- United States

- /

- Medical Equipment

- /

- NasdaqGS:QDEL

Will QuidelOrtho’s (QDEL) Expanded Immunohematology Portfolio Strengthen Its Competitive Edge in Diagnostics?

Reviewed by Sasha Jovanovic

- QuidelOrtho recently highlighted its commitment to transfusion medicine at the Association for the Advancement of Blood & Biotherapies (AABB) 2025 Annual Meeting, showcasing the newly FDA-approved Micro Typing Systems (MTS) DAT Card and its integration with the ORTHO VISION Platform.

- This development expands the company’s immunohematology portfolio and is expected to enhance laboratory efficiency in making timely transfusion decisions.

- We'll examine how the FDA approval of the MTS DAT Card may influence QuidelOrtho's investment narrative and long-term outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

QuidelOrtho Investment Narrative Recap

Investors in QuidelOrtho need to believe in the company’s ability to offset steep declines in COVID-related revenue by reinvigorating growth in core diagnostic platforms and introducing new products that support clinical laboratories. The recent FDA approval of the MTS DAT Card is a positive step for the immunohematology segment, yet this development is unlikely to materially move the needle on the most pressing near-term earnings risk: shrinking high-margin COVID testing sales with limited new products of similar scale to offset the drag.

Among recent announcements, the launch of the QUICKVUE Influenza + SARS Test stands out. This product underscores QuidelOrtho’s focus on expanding its point-of-care offering amid the loss of COVID-related revenues and highlights continued innovation in respiratory diagnostics, which remains a key catalyst for driving recurring revenue as the business adapts to post-pandemic normalization.

In contrast, investors should be aware that persistent top-line pressure from falling COVID testing revenue could impact net margins if…

Read the full narrative on QuidelOrtho (it's free!)

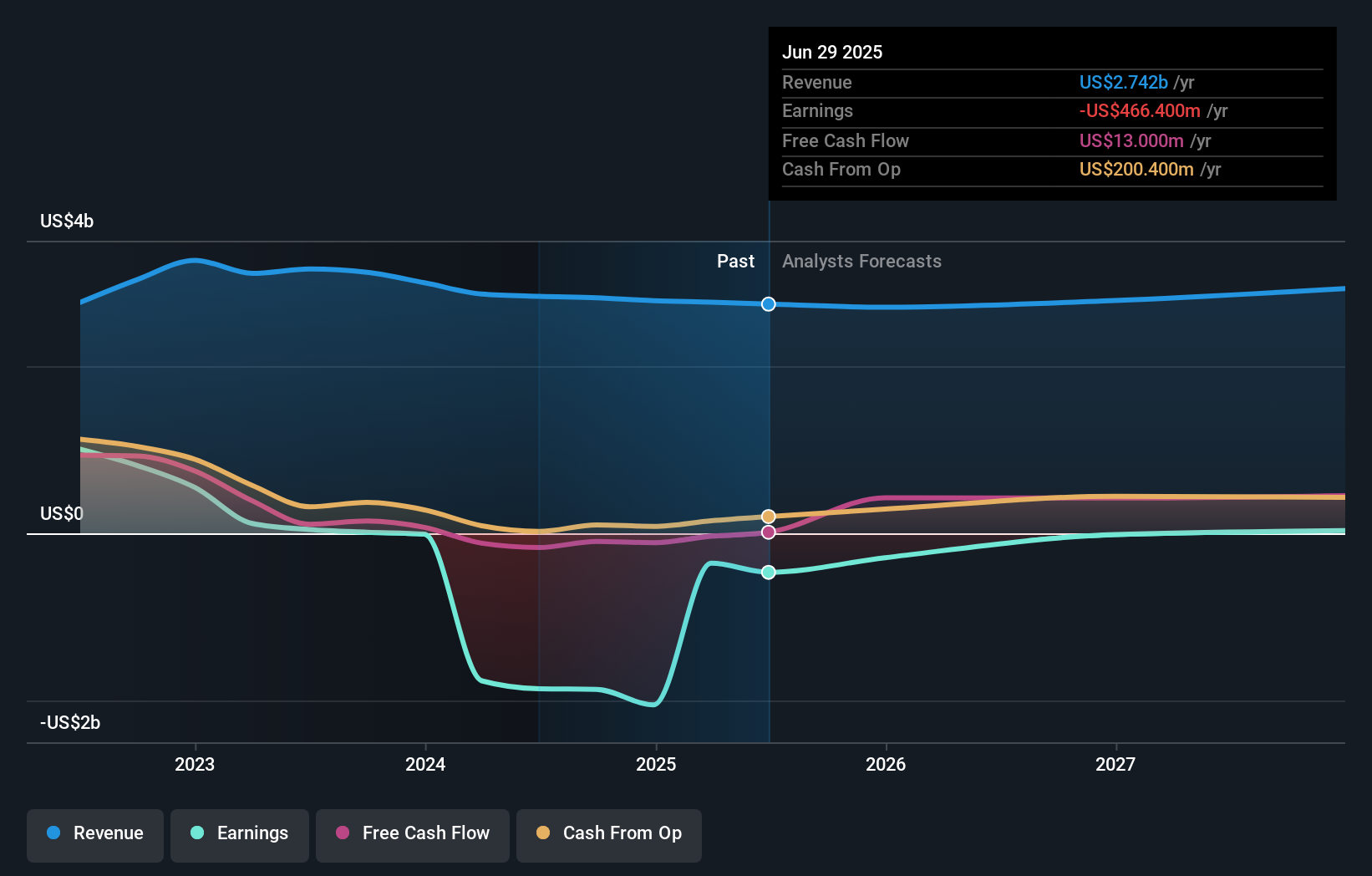

QuidelOrtho's outlook anticipates $3.0 billion in revenue and $17.2 million in earnings by 2028. This is based on a projected annual revenue growth rate of 2.6% and represents an earnings increase of $483.6 million from the current earnings of -$466.4 million.

Uncover how QuidelOrtho's forecasts yield a $40.33 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$40.33 to US$85.78 across three contributors. While projections for new product adoption continue, persistent declines in COVID test sales highlight challenges for sustained profitability and revenue diversification, so consider the breadth of opinions available.

Explore 3 other fair value estimates on QuidelOrtho - why the stock might be worth over 3x more than the current price!

Build Your Own QuidelOrtho Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QuidelOrtho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QuidelOrtho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QuidelOrtho's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuidelOrtho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QDEL

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives