- United States

- /

- Healthcare Services

- /

- NasdaqGS:ADUS

Assessing Addus HomeCare (ADUS) Valuation After Strong Q3 Growth and Strategic Acquisition

Reviewed by Simply Wall St

Addus HomeCare (ADUS) just posted its third quarter earnings, with revenue jumping 25% year over year and adjusted EPS topping forecasts. The results came along with news of a recent acquisition that expands the company’s Texas footprint.

See our latest analysis for Addus HomeCare.

After a strong third quarter and the acquisition of Del Cielo Home Care, Addus HomeCare’s stock has seen some ups and downs. Most recently, the share price dipped 4.7% in a single day, bringing its year-to-date price return to -8.1%. Despite these shorter-term swings, the company’s five-year total shareholder return of 14.4% hints at the longer-term resilience that has kept investors engaged.

If you’re curious about which other companies in healthcare are capturing attention with strong performance, take the next step and explore See the full list for free.

Given the recent selloff despite solid growth and upbeat analyst coverage, is Addus HomeCare undervalued at these levels, or are investors already factoring in all the expected gains ahead?

Most Popular Narrative: 26.1% Undervalued

With Addus HomeCare recently closing at $114.19, the current fair value suggested by the most popular narrative points to an opportunity that could be worth watching. While the stock trades well below this estimate, market watchers are weighing whether disciplined growth and defensive business strengths can justify a premium price.

The company's business model is resilient and defensive against cyclical downturns, making it a safe haven in times of economic uncertainty. Valuation premiums reflect a superior business model and significant long-term growth prospects, but also imply limited margin of safety for investors.

Want to know what’s driving this compelling valuation? This narrative hinges on bold growth assumptions, a premium profit outlook, and a high-stakes multiple. The underlying math could surprise you. See which projections push the fair value far above today’s price.

Result: Fair Value of $154.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages or unexpected regulatory changes could quickly challenge even the most optimistic outlook for Addus HomeCare’s continued growth.

Find out about the key risks to this Addus HomeCare narrative.

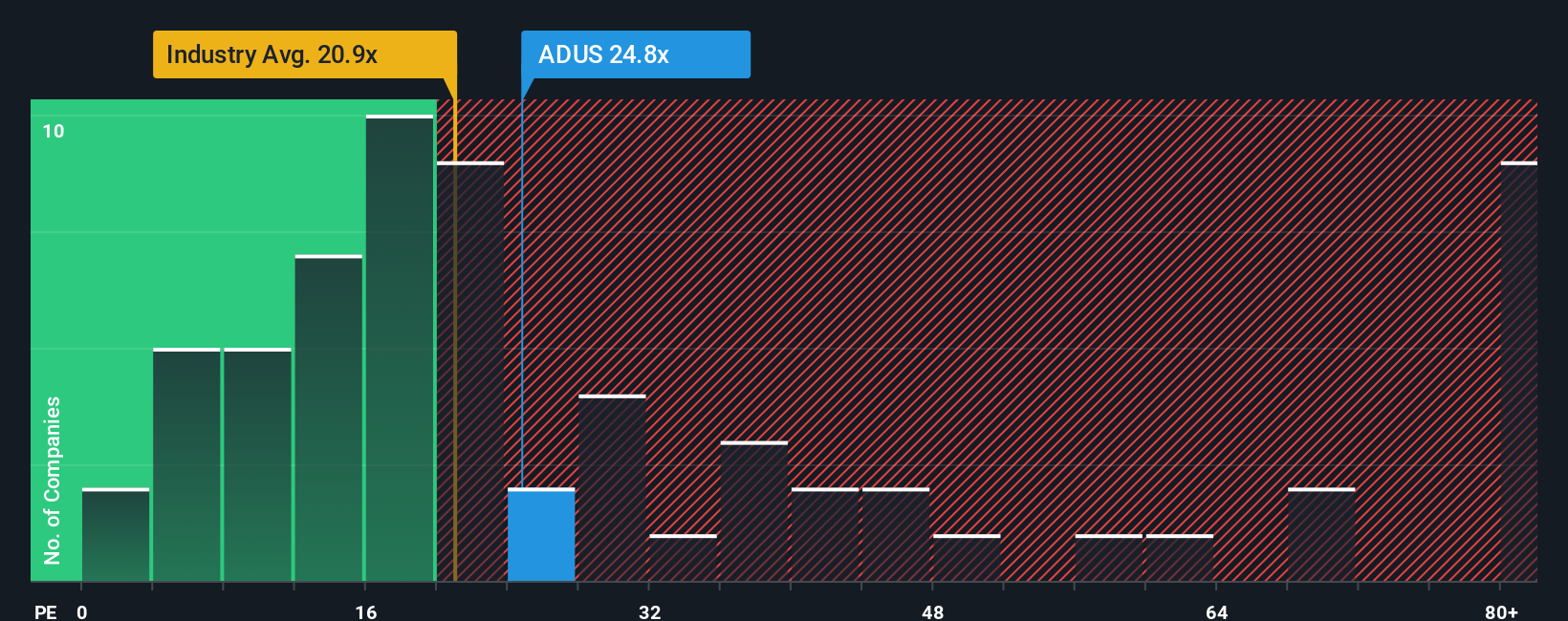

Another View: Market Ratios Tell a Different Story

Looking at Addus HomeCare's valuation through market ratios, things look less attractive. The company's price-to-earnings ratio stands at 24.3 times earnings, which is above both the US Healthcare industry average of 21.5x and its peer average of 23.1x. Even compared to the fair ratio of 20.6x, the shares are trading at a clear premium. This means the stock price reflects high expectations and leaves less room for disappointment. If the market shifts toward the fair ratio, could today’s price become a risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Addus HomeCare Narrative

If you'd rather draw your own conclusions or want to dive deeper into the numbers, it's easy to put together a custom narrative in just a few minutes. Do it your way

A great starting point for your Addus HomeCare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities slip away while others move ahead. Use these powerful tools to target your next breakout winner. Your next smart move could be just a click away.

- Spot income potential by reviewing these 17 dividend stocks with yields > 3% offering yields over 3%, giving your portfolio a reliable edge with strong, steady payers.

- Supercharge your growth search with these 25 AI penny stocks making advancements at the forefront of artificial intelligence, automation, and tomorrow’s innovation.

- Maximize value by targeting these 861 undervalued stocks based on cash flows, uncovering well-priced stocks whose future cash flows suggest they’re trading at a discount today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADUS

Addus HomeCare

Provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives