- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

Did Positive WAVE Trial Results and Global Approvals Just Shift Merit Medical Systems' (MMSI) Investment Narrative?

Reviewed by Sasha Jovanovic

- In early November 2025, Merit Medical Systems announced positive 24-month clinical results from the WAVE trial for its WRAPSODY Cell-Impermeable Endoprosthesis, with findings presented at major vascular conferences and demonstrating superior performance compared to standard treatments for restoring functional vascular access in hemodialysis patients.

- The announcement highlights both the extensive clinical validation and broad regulatory approvals for WRAPSODY CIE, which is now available across multiple international markets including the United States, Canada, the United Kingdom, and Brazil.

- We’ll explore how these strong clinical trial outcomes and expanding regulatory traction could impact Merit’s investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Merit Medical Systems Investment Narrative Recap

Owning Merit Medical Systems stock requires confidence in its ability to drive growth through innovation in vascular access devices, notably WRAPSODY CIE, while overcoming potential reimbursement delays. The strong 24-month WAVE trial results underscore clinical effectiveness, which likely strengthens the case for broader adoption; however, the company’s progress in securing U.S. outpatient reimbursement remains the most important near-term catalyst, and prolonged reimbursement delays could still present the biggest risk to revenue growth in the immediate future.

Among recent announcements, Merit’s raised 2025 net sales guidance stands out, as it reflects management’s direct response to positive clinical and commercial momentum, particularly following successful WRAPSODY CIE trials and growing international approvals. This updated outlook connects closely with the catalyst of increasing adoption and market expansion, even as near-term revenue contribution from WRAPSODY may depend heavily on timely reimbursement decisions.

On the flip side, investors should be aware that extended setbacks in securing outpatient reimbursement for WRAPSODY CIE could ...

Read the full narrative on Merit Medical Systems (it's free!)

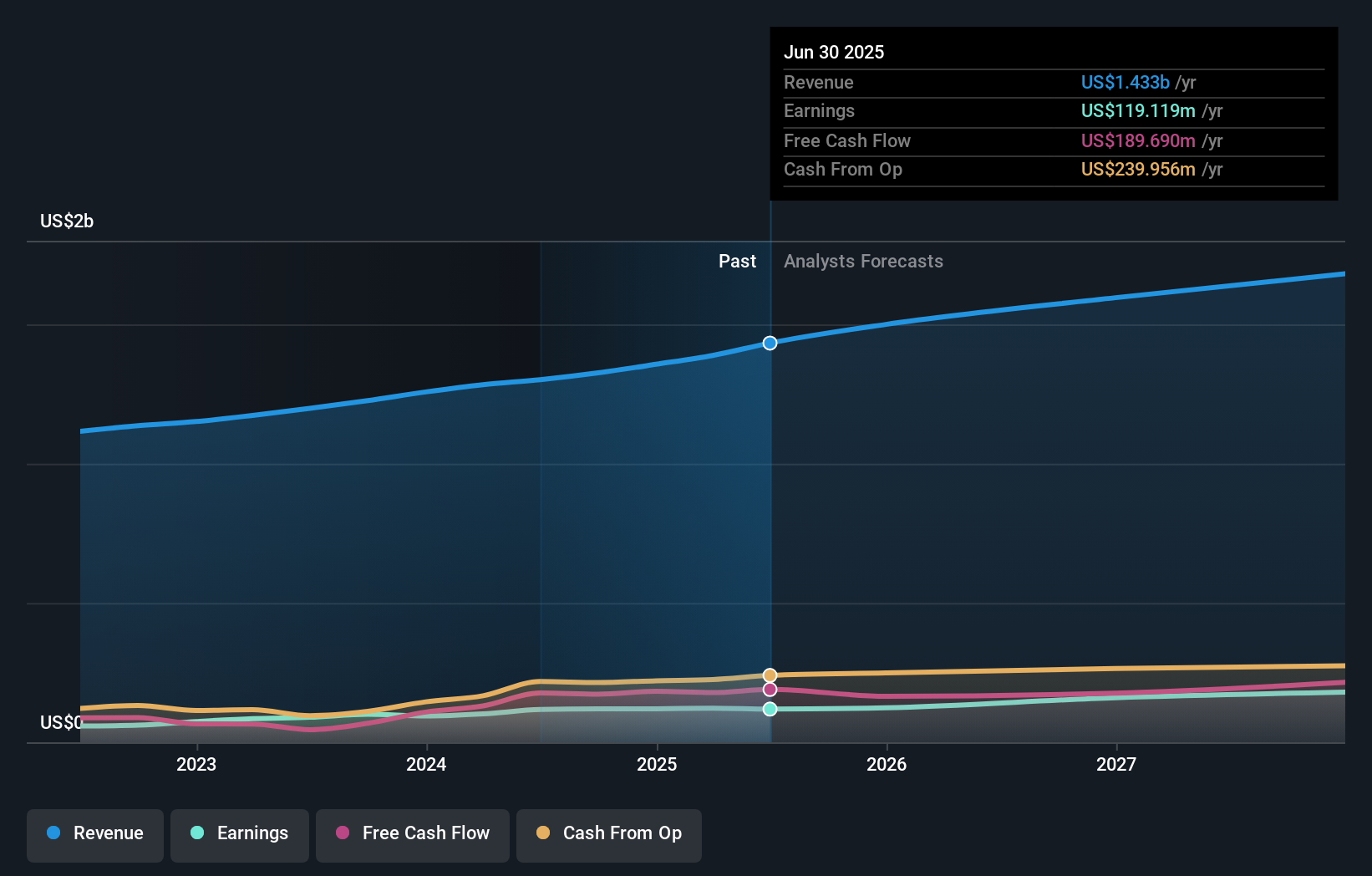

Merit Medical Systems is projected to reach $1.8 billion in revenue and $197.2 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 7.0% and a $78.1 million earnings increase from current earnings of $119.1 million.

Uncover how Merit Medical Systems' forecasts yield a $103.55 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Community members on Simply Wall St offer two distinct fair value estimates ranging from US$77.67 to US$103.55 per share. While hopes ride on strong clinical trial outcomes driving product adoption, views differ as to how reimbursement hurdles might affect future performance; consider multiple viewpoints before acting.

Explore 2 other fair value estimates on Merit Medical Systems - why the stock might be worth as much as 18% more than the current price!

Build Your Own Merit Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Merit Medical Systems research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Merit Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Merit Medical Systems' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives