- United States

- /

- Food

- /

- NYSE:K

Kellanova (NYSE:K): Assessing the Stock’s Value After a Year of Steady Growth

Reviewed by Simply Wall St

See our latest analysis for Kellanova.

Momentum has been building for Kellanova, with the share price steadily appreciating and a total shareholder return of 6.1% over the last year. This indicates that investors are rewarding its underlying growth, and the stock's longer-term track record remains impressive.

If steady performance like this has your attention, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares now trading near analyst targets and long-term growth reflected in recent gains, the question for investors is clear: does Kellanova offer more upside from here, or is all the future potential already priced in?

Most Popular Narrative: 20% Undervalued

With Kellanova’s last close at $83.23, the most widely followed narrative values the stock notably higher, suggesting substantial upside potential compared to the current market price.

The company's focus on a differentiated geographic footprint, particularly in emerging markets, is expected to lead to sequential volume improvement and organic growth in net sales, which could positively impact revenue. A heavy calendar of innovation, including product launches in snacks and away-from-home channels, is projected to increase the net sales contribution from innovation, and support revenue growth.

Curious what financial leaps and bold growth calls drive that bullish fair value? The narrative’s secret sauce is a combination of aggressive international expansion, promising new brands, and ambitious margin moves. Want the full story behind these numbers? Only a click away.

Result: Fair Value of $83.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reliance on price hikes in regions like Nigeria or weak innovation performance could pose challenges to Kellanova’s bullish growth outlook.

Find out about the key risks to this Kellanova narrative.

Another View: Multiples Paint a Pricier Picture

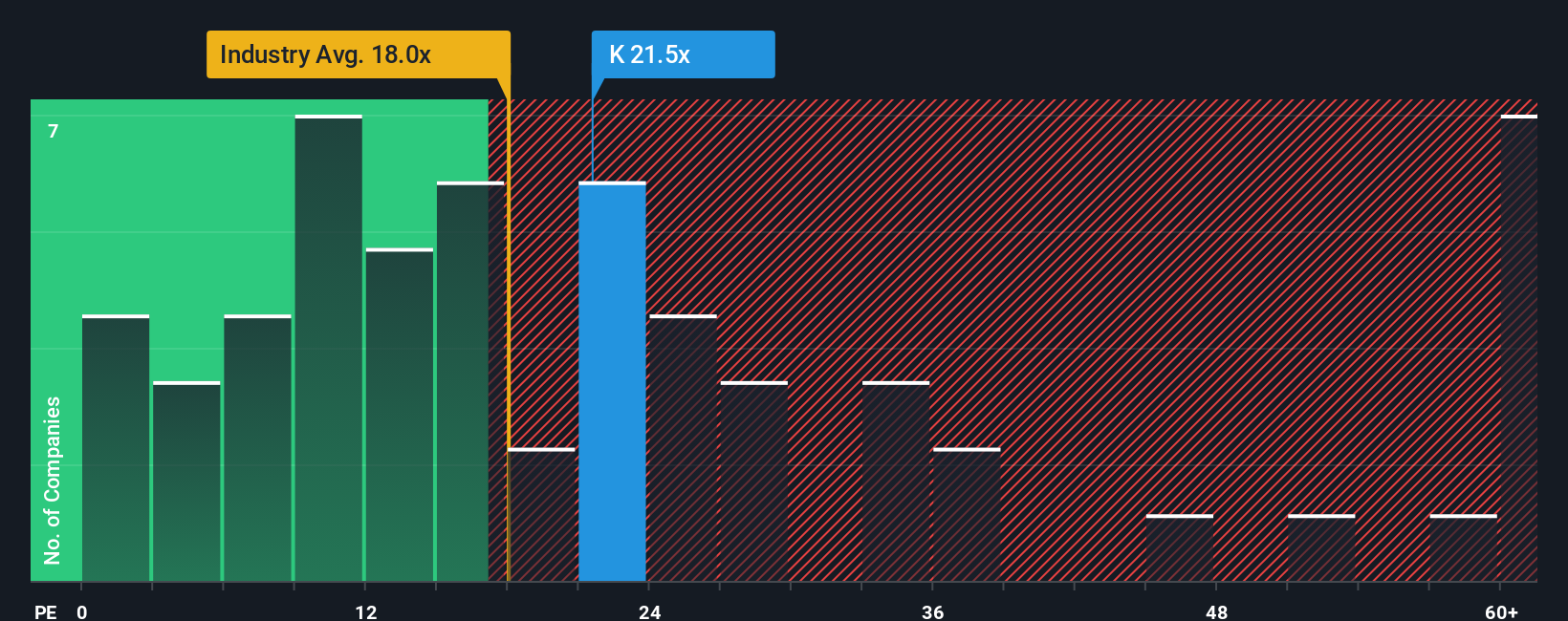

While one narrative says Kellanova is undervalued, the current price-to-earnings ratio stands at 22.7x, which is notably higher than both the US Food industry average (17.8x) and its peers (19.7x). The fair ratio our analysis suggests is 16.5x. This raises a practical question: is the optimism already reflected in the price, or is the market overlooking risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kellanova Narrative

If you’re eager to interpret the numbers for yourself or want to craft your own perspective, it only takes a few minutes to get started with your own insights. Do it your way

A great starting point for your Kellanova research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead of the curve, don't limit yourself to just one stock. The market is full of exciting opportunities you won't want to overlook.

- Tap into rapid technological transformation by checking out these 25 AI penny stocks. Pioneers in artificial intelligence are redefining entire industries.

- Lift your income potential and stability with these 17 dividend stocks with yields > 3%. This list features companies offering strong yields above 3% for reliable returns.

- Capture value opportunities right now by scanning these 849 undervalued stocks based on cash flows, which spotlights stocks that our research shows are trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kellanova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:K

Kellanova

Manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives