- United States

- /

- Medical Equipment

- /

- NasdaqGS:NVCR

Should Rising Losses Despite Higher Sales Require Action From NovoCure (NVCR) Investors?

Reviewed by Sasha Jovanovic

- NovoCure reported its third quarter 2025 results, showing sales of US$167.2 million and a net loss of US$37.27 million, alongside a nine-month net loss of US$111.73 million on sales of US$481 million.

- While revenue increased year-over-year, the company's rising net losses may fuel ongoing debates about the pace toward profitability and margin improvement.

- We'll take a closer look at how rising net losses alongside higher sales may shape the outlook for NovoCure’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NovoCure Investment Narrative Recap

To be a NovoCure shareholder, you need to believe in the long-term value of Tumor Treating Fields technology and the company's ability to expand its addressable market through new clinical indications and regulatory approvals. The recent Q3 results, showing higher revenue but also rising net losses, do not appear to change the most important short-term catalyst, which is the pace of TTFields adoption in newly approved markets, or the largest risk, which remains persistent financial losses impacting the path to profitability.

Of the company's recent announcements, the September 2025 final results presentation for the Phase 3 METIS trial is most relevant to the investment story. Breakthroughs from this trial could factor significantly into driving physician adoption and future regulatory approvals, directly supporting NovoCure’s expansion goals while investor attention remains closely fixed on translating clinical progress into more robust revenue and margin gains.

However, persistent losses and an uncertain timeline for profitability present risks investors should not overlook, especially if...

Read the full narrative on NovoCure (it's free!)

NovoCure's narrative projects $863.5 million revenue and $107.8 million earnings by 2028. This requires 11.1% yearly revenue growth and a $278.8 million earnings increase from current earnings of -$171.0 million.

Uncover how NovoCure's forecasts yield a $25.19 fair value, a 112% upside to its current price.

Exploring Other Perspectives

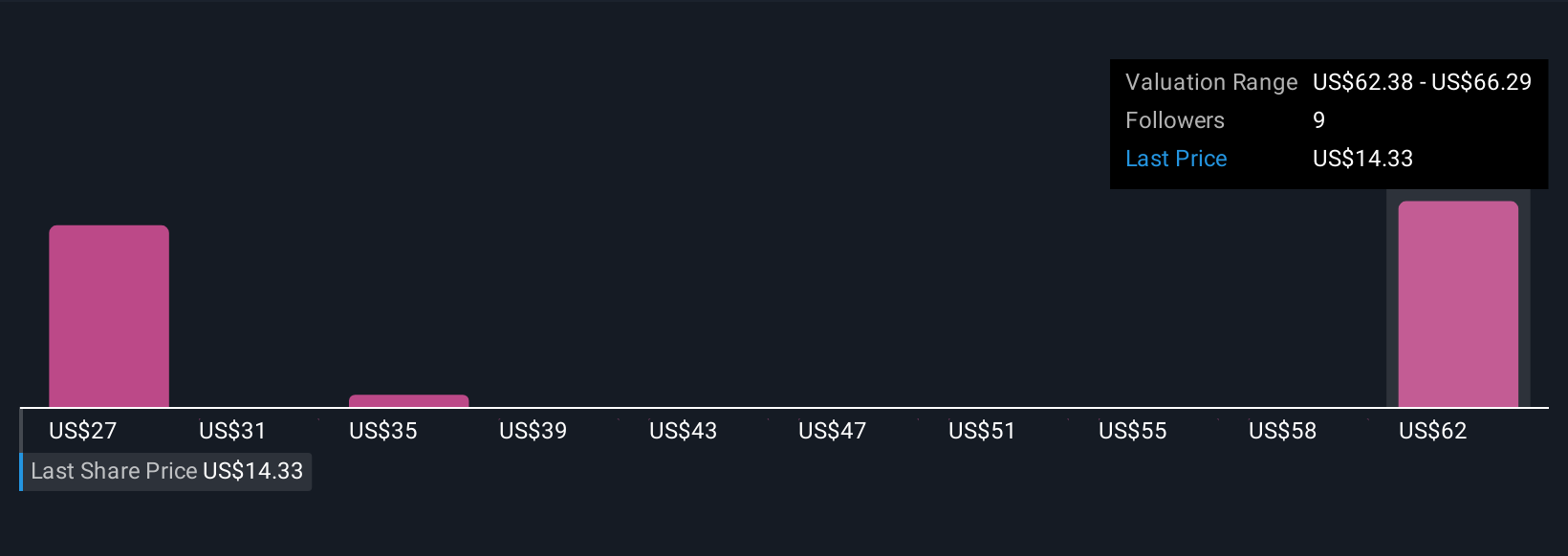

Four members of the Simply Wall St Community estimate NovoCure’s fair value between US$24.69 and US$168.60 per share. While diverse opinions abound, the ongoing challenge of increasing losses with rising revenue highlights the importance of understanding a range of possible outcomes, be sure to review multiple perspectives before making any decisions.

Explore 4 other fair value estimates on NovoCure - why the stock might be worth just $24.69!

Build Your Own NovoCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NovoCure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NovoCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NovoCure's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NovoCure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVCR

NovoCure

An oncology company, engages in the development, manufacture, and commercialization of tumor treating fields (TTFields) devices for the treatment of solid tumor cancers in the United States, Germany, France, Japan, Greater China, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives