- United States

- /

- Healthcare Services

- /

- NasdaqGS:ENSG

Is Ensign Group's (ENSG) 2025 Outlook Boost and Facility Acquisitions Altering the Investment Case?

Reviewed by Sasha Jovanovic

- The Ensign Group recently raised its 2025 earnings and revenue guidance, citing strong third quarter results and the acquisition of multiple skilled nursing facilities across Alabama and Utah.

- This reflects ongoing expansion efforts and acquisition-driven growth that the company anticipates will continue to enhance its performance in the near term.

- We'll explore how the company’s higher 2025 guidance and new facility acquisitions could shape Ensign’s long-term investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Ensign Group's Investment Narrative?

For Ensign Group shareholders, the big picture centers on believing in the company's ability to grow through steady operational performance and a disciplined acquisition strategy. The recent news, strong third quarter earnings, higher 2025 revenue and earnings guidance, and the addition of eight skilled nursing facilities, directly strengthens these short-term catalysts by signaling management’s confidence in both organic and acquisition-fueled growth. This improved outlook comes despite sector risks, such as regulatory challenges and recently-settled legal issues, which can still weigh on sentiment. While forecasts of double-digit earnings and revenue growth now have clearer support, investors will want to see how new facilities are integrated and whether margins remain stable. Overall, the increased guidance and expansion activity marks a material shift that may lead to an evolution in risk priorities, especially around execution and post-acquisition performance. Yet against strong growth signals, legal and regulatory risks remain important to watch.

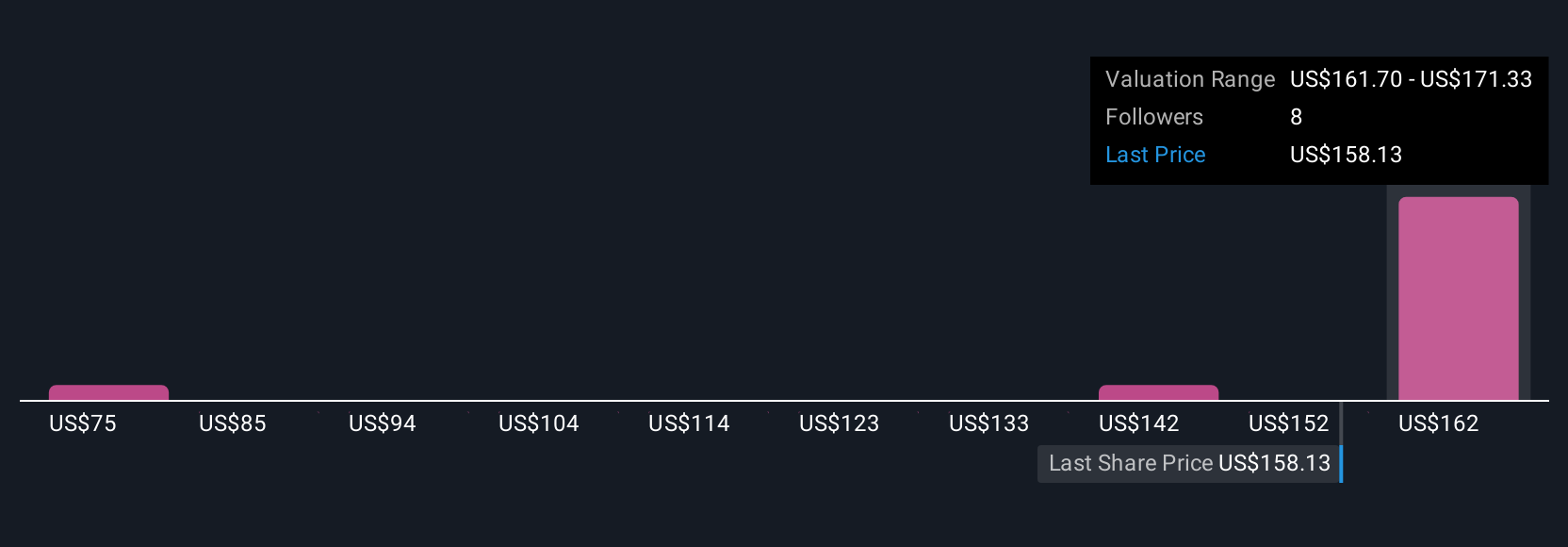

Despite retreating, Ensign Group's shares might still be trading 12% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on Ensign Group - why the stock might be worth as much as 14% more than the current price!

Build Your Own Ensign Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ensign Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ensign Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ensign Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENSG

Ensign Group

Provides skilled nursing, senior living, and rehabilitative services.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives