- United States

- /

- Medical Equipment

- /

- NasdaqCM:PLSE

Did Widening Losses and NANOCLAMP AF Study Shift Pulse Biosciences' (PLSE) Investment Narrative?

Reviewed by Sasha Jovanovic

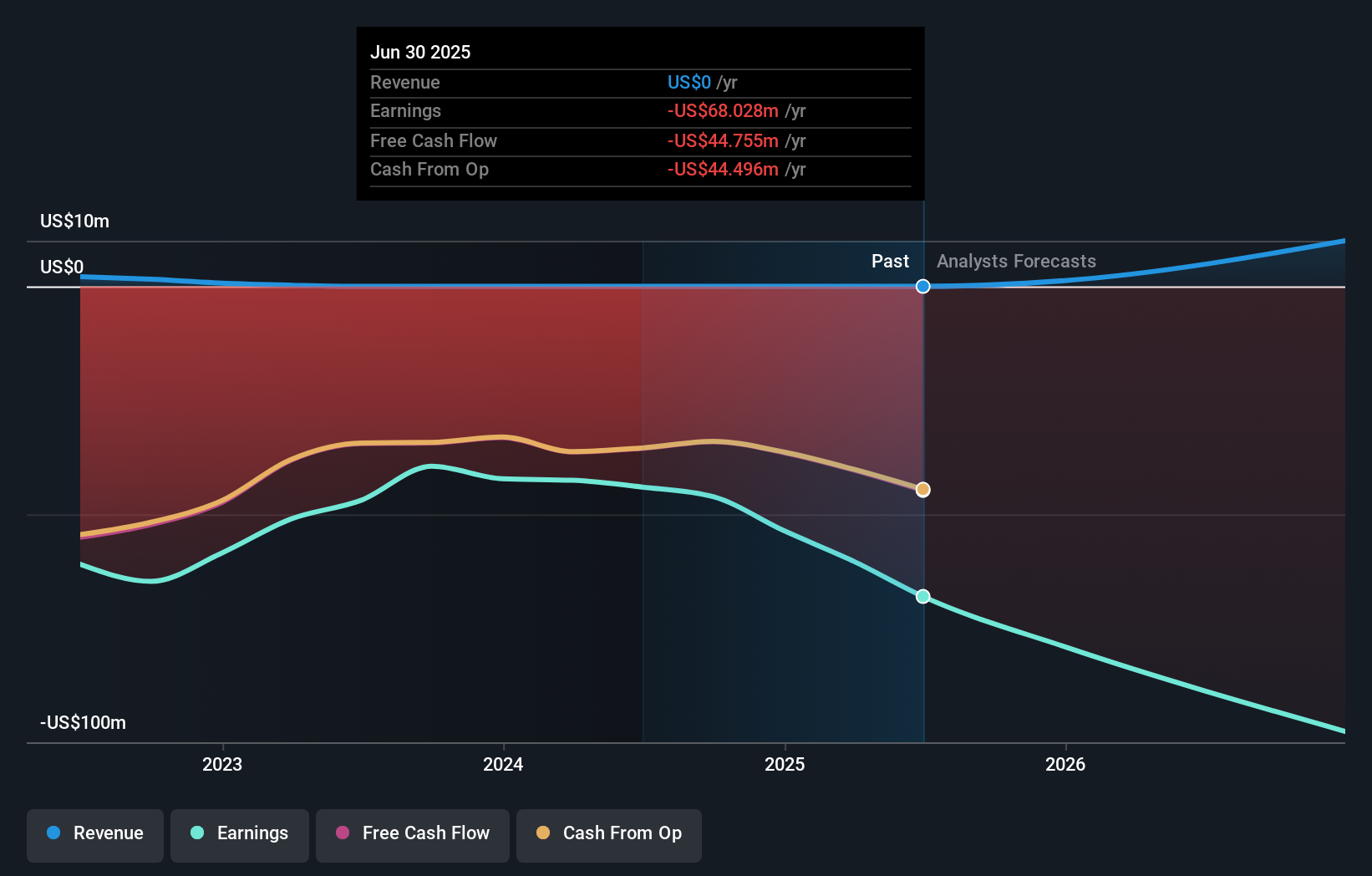

- Pulse Biosciences reported third quarter results showing a net loss of US$19.39 million, widening from US$12.68 million a year earlier, and a nine-month net loss of US$55.35 million compared to US$34.2 million previously.

- Investors may note this increased loss comes soon after the company began patient enrollment in its NANOCLAMP AF Study, reflecting continued investment in its nonthermal cardiac ablation technology.

- We'll explore how the combination of growing losses and continued clinical development efforts shapes Pulse Biosciences' investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Pulse Biosciences' Investment Narrative?

For anyone considering Pulse Biosciences as an investment, the big picture hinges on believing that the company can turn its breakthrough cardiac ablation technology into both clinical and commercial success before its cash resources run thin. The latest quarterly report underlines the key risk, with net losses deepening to US$19.39 million for the third quarter amid zero revenue, reflecting the high costs of ongoing research and clinical trials. At the same time, the initiation of patient enrollment for the NANOCLAMP AF Study is a genuinely important catalyst, signaling momentum in clinical development, which remains the most compelling short-term driver for the stock. This milestone reinforces the investment thesis, but also heightens near-term financial risk, given that ramped-up spending may continue without revenue relief in sight. The risk-reward equation now tilts even more sharply toward execution on clinical milestones and future funding needs. In contrast, funding gaps could pose surprises for investors watching the clinical timeline closely.

Our valuation report here indicates Pulse Biosciences may be overvalued.Exploring Other Perspectives

Build Your Own Pulse Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pulse Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Pulse Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pulse Biosciences' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLSE

Flawless balance sheet with low risk.

Market Insights

Community Narratives