- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Guardant Health’s (GH) Funding Drive and New Data Might Change The Case For Investing

Reviewed by Sasha Jovanovic

- In the past week, Guardant Health announced an upsized US$350 million convertible senior notes offering and a follow-on public stock offering of over 3.3 million shares at US$90.00 per share, along with new clinical validation data showing its Guardant Reveal® blood test can assess chemotherapy effectiveness in advanced solid tumor patients months earlier than traditional methods.

- These developments highlight Guardant Health's efforts to secure substantial funding while supporting the broader adoption of its non-invasive cancer monitoring tools across multiple tumor types.

- We’ll examine how concerns around dilution from the capital raises may intersect with clinical momentum from Guardant Reveal’s latest validation.

Find companies with promising cash flow potential yet trading below their fair value.

Guardant Health Investment Narrative Recap

To be a shareholder in Guardant Health, you need to believe in the mainstream adoption of blood-based cancer testing, enabled by its expanding diagnostics portfolio, and expect that continued clinical validation will help drive payer coverage and physician uptake. The recent news around Guardant Reveal’s early chemotherapy monitoring data strongly supports adoption but is less material to the main short-term catalyst, broad commercial insurance coverage for Shield, while also not alleviating the near-term risk of further equity dilution due to persistent cash burn.

Among recent updates, the upsized US$350 million convertible notes and the US$299.99 million follow-on stock offering are most relevant, as they directly impact Guardant’s liquidity but also raise the risk of shareholder dilution. While these funds strengthen the company’s balance sheet to fuel R&D and commercial expansion, the capital raise underscores the importance of achieving sustained revenue growth and margin improvement to reduce future financing needs.

By contrast, investors should be aware of the ongoing need to deliver operating leverage as expenses rise and the potential implications of future equity offerings…

Read the full narrative on Guardant Health (it's free!)

Guardant Health's projections anticipate $1.5 billion in revenue and $82.1 million in earnings by 2028. Achieving this outlook relies on a 22.5% annual revenue growth rate and a $496 million increase in earnings from the current level of -$413.8 million.

Uncover how Guardant Health's forecasts yield a $93.82 fair value, a 4% downside to its current price.

Exploring Other Perspectives

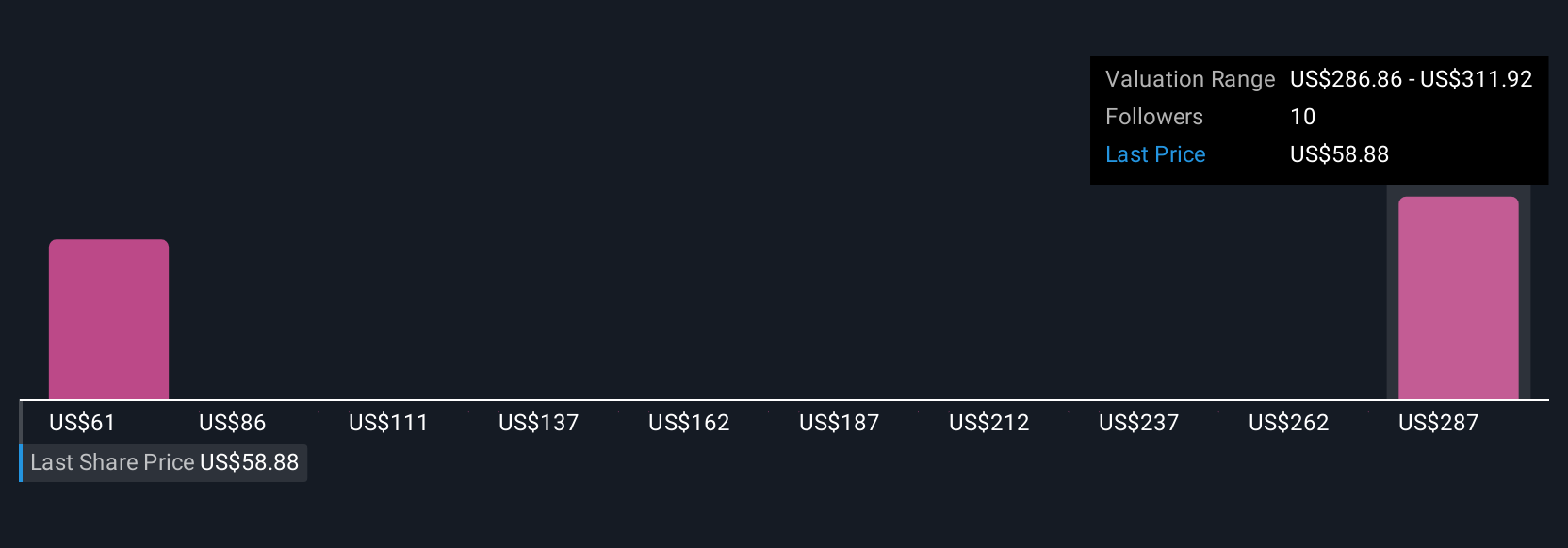

Fair value estimates from the Simply Wall St Community range from US$68.10 to US$246.97 as of three contributors. While many see expanded clinical validation as a growth driver, the risk of continued net losses and additional dilution remains top of mind for market participants, explore various views to inform your outlook.

Explore 3 other fair value estimates on Guardant Health - why the stock might be worth 30% less than the current price!

Build Your Own Guardant Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Guardant Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardant Health's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives