- United States

- /

- Medical Equipment

- /

- NasdaqGM:STIM

Even With A 26% Surge, Cautious Investors Are Not Rewarding Neuronetics, Inc.'s (NASDAQ:STIM) Performance Completely

Despite an already strong run, Neuronetics, Inc. (NASDAQ:STIM) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

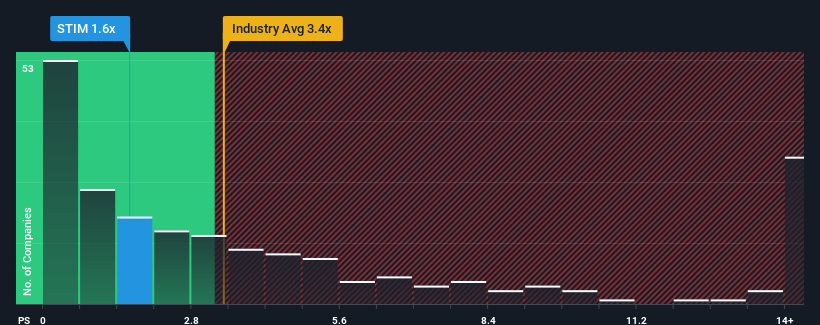

Even after such a large jump in price, Neuronetics may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Neuronetics

How Neuronetics Has Been Performing

Neuronetics' revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Neuronetics will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Neuronetics will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Neuronetics would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. Pleasingly, revenue has also lifted 45% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 13% per annum over the next three years. That's shaping up to be materially higher than the 9.5% each year growth forecast for the broader industry.

With this information, we find it odd that Neuronetics is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Neuronetics' P/S

Neuronetics' stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Neuronetics currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for Neuronetics that you need to take into consideration.

If these risks are making you reconsider your opinion on Neuronetics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Neuronetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:STIM

Neuronetics

Engages in providing in office treatments for patients with neurohealth disorders in the United States and internationally.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives