- United States

- /

- Medical Equipment

- /

- NasdaqCM:SSII

Can Remote Surgery Success Reinforce SS Innovations' (SSII) Lead in Medtech Disruption?

Reviewed by Sasha Jovanovic

- SS Innovations International recently completed its first remote telesurgery using the SSi Mantra Tele Surgeon Console, with a surgeon in New Delhi operating on a patient at Manipal Hospital in Jaipur, approximately 185 miles away.

- This achievement illustrates the potential for remote robotic surgery to expand access to specialized medical care beyond traditional hospital settings.

- We’ll explore how SS Innovations’ breakthrough in remote telesurgery technology could impact its investment narrative and long-term market positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is SS Innovations International's Investment Narrative?

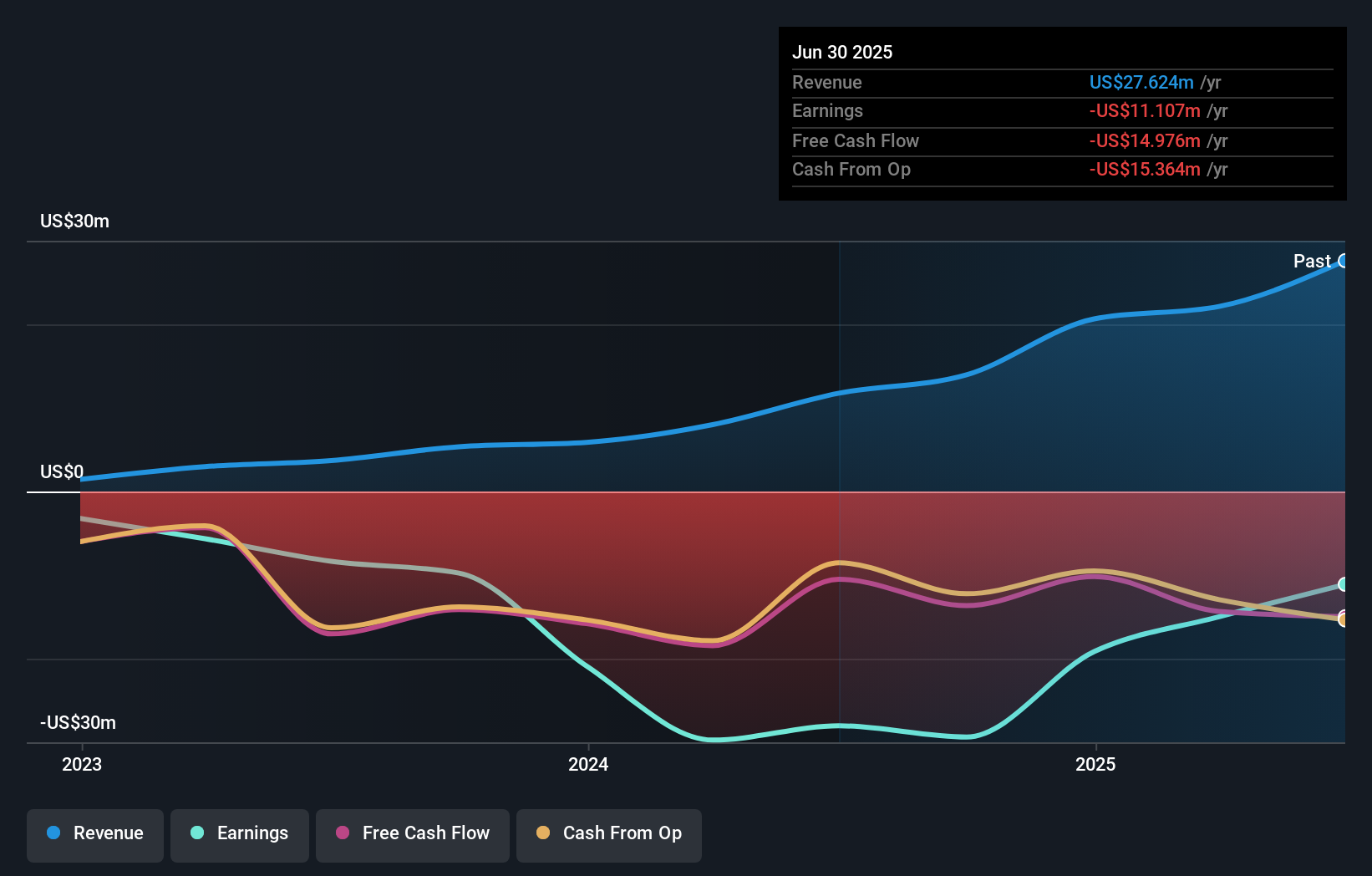

For anyone considering SS Innovations International as an investment, the story revolves around belief in the company's potential to transform the field of surgery through its remote robotic platforms. The recent milestone, the first successful remote operation using the SSi Mantra Tele Surgeon Console, underscores both the promise and the uncertainty: while it demonstrates real-world capability and could accelerate attention from hospitals and regulators, its immediate impact on catalysts such as FDA approval or rapid sales expansion remains to be seen. Shareholder hopes likely hinge on the company converting technical achievements into commercial momentum, but challenges like continued net losses, a relatively new management team, cash runway concerns, and a high price-to-sales ratio persist. The telesurgery success may adjust risk calculations by proving feasibility, but meaningful changes to financials or valuation will require sustained execution and broader market adoption.

However, the relative inexperience of SSII’s board still raises some big questions for investors.

Exploring Other Perspectives

Explore another fair value estimate on SS Innovations International - why the stock might be worth less than half the current price!

Build Your Own SS Innovations International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SS Innovations International research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free SS Innovations International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SS Innovations International's overall financial health at a glance.

No Opportunity In SS Innovations International?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SSII

SS Innovations International

Operates as a commercial-stage surgical robotics company in India and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives