- United States

- /

- Healthcare Services

- /

- NasdaqGS:WGS

GeneDx (WGS) Valuation After New Clinical Breakthroughs Spotlighted Ahead of 2025 NSGC Conference

Reviewed by Simply Wall St

GeneDx Holdings is in the spotlight as it prepares to reveal new research at the upcoming National Society of Genetic Counselors Annual Meeting. The company’s presentations focus on cutting-edge genomic data and advancements in rare disease diagnosis, highlighting their leadership in precision medicine.

See our latest analysis for GeneDx Holdings.

After news of GeneDx’s landmark research presentations and growing recognition at major industry events, momentum appears to be building. The company’s stock has surged, with a 14.9% 1-month share price return and a remarkable 81.9% total shareholder return over the past year. This underscores renewed optimism about its growth prospects.

If GeneDx’s rapid progress has you thinking about broader opportunities in healthcare, why not discover other innovators with potential breakthroughs through our See the full list for free.

The recent surge in GeneDx Holdings’ share price raises the question: is the market underestimating the long-term potential driven by these breakthroughs, or is future growth already fully reflected in the current stock price?

Most Popular Narrative: 7.5% Undervalued

GeneDx Holdings’ widely followed narrative puts its fair value at $151.22, around 7.5% above the last close of $139.91. This comparison highlights a market that may be rewarding rapid progress, but still sees room for further upside.

Ongoing development and enrichment of GeneDx's comprehensive rare disease genomic database strengthens product differentiation, enables premium pricing, and creates high barriers to entry. This supports sustained top-line growth and long-term profitability as data network effects compound.

Want to peek inside the financial engine driving this target? The entire valuation relies on strong top-line growth and a bold projection of margins and earnings expansion. How aggressive are these assumptions, and what is the narrative’s secret catalyst? Find out what is pushing GeneDx Holdings’ valuation above today's price.

Result: Fair Value of $151.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reimbursement challenges or slow adoption in new markets could quickly cool optimism and serve as powerful catalysts that derail GeneDx’s bullish outlook.

Find out about the key risks to this GeneDx Holdings narrative.

Another View: Is the Price Getting Ahead of Itself?

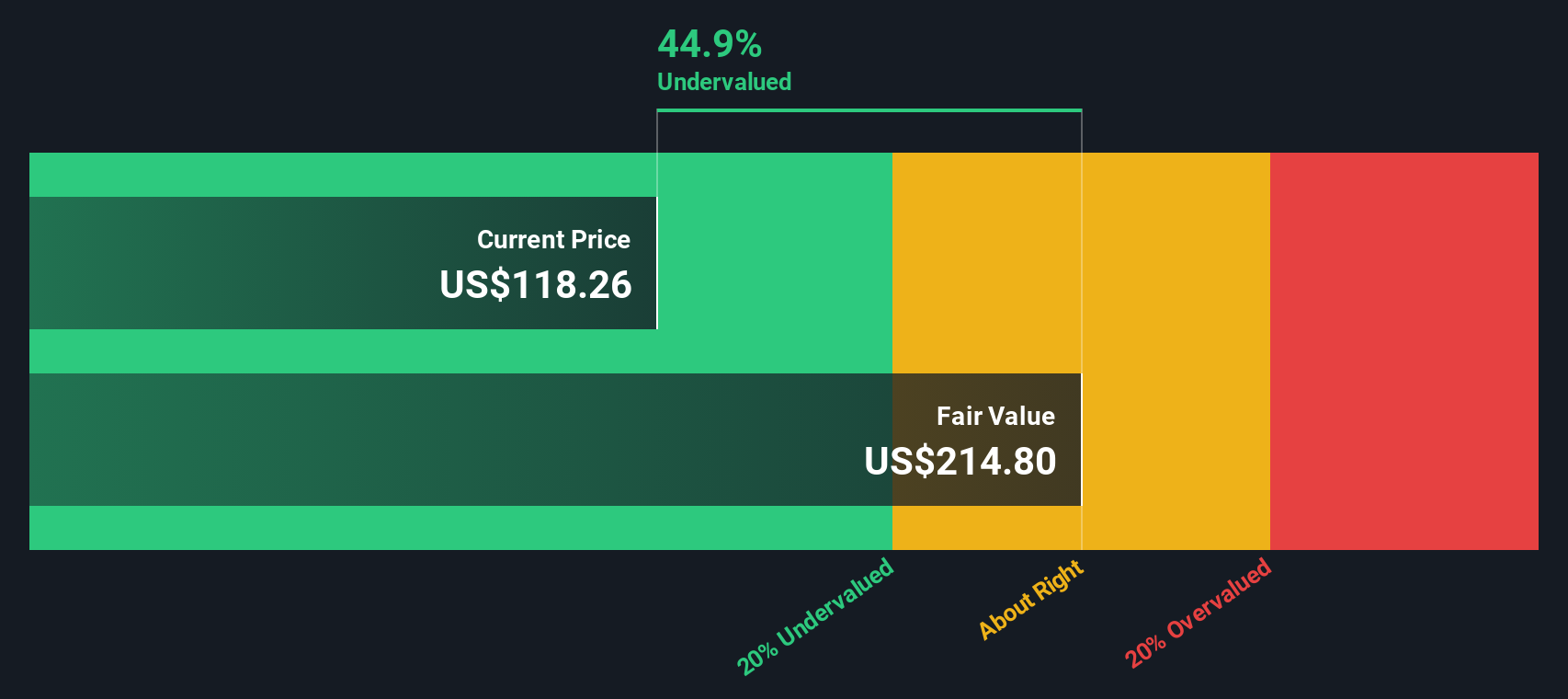

Looking at GeneDx Holdings using our DCF model reveals a very different picture. While the latest market narratives point to upside, the SWS DCF model suggests shares are actually trading 44.8% below fair value, which indicates substantial undervaluation. Could growth potential be even larger than recent multiples imply?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GeneDx Holdings Narrative

If you see things differently or want to dive into the data on your own terms, it’s easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your GeneDx Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t miss out on even bigger opportunities. Your next great stock pick could be waiting. Use the right tool now to gain an edge over the crowd.

- Hunt for tomorrow’s tech disruptors by checking out these 25 AI penny stocks and see which companies are set to capitalize on the AI revolution.

- Start building your income stream by reviewing these 15 dividend stocks with yields > 3% to pick out established businesses with attractive, reliable yields.

- Uncover hidden value by zeroing in on these 857 undervalued stocks based on cash flows where market pricing may not reflect future growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WGS

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives