- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

A Piece Of The Puzzle Missing From Alignment Healthcare, Inc.'s (NASDAQ:ALHC) 30% Share Price Climb

Alignment Healthcare, Inc. (NASDAQ:ALHC) shares have continued their recent momentum with a 30% gain in the last month alone. The annual gain comes to 126% following the latest surge, making investors sit up and take notice.

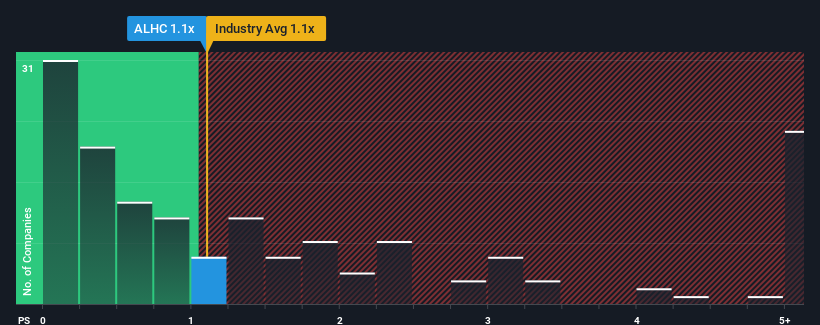

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Alignment Healthcare's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in the United States is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Alignment Healthcare

How Has Alignment Healthcare Performed Recently?

With revenue growth that's superior to most other companies of late, Alignment Healthcare has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Alignment Healthcare's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Alignment Healthcare's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 43%. The strong recent performance means it was also able to grow revenue by 122% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 25% per annum during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 7.3% per annum growth forecast for the broader industry.

In light of this, it's curious that Alignment Healthcare's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Alignment Healthcare's P/S?

Alignment Healthcare appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Alignment Healthcare's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 3 warning signs for Alignment Healthcare that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives