- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Will ESMO 2025 Clinical Data on Blood-Based Cancer Detection Change Guardant Health's (GH) Narrative?

Reviewed by Sasha Jovanovic

- Guardant Health, Inc. announced that data spanning 15 accepted abstracts from its oncology portfolio were presented at the European Society for Medical Oncology (ESMO) Congress 2025 in Berlin, covering key innovations in blood-based cancer detection, monitoring, and tumor profiling across multiple cancer types.

- New findings showcased the clinical utility of Guardant’s Infinity and Reveal technologies for molecular tumor subtyping and therapy response monitoring, highlighting the company’s efforts to address significant needs such as cancers of unknown primary and early recurrence detection.

- We’ll explore how the presentation of extensive new clinical data at ESMO could influence Guardant Health’s growth outlook and future prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Guardant Health Investment Narrative Recap

To be a Guardant Health shareholder, one must believe that demand for blood-based cancer diagnostics will accelerate as new clinical evidence drives wider usage, payer coverage, and medical guideline inclusion. The presentation of robust data at ESMO 2025 reinforces Guardant’s commitment to clinical innovation, which could bolster confidence for future payer adoption, currently a key near-term catalyst. However, these data presentations are not likely to meaningfully address the company’s largest risk today: ongoing high operating losses and cash burn threatening its path to profitability.

Of recent announcements, the FDA approval of Guardant360 CDx as a companion diagnostic for Eli Lilly’s new breast cancer drug directly supports a crucial catalyst: regulatory and clinical validation milestones that may open new markets and revenue streams. This development, along with increasing Shield test coverage, illustrates management’s push for broader acceptance, but the overall financial impact still hinges on how quickly these new opportunities can offset continued losses and support profitable growth.

By contrast, investors should be aware that ongoing high R&D and operating expenses could pressure Guardant Health’s ability to reach profitability, especially if...

Read the full narrative on Guardant Health (it's free!)

Guardant Health's narrative projects $1.5 billion revenue and $82.1 million earnings by 2028. This requires 22.5% yearly revenue growth and a $495.9 million increase in earnings from -$413.8 million.

Uncover how Guardant Health's forecasts yield a $68.23 fair value, a 4% upside to its current price.

Exploring Other Perspectives

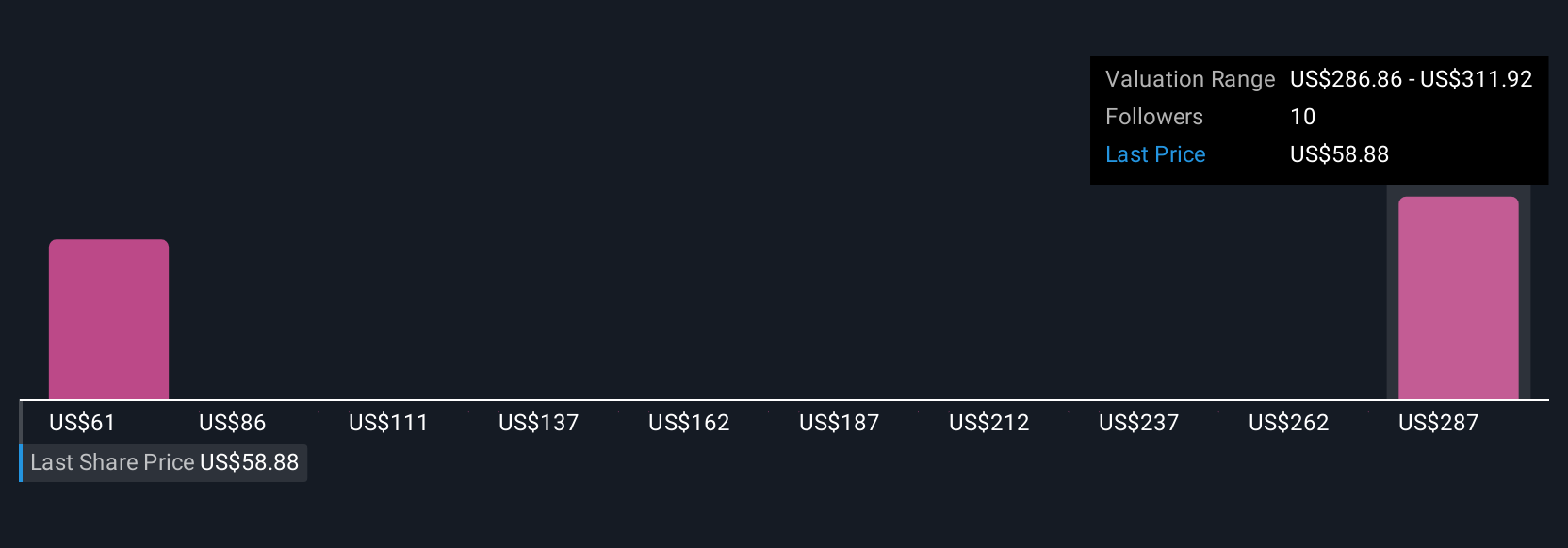

Three independent Simply Wall St Community fair value estimates for Guardant Health range widely from US$68.10 to US$195.52. While these varied views signal big differences in sentiment, the company’s ability to accelerate guideline inclusion and payer adoption remains a pivotal theme shaping future performance.

Explore 3 other fair value estimates on Guardant Health - why the stock might be worth just $68.10!

Build Your Own Guardant Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Guardant Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardant Health's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives