- United States

- /

- Food

- /

- NYSE:SJM

Is J. M. Smucker (SJM) Undervalued After New Signs of Weakening Financial Strength?

Reviewed by Simply Wall St

Recent analysis of J. M. Smucker (SJM) points to declines in its financial strength, growth, and profitability rankings. The review highlights concerns over financial distress and signals the potential for underperformance compared to past results and competitors.

See our latest analysis for J. M. Smucker.

Despite some renewed optimism with a 1-day share price return of 2.04%, J. M. Smucker has faced a year-to-date decline of 3.87% and a one-year total shareholder return of -3.51%. The bigger story is a fading momentum, as longer-term total returns continue to lag industry peers even in the face of brief upticks.

If J. M. Smucker’s shifting fortunes have you thinking more broadly, now is a great moment to expand your search and discover fast growing stocks with high insider ownership

This pattern of underperformance prompts a key question: is J. M. Smucker now undervalued given recent setbacks, or is the market already accounting for muted growth in its current share price?

Most Popular Narrative: 7.9% Undervalued

With a narrative fair value of $116.19 versus a last close price of $107.06, the consensus view sees real upside potential if J. M. Smucker delivers on growth assumptions ahead.

Continued investments in advertising, innovation (for example, new Milk-Bone PB Bites), and category expansion, especially in growing urban, convenience, and pet segments, are positioning the portfolio to leverage both changing consumer demographics and rising demand for convenient, branded packaged foods, supporting top-line and volume growth.

Ever wondered what ambitious profit jumps and a forward-looking margin reset can do for a blue-chip food maker's valuation? Dig into the narrative's secret recipe, unpack the projections and see what’s fueling this bullish fair value.

Result: Fair Value of $116.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff headwinds and heavy reliance on legacy brands could undermine forecasts and challenge the optimistic narrative for J. M. Smucker's rebound.

Find out about the key risks to this J. M. Smucker narrative.

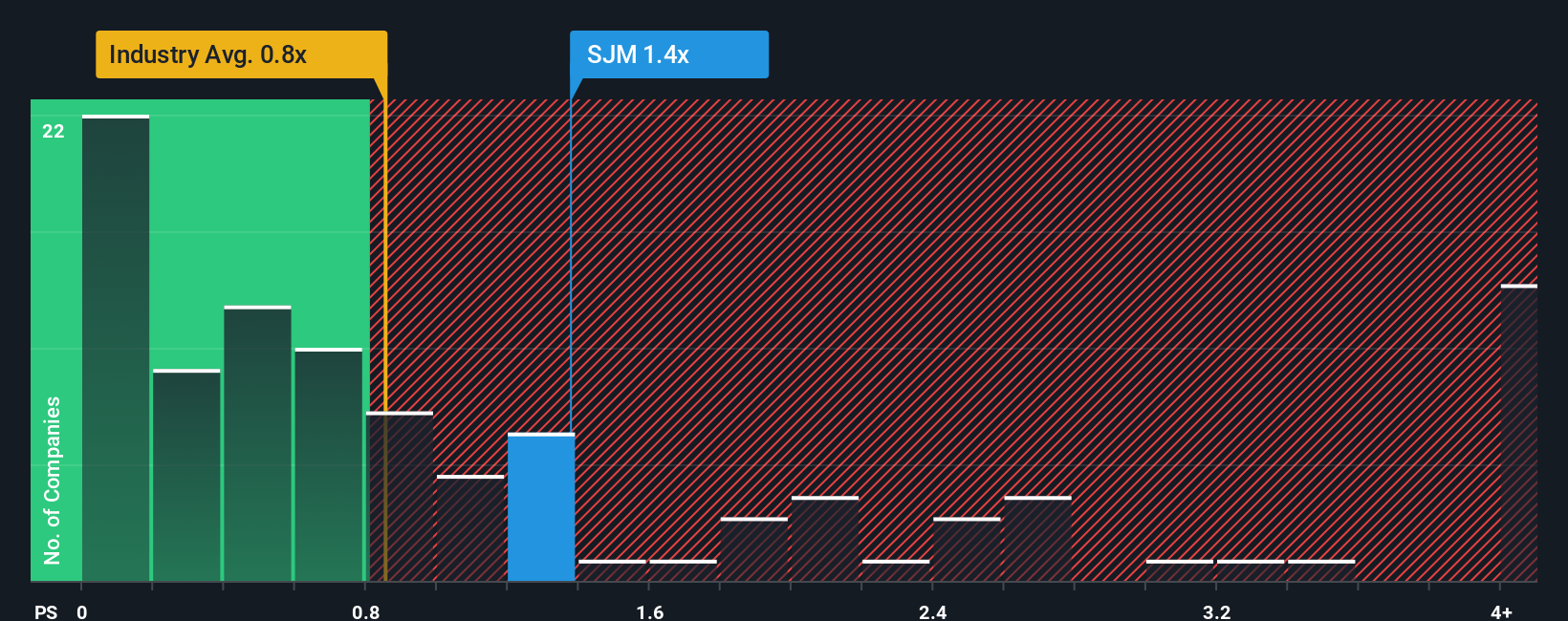

Another View: Price-to-Sales Ratio Signals Caution

Looking at J. M. Smucker through its price-to-sales ratio tells a more sobering story. The company's current ratio of 1.3x stands not only above the US Food industry average of 0.9x, but also well above its peer group at 0.6x. Even when compared to its "fair ratio" of 1.3x, Smucker appears expensive. This suggests the stock may not be as undervalued as some would hope. Does this premium pricing signal the market expects a turnaround, or does it mean further downside risk is being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J. M. Smucker Narrative

Feel free to challenge the consensus or draw your own conclusions. It takes less than three minutes to craft your own perspective from the numbers, your way with Do it your way.

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Ideas?

Ready to move beyond Smucker? Seize your next opportunity by using the Simply Wall Street Screener and find companies at the forefront of emerging trends, lucrative yields, and technological transformation.

- Target real income by reviewing these 16 dividend stocks with yields > 3% to find attractive yields and consistent payouts for smart cash flow.

- Capitalize on tomorrow’s breakthroughs with these 25 AI penny stocks that are reshaping markets through artificial intelligence innovation.

- Get ahead of the crowd and scan these 3589 penny stocks with strong financials to discover game-changing businesses flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives