- United States

- /

- Tobacco

- /

- NYSE:PM

Is Philip Morris International Still a Bargain After 26.7% Rally?

Reviewed by Bailey Pemberton

- Wondering if Philip Morris International stock is a hidden bargain or just fairly priced? You are not alone, and the answer depends on which valuation lens we use.

- The stock has rallied 6.3% in the past week, adding to an impressive 26.7% year-to-date surge. There have been some short-term dips along the way.

- Recent headlines have focused on the company’s ongoing expansion outside the U.S. and strategic moves to innovate within the tobacco industry. These news stories have helped fuel market optimism and brought increased attention to the stock’s growth outlook.

- On our valuation scorecard, Philip Morris International earns a 3 out of 6, indicating it’s undervalued in half the checks we run. Next, we will break down those traditional valuation methods, and there is an even more insightful way to judge value coming up at the end of this article.

Approach 1: Philip Morris International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common way investors estimate what a company is really worth by projecting its future free cash flows and then discounting those amounts back to today’s value. This gives a snapshot of the business’s intrinsic value based on actual and expected cash generation.

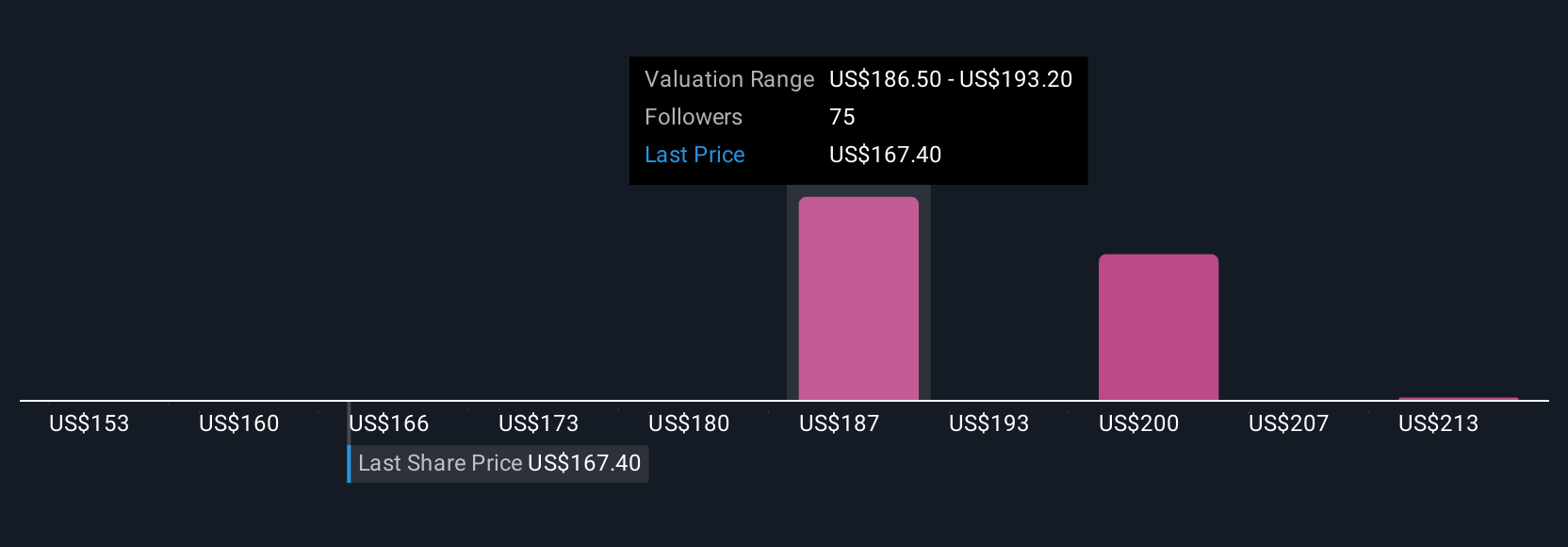

For Philip Morris International, the company generated Free Cash Flow of $10.0 Billion over the last twelve months. Analysts forecast robust growth over the coming years, with cash flow expected to reach $16.3 Billion by the end of 2029. While analyst estimates are typically given for just a handful of years, projections out to 2035, extrapolated by Simply Wall St, suggest continued, steady growth and reflect confidence in the company's ability to generate cash well into the next decade.

According to the DCF model (using a 2 Stage Free Cash Flow to Equity approach), the estimated intrinsic value per share is $202.66. With the current share price trading around 24.3% below this fair value estimate, Philip Morris International appears notably undervalued through this lens.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Philip Morris International is undervalued by 24.3%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

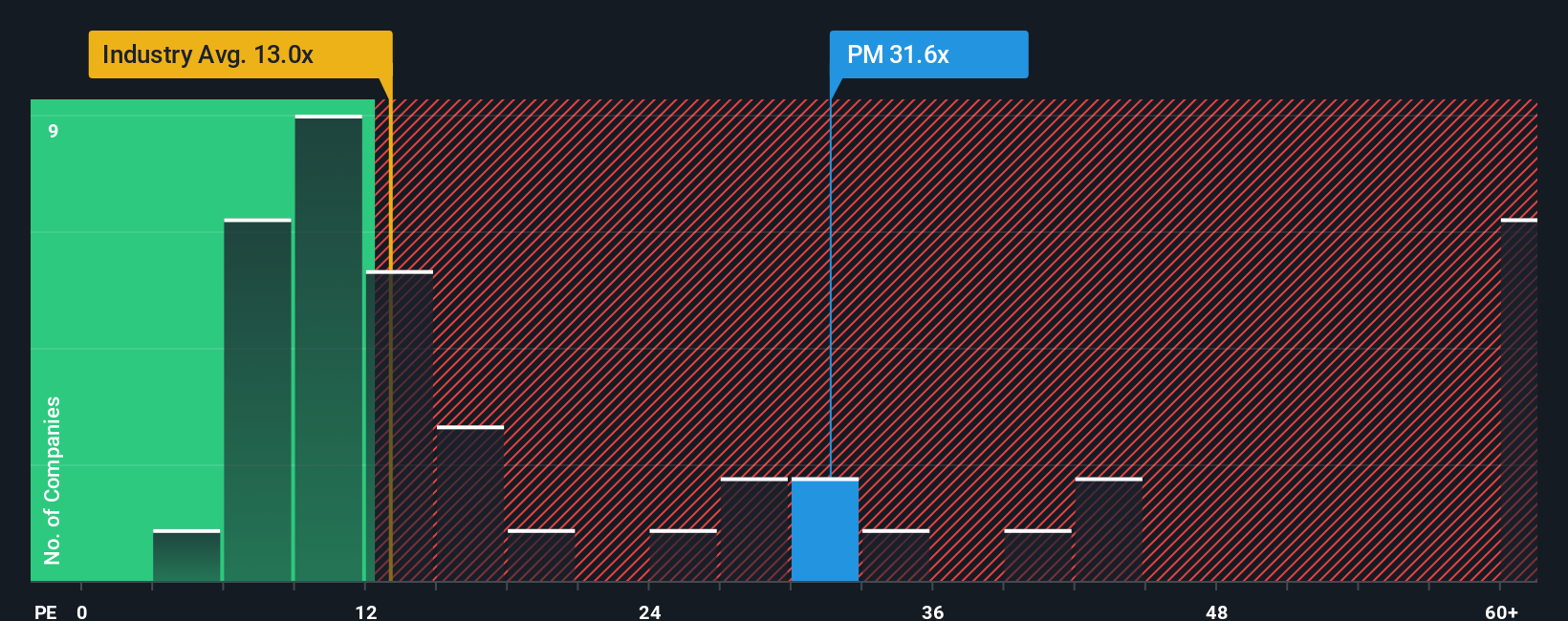

Approach 2: Philip Morris International Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely accepted tool for evaluating profitable companies because it directly ties a company’s stock price to its bottom line, which is earnings. For investors, the PE ratio provides a simple, apples-to-apples way to gauge how much they’re paying for each dollar of net income Philip Morris International generates.

In practice, the “right” PE ratio is influenced by both growth expectations and risk. Fast-growing, stable companies typically warrant higher PE ratios, while mature or riskier businesses tend to trade at lower multiples. Comparing PE ratios helps reveal whether a stock looks cheap or rich relative to its prospects and risks.

Philip Morris International currently trades at a 27.8x PE ratio, which stands well above the tobacco industry average of 14.5x and the peer group’s average of 18.3x. However, raw comparisons can be misleading because they ignore unique company characteristics.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for Philip Morris International is 26.8x, a proprietary figure that takes into account not only the company’s sector, earnings outlook, and profit margins, but also its size and specific risk profile. This makes it a more nuanced benchmark than just using sector or peer multiples.

With Philip Morris International’s PE ratio only about 1x higher than its Fair Ratio, the stock appears to be priced about right from this angle.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Philip Morris International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple, powerful tool that let you attach a story—your perspective on a company’s future—to the numbers behind its estimated fair value, revenue, earnings, and profit margins.

Rather than relying only on standard models or analyst averages, Narratives help you connect the company’s broader story, such as new product launches, regulatory changes, or shifts in demand, directly to a forecast of its future performance and fair value. It is a flexible approach and available today to all investors within the Community page on Simply Wall St, where millions are already using it to turn information and opinions into actionable decisions.

Narratives allow you to clearly see when your story for Philip Morris International signals it is a buy, hold, or sell by comparing your Fair Value to the current share price, and they automatically update as new earnings releases or news hits the market. For example, a bullish Narrative could see value as high as $220.00 if you believe in rapid growth for ZYN and smoke-free products, while a bearish Narrative might set fair value near $153.00 if you are cautious about regulatory headwinds and slowing demand.

For Philip Morris International, here are previews of two leading Philip Morris International Narratives:

🐂 Philip Morris International Bull Case

Fair Value: $185.44

Undervalued by: 17.3%

Revenue Growth Rate: 7.7%

- Accelerating adoption of smoke-free products (such as IQOS and ZYN) and regulatory support are driving strong growth, improved margins, and lower regulatory risks for the company.

- Digital investment and geographic diversification are boosting engagement and earnings stability across both emerging and established markets.

- Fair value assumes revenue reaches $49.4 billion and earnings $14.5 billion by 2028, with a price target 13.4% above the current share price based on continued momentum in smoke-free transformation.

🐻 Philip Morris International Bear Case

Fair Value: $153.00

Overvalued by: 0.3%

Revenue Growth Rate: 6.4%

- Intensifying health sentiment, complex regulations, and ESG-driven divestment threaten both traditional and next-generation product growth, challenging future revenues and operating margins.

- Ongoing decline in cigarette volumes and heavy investment requirements may compress margins further if smoke-free adoption or regulatory approvals lag market expectations.

- Bearish case values the stock below its latest close, assuming muted growth and margin outlook as regulatory risks and capital costs build.

Do you think there's more to the story for Philip Morris International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives