- United States

- /

- Healthcare Services

- /

- NasdaqCM:ASTH

Astrana Health (ASTH): Exploring Valuation After Prolonged Share Price Decline

Reviewed by Simply Wall St

Astrana Health (ASTH) shares have drifted lower by almost 17% over the past month, continuing a longer downward trend this year. Despite the lack of a headline event, investors may be considering shifting performance dynamics along with recent market sentiment.

See our latest analysis for Astrana Health.

With a 1-day share price return of -23.46% following several months of declines and a 1-year total shareholder return approaching -46%, Astrana Health's persistent selloff signals that market sentiment is firmly in reverse. However, longer-term results still show a gain for early investors. Fading momentum may indicate heightened perceived risks or shifting expectations for growth.

If you're curious how other companies are faring in this environment, now is a great time to broaden your investment radar and discover See the full list for free.

As Astrana Health's share price sits well below analyst targets, investors face a critical question: does the current low valuation signal a compelling buying opportunity, or is the market already factoring in all future risks and rewards?

Most Popular Narrative: 41.8% Undervalued

At the last close price of $25.54, the most widely followed analyst narrative sees Astrana Health’s fair value as substantially higher. The narrative’s view is based on deep sector shifts and business model changes, which set up a bold long-term growth scenario.

Continued transition to full risk, value-based care contracts (now 78% of revenue, up from 60% YoY) is driving recurring, higher-quality revenue streams and improved patient retention. This positions Astrana to benefit from rising demand for coordinated, efficient healthcare as the U.S. population ages, likely supporting both revenue growth and sustainable margin expansion over time.

What’s the driving force behind the valuation gap? The heart of this narrative is an ambitious projection about future profitability, powered by fast-growing revenues and increased margins. Find out exactly which future financial leaps are included in these bullish forecasts, and why they matter for today’s share price.

Result: Fair Value of $43.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reimbursement cuts or slow integration of key acquisitions could quickly undermine these bullish assumptions and place pressure on Astrana Health's future profitability.

Find out about the key risks to this Astrana Health narrative.

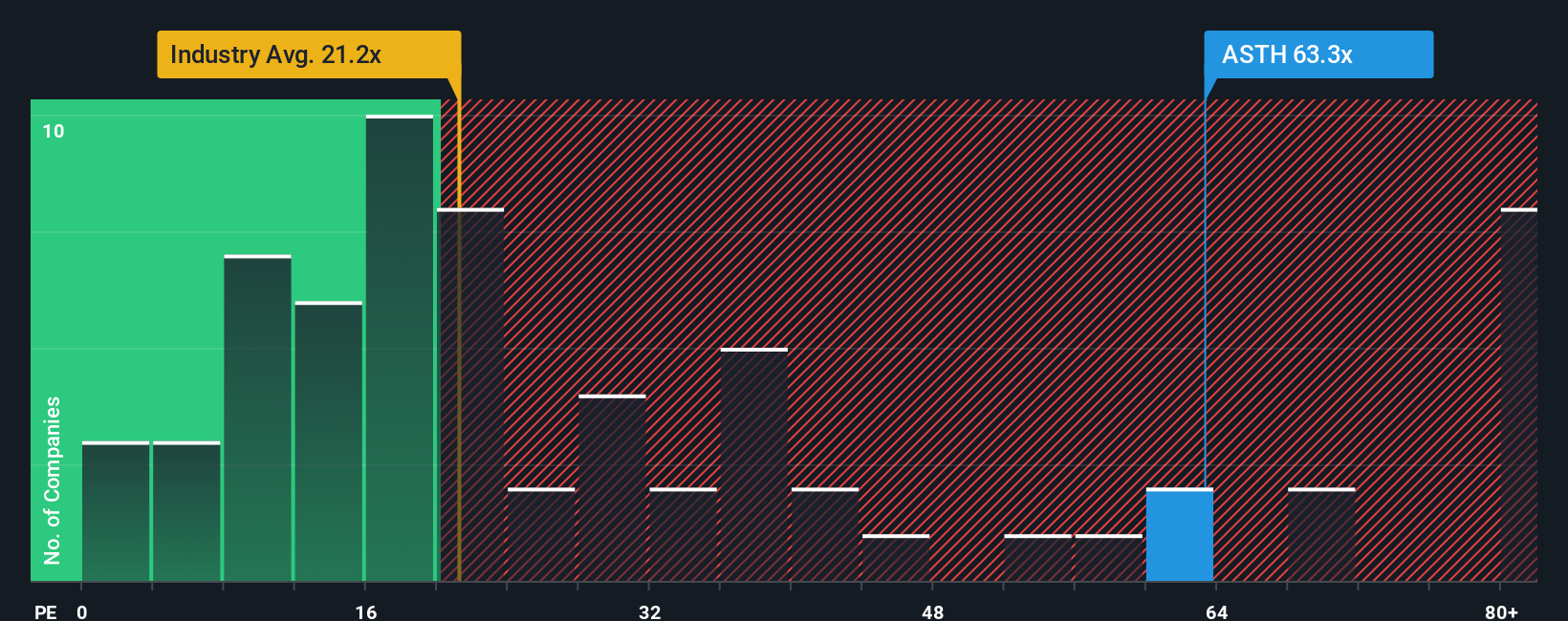

Another View: Multiple-Based Valuation Sends a Warning

Looking from a different angle, the current price-to-earnings ratio for Astrana Health stands at 132.2x. This is considerably higher than both the industry average of 21.1x and the average for its immediate peers at 23.2x. Even the fair ratio, estimated at 73.4x, is far below where Astrana is trading today. Such a wide gap means investors are paying a hefty premium, signaling greater valuation risk if high growth does not materialize as anticipated. Does this premium reflect genuine future potential, or does it create a sharper downside if forecasts fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astrana Health Narrative

If you have a different perspective or want to weigh up the numbers firsthand, take a few minutes to dive in and shape your own outlook. Do it your way

A great starting point for your Astrana Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Spot Your Next Big Opportunity?

Don’t just watch from the sidelines while others seize new investment wins. Supercharge your portfolio and uncover hidden gems using our powerful stock screeners below.

- Unlock high-potential gains by tapping into these 870 undervalued stocks based on cash flows, and find companies poised for a market re-rating.

- Earn more from your investments by targeting steady income and reliable growth with these 16 dividend stocks with yields > 3% where yields beat the average.

- Catalyze your research by seeking out innovation leaders with these 24 AI penny stocks, featuring firms driving breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASTH

Astrana Health

A healthcare management company, provides medical care services in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives