- United States

- /

- Healthcare Services

- /

- OTCPK:MODV.Q

ModivCare Inc. (NASDAQ:MODV) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, ModivCare Inc. (NASDAQ:MODV) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

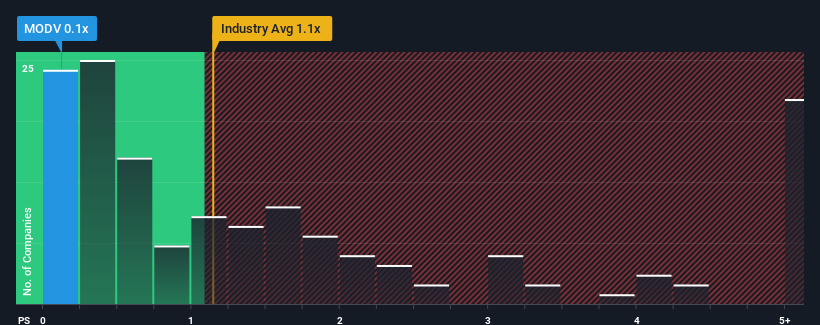

Following the heavy fall in price, given about half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider ModivCare as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for ModivCare

What Does ModivCare's P/S Mean For Shareholders?

There hasn't been much to differentiate ModivCare's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ModivCare.Is There Any Revenue Growth Forecasted For ModivCare?

The only time you'd be truly comfortable seeing a P/S as low as ModivCare's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 9.9% gain to the company's revenues. The latest three year period has also seen an excellent 101% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 5.3% per annum as estimated by the six analysts watching the company. With the industry predicted to deliver 7.8% growth per year, the company is positioned for a weaker revenue result.

With this information, we can see why ModivCare is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

ModivCare's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of ModivCare's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for ModivCare you should be aware of.

If you're unsure about the strength of ModivCare's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:MODV.Q

ModivCare

A technology-enabled healthcare services company, provides a suite of integrated supportive care solutions for public and private payors and their members in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives