- United States

- /

- Medical Equipment

- /

- NasdaqGM:NPCE

Can Improving Sales and Narrowing Losses Give NeuroPace (NPCE) a Sustainable Competitive Edge?

Reviewed by Sasha Jovanovic

- NeuroPace, Inc. recently reported earnings for the third quarter and nine months ended September 30, 2025, highlighting third-quarter sales of US$27.35 million and a net loss of US$3.5 million, both reflecting improvement over the previous year.

- The company also reduced its basic loss per share and continued to increase total sales year-to-date, indicating ongoing progress in narrowing losses while expanding revenue.

- We'll examine how NeuroPace's stronger sales growth and reduced losses may influence its long-term investment narrative and prospects.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NeuroPace Investment Narrative Recap

To be a shareholder in NeuroPace, you need conviction in the company's ability to grow sales and move toward profitability, driven by expansion into new clinical indications and wider adoption of its technology. The recent third-quarter results reinforce progress on sales growth and reducing losses, which supports confidence in near-term catalysts like increasing implants and referrals. However, these results do not materially change the primary risk: that accelerating expansion efforts may strain resources if growth in implants and referrals falls short.

One recent announcement highly relevant to the current financial results is the company's updated 2025 revenue guidance, now set at US$94 million to US$98 million. This increased guidance both reflects management’s confidence in ongoing adoption, including through initiatives such as Project CARE, and highlights how momentum in sales is viewed as central to achieving long-term growth targets and supporting future clinical expansion.

By contrast, investors should also be aware of how sales growth could stretch resources and expose the company to...

Read the full narrative on NeuroPace (it's free!)

NeuroPace's narrative projects $140.7 million in revenue and $17.4 million in earnings by 2028. This requires 18.6% annual revenue growth and a $42.2 million increase in earnings from the current level of -$24.8 million.

Uncover how NeuroPace's forecasts yield a $17.12 fair value, a 34% upside to its current price.

Exploring Other Perspectives

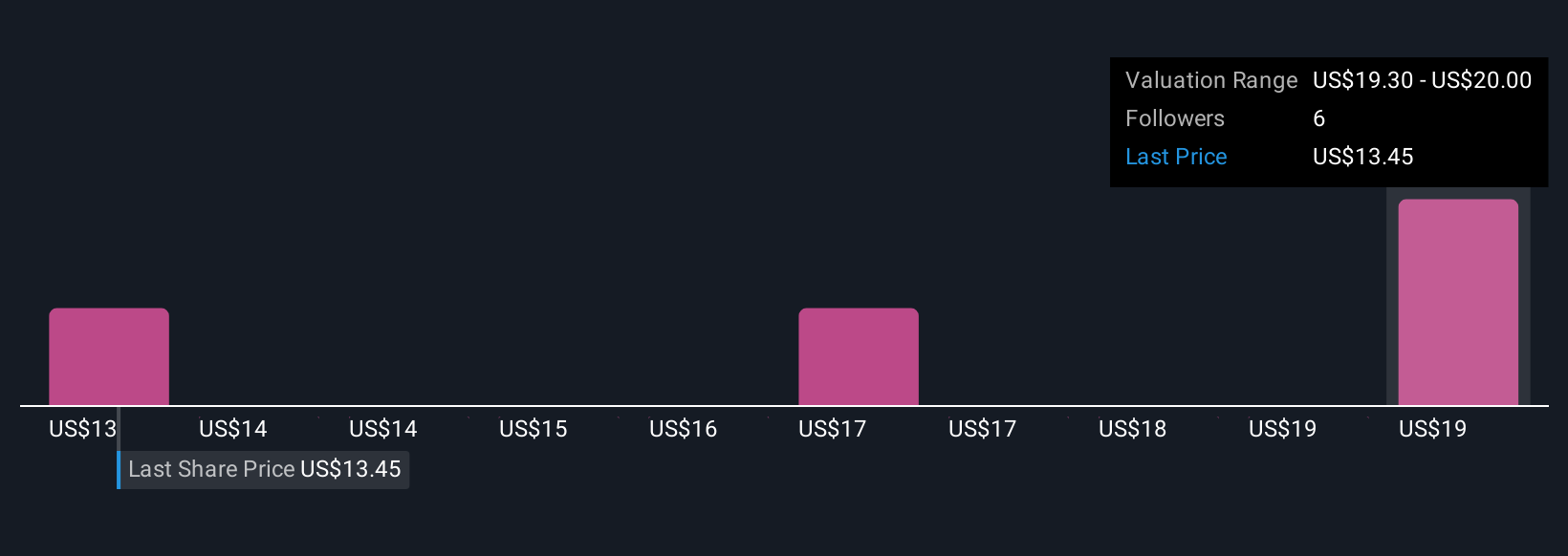

Four members of the Simply Wall St Community estimate NeuroPace’s fair value between US$13 and US$20 per share. While hopes are high for clinical expansion and sales, some investors are closely tracking the strain that rapid growth may place on resources.

Explore 4 other fair value estimates on NeuroPace - why the stock might be worth as much as 56% more than the current price!

Build Your Own NeuroPace Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NeuroPace research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NeuroPace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NeuroPace's overall financial health at a glance.

No Opportunity In NeuroPace?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NeuroPace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NPCE

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives