- United States

- /

- Medical Equipment

- /

- OTCPK:VRAY.Q

ViewRay's (NASDAQ:VRAY) Stock Price Has Reduced 56% In The Past Three Years

ViewRay, Inc. (NASDAQ:VRAY) shareholders will doubtless be very grateful to see the share price up 30% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Indeed, the share price is down a tragic 56% in the last three years. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for ViewRay

Given that ViewRay didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, ViewRay saw its revenue grow by 15% per year, compound. That's a fairly respectable growth rate. So some shareholders would be frustrated with the compound loss of 16% per year. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

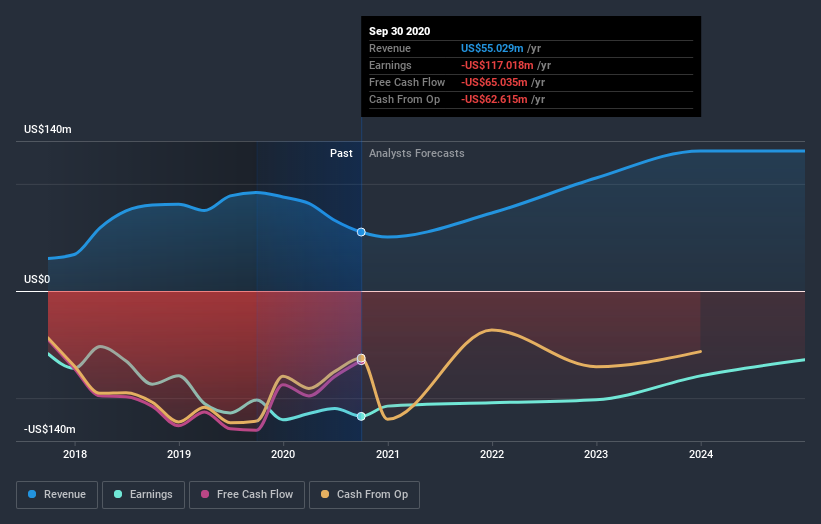

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling ViewRay stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Investors in ViewRay had a tough year, with a total loss of 12%, against a market gain of about 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for ViewRay you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade ViewRay, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:VRAY.Q

ViewRay

ViewRay, Inc. designs, manufactures, and markets magnetic resonance imaging (MRI) guided radiation therapy systems to image and treat cancer patients in the United States, Italy, France, Taiwan, the United Kingdom, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives