term performance remains in the red.

If Bausch + Lomb’s ongoing turnaround has your attention, it could be the perfect time to discover other healthcare stocks making waves using See the full list for free.

The question now is whether Bausch + Lomb’s recent gains reflect a genuine bargain for investors or if the market has already factored in all of its expected growth. Could this be a buying opportunity, or is future upside already priced in?

Price-to-Sales of 1.1x: Is it justified?

Bausch + Lomb’s recent close at $15.97 equates to a price-to-sales (P/S) ratio of 1.1x, noticeably lower than both its healthcare industry peers and broader benchmarks. This result stands out as a potential signal that the market is underpricing the company’s current and future revenue streams compared to sector averages.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of revenue generated. For medical equipment companies, this multiple is especially useful given that many businesses focus on top-line growth over bottom-line profit at certain stages in their lifecycle.

With Bausch + Lomb’s P/S ratio of 1.1x, the company is trading well below the US Medical Equipment industry average of 3.1x and below the peer average of 2.4x. Relative to our estimate of a fair P/S ratio of 2.3x, current pricing leaves considerable upside potential if the market re-rates the stock closer to these benchmarks.

Explore the SWS fair ratio for Bausch + Lomb

Result: Price-to-Sales of 1.1x (UNDERVALUED)

However, ongoing net losses and historically weak shareholder returns pose key risks that could limit Bausch + Lomb’s rerating in the near term.

Find out about the key risks to this Bausch + Lomb narrative.

Another View: SWS DCF Model Sees Deeper Value

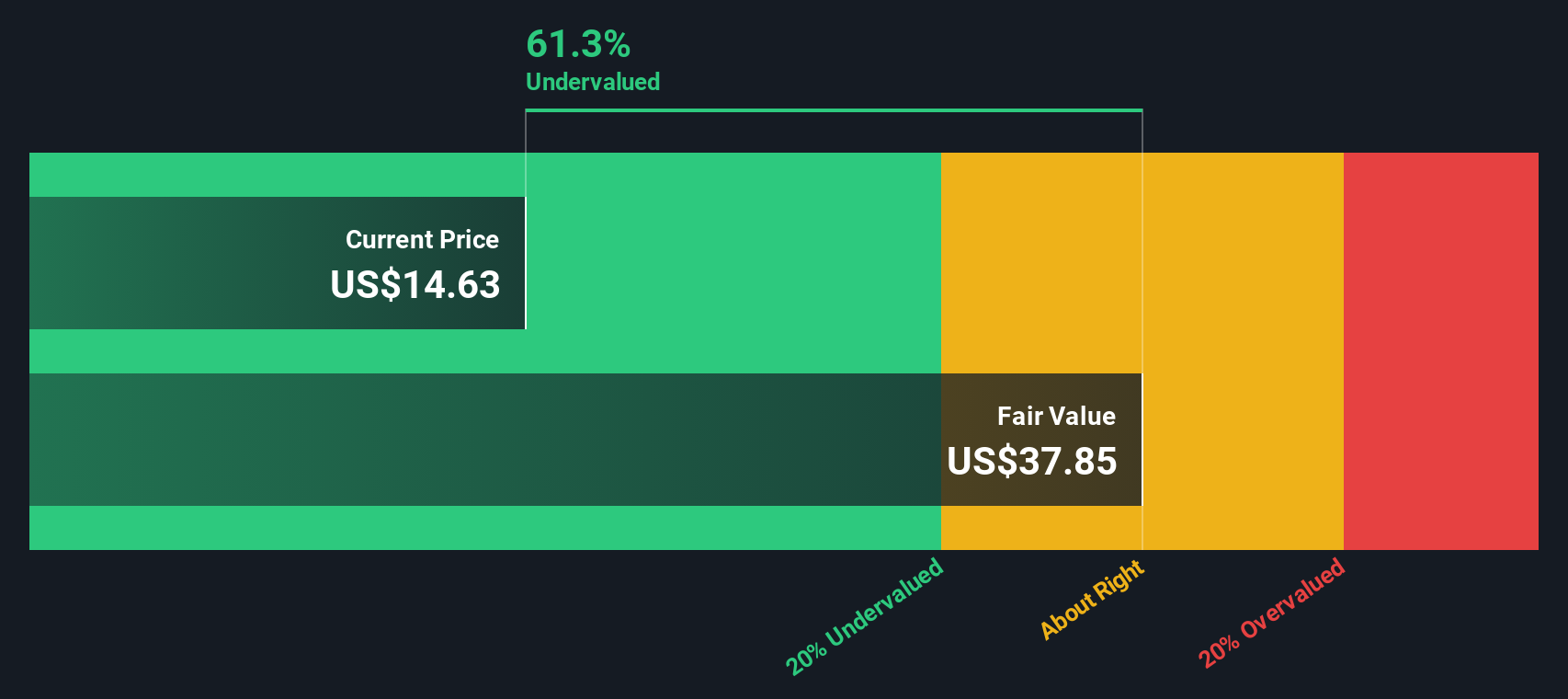

While the price-to-sales ratio presents Bausch + Lomb as undervalued compared to its peers, our SWS DCF model indicates there could be even more potential upside. According to this approach, the stock is trading well below an estimated fair value, suggesting that the market may be discounting its longer-term prospects. However, the question remains whether these DCF assumptions are too optimistic or if the market is being overly cautious about BLCO's future.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bausch + Lomb for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bausch + Lomb Narrative

If you prefer to draw your own conclusions or want to dig deeper into the numbers, you can craft your own perspective in just minutes with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bausch + Lomb.

Looking for more investment ideas?

Smart investors always keep their watchlist fresh. Strengthen your portfolio with unique opportunities that others might miss using Simply Wall Street's targeted stock screeners.

- Target high potential returns by tapping into these 874 undervalued stocks based on cash flows that the market may be overlooking in today's environment.

- Capture reliable income streams and see which companies offer strong yields by checking out these 16 dividend stocks with yields > 3%.

- Position yourself for future breakthroughs by reviewing these 28 quantum computing stocks, which highlights innovators driving advancements in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives