- United States

- /

- Healthtech

- /

- NasdaqGS:WAY

Waystar (WAY): Assessing Valuation Following Raised Guidance and Strong Q3 Results

Reviewed by Simply Wall St

Waystar Holding (WAY) caught attention after announcing increased earnings guidance for 2025, along with third quarter results that featured a notable rise in both sales and net income compared to last year.

See our latest analysis for Waystar Holding.

This jump in guidance helped Waystar Holding gain some fresh momentum, with investors looking beyond last quarter's sharp net income growth to the company’s longer-term track record. After a tough October, the share price has started to find its feet again, logging a 4.7% return over the last 90 days and rewarding shareholders with a 14.6% total return over the past year. With higher targets in sight, the mood is shifting toward optimism around Waystar’s growth prospects.

If this trajectory has you rethinking where to look next in healthcare, you can check out more possibilities with See the full list for free.

With Waystar’s fresh guidance and strong results driving renewed interest, the real question now is whether the company’s shares remain undervalued given its growth, or if the market has already priced in its future gains.

Most Popular Narrative: 28.1% Undervalued

Waystar Holding’s fair value in the most widely followed narrative sits well above its last close price, creating a striking upside case for shares. With such a large gap between trading levels and the narrative fair value, understanding the catalysts behind this view is essential.

The acquisition of Iodine Software, a leading provider of AI-powered clinical intelligence, will expand Waystar's total addressable market by over 15%, accelerate its product roadmap, and immediately boost gross margins and adjusted EBITDA margins. This positions the company for compounding, long-term revenue and earnings growth.

What exactly convinces analysts this company should command such a premium? The answer points to bold revenue expansion, widening profit margins, and a transformative deal reshaping the business model. Curious what financial forecasts stand behind this confident price target? Dive in to see what powers this valuation.

Result: Fair Value of $50.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt levels after the Iodine deal and potential shifts in patient healthcare utilization could quickly challenge this optimistic outlook.

Find out about the key risks to this Waystar Holding narrative.

Another View: Are High Valuations Justified?

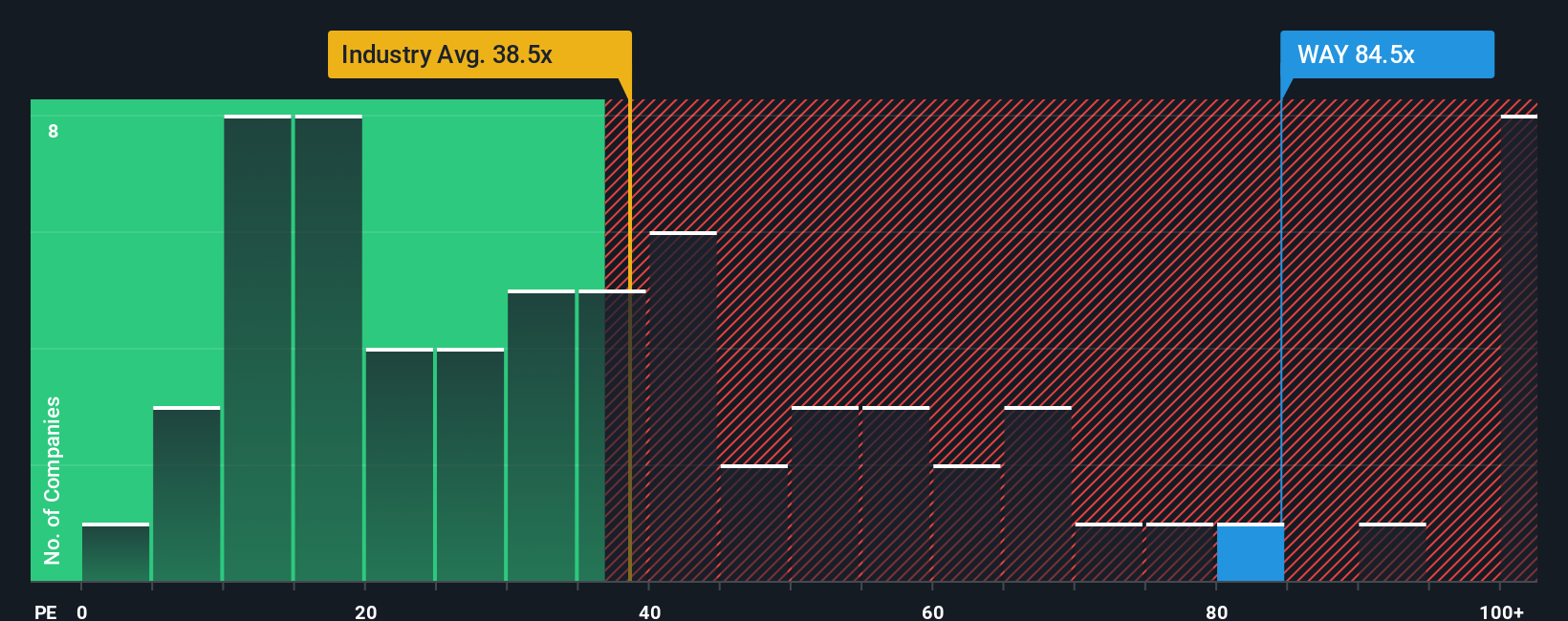

While the most popular narrative argues that Waystar is undervalued, a traditional price-to-earnings lens tells a different story. The shares currently trade at 62.3 times earnings, far above both the industry average of 34.4 and the peer average of 42.1. The fair ratio, based on market trends, is even lower at 31.7. This sizable premium suggests investors may be pricing in rapid earnings growth or unique company strengths, but it also raises the stakes. Could these high expectations make the stock vulnerable if future results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waystar Holding Narrative

If you think there’s more to the story or would rather follow your own research, it only takes a few minutes to build your own view. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Waystar Holding.

Looking for More Investment Ideas?

Don’t let standout opportunities pass you by, especially when the market is teeming with potential beyond just Waystar. Make smarter moves by checking out fresh investment ideas tailored to different strategies below.

- Target growing income streams and secure your portfolio’s yield by reviewing these 16 dividend stocks with yields > 3% with impressive payouts above 3%.

- Tap into the world of high-potential innovation and see which trailblazers are making breakthroughs in artificial intelligence through these 24 AI penny stocks.

- Position yourself early for the next wave of value by spotting mispriced opportunities. Use these 870 undervalued stocks based on cash flows, which is built on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waystar Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAY

Waystar Holding

Develops a cloud-based software solution for healthcare payments.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives