- United States

- /

- Food

- /

- NYSE:TR

A Look at Tootsie Roll Industries’s Valuation Following Strong Q3 Earnings and Revenue Growth

Reviewed by Simply Wall St

Tootsie Roll Industries (NYSE:TR) released its third-quarter and nine-month results on November 7, showing increases in sales, revenue, and net income compared to last year. Investors are paying close attention to these steady gains.

See our latest analysis for Tootsie Roll Industries.

This latest report seems to have sparked a fresh wave of momentum for Tootsie Roll Industries, with the stock's share price up 2.14% in a day and a strong 18.98% gain so far this year. While the recent 30-day share price return dipped, investors looking long-term are seeing a compelling 27.20% total shareholder return for the past year. This suggests market optimism is building as steady growth continues to show up on the bottom line.

If you’re inspired by these resilient results, why not expand your investing radar and discover fast growing stocks with high insider ownership

With solid gains on the books and investor enthusiasm growing, the real question is whether Tootsie Roll Industries is still undervalued or if the market has already factored future growth into today’s share price.

Price-to-Earnings of 30.2x: Is it justified?

Tootsie Roll Industries currently trades at a price-to-earnings (P/E) ratio of 30.2x, considerably higher than both its industry peers and its recent closing price of $37.67. This premium suggests investors are paying much more per dollar of earnings compared to other food companies.

The P/E ratio measures how much investors are willing to pay for each dollar of the company’s earnings. For consumer staples like confectionery, a higher multiple can sometimes reflect expectations for steady demand, established brand value, or potential for future growth.

Despite Tootsie Roll's popularity, the P/E of 30.2x stands well above the US Food industry average of 18.5x and the broader peer average of just 12.3x. This signals the market has priced in a significant premium for Tootsie Roll’s earnings, likely anticipating stability and brand strength rather than rapid profit expansion. If market conditions change or growth fails to accelerate, the multiple could retreat closer to industry norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.2x (OVERVALUED)

However, continued premium valuation leaves Tootsie Roll Industries exposed if consumer demand slows or if the company fails to deliver above-average growth.

Find out about the key risks to this Tootsie Roll Industries narrative.

Another View: Discounted Cash Flow Model Suggests Undervaluation

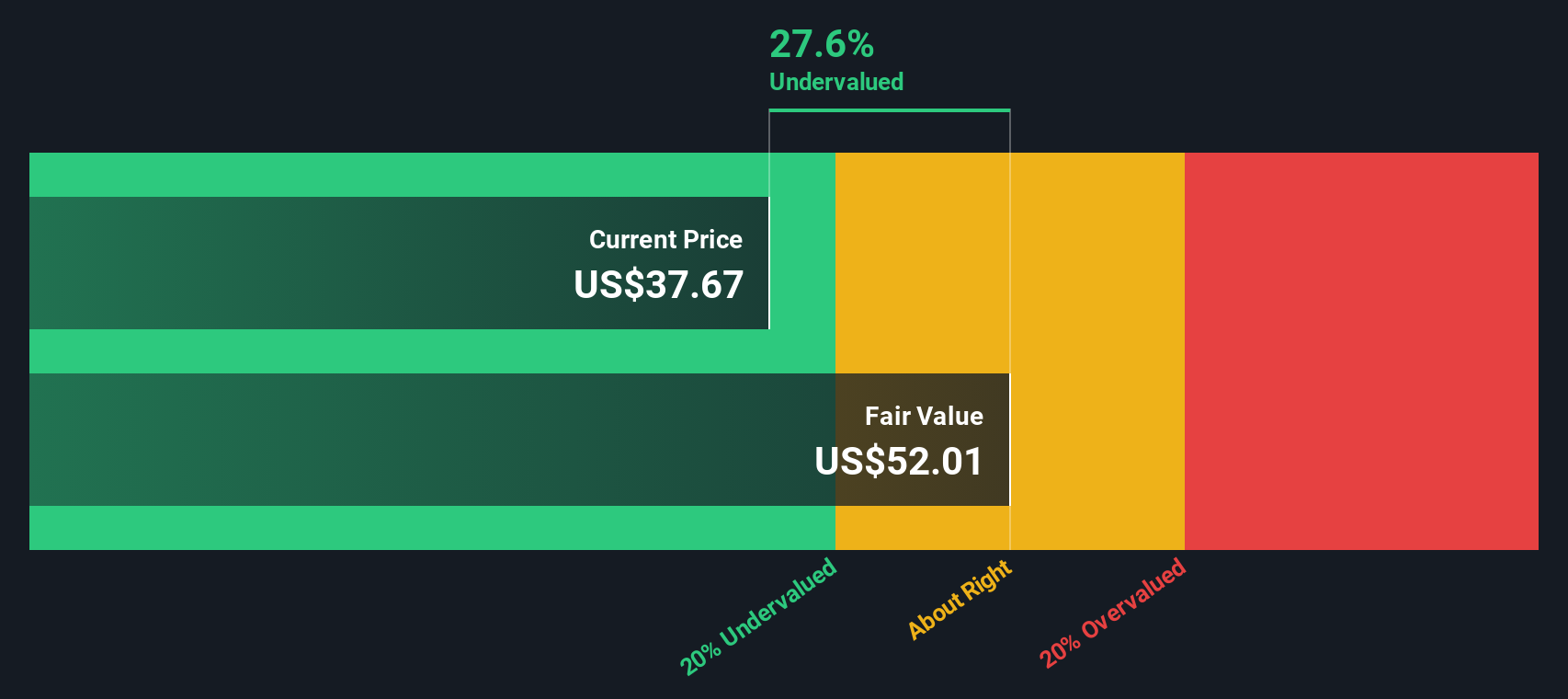

Looking beyond standard multiples, our SWS DCF model offers a different perspective. By estimating future cash flows, the model calculates a fair value of $52.01 per share, while Tootsie Roll trades at just $37.67. This signals the stock could be undervalued by nearly 28%. Does this imply the market is missing hidden value, or are there risks holding the share price back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tootsie Roll Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tootsie Roll Industries Narrative

If you see things differently or want to take your own approach, you can dive into the numbers and put together your own perspective in minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Tootsie Roll Industries.

Looking for more investment ideas?

Smart investors always keep an eye on the next big opportunity. Don’t let great stocks pass you by. Use the Simply Wall St Screener now to spot hidden winners, booming sectors, and future trends before everyone else.

- Capture regular income with these 16 dividend stocks with yields > 3%, featuring companies offering standout yields above 3% for a stronger portfolio foundation.

- Catch the next wave of disruptive tech by checking out these 24 AI penny stocks, packed with innovative companies shaping tomorrow with artificial intelligence.

- Tap into bargains by reviewing these 870 undervalued stocks based on cash flows to pinpoint opportunities trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tootsie Roll Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TR

Tootsie Roll Industries

Manufactures and sells confectionery products in the United States, Canada, Mexico, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives