- United States

- /

- Food

- /

- NYSE:DOLE

Is There Now an Opportunity in Dole After Recent Sustainability Initiatives?

Reviewed by Bailey Pemberton

- Wondering if Dole’s current share price actually reflects its real value? You’re not alone in wanting to know whether now is the right time to buy, hold, or move on.

- After a 3.1% bounce over the past week and a smaller 2.1% rise across the last month, Dole’s shares are showing renewed momentum. However, they’re still down 19.5% over the past year.

- Behind these ups and downs, Dole has been navigating shifting trade policy headlines and evolving consumer trends. Recent news cycles have focused on its sustainability initiatives and fresh produce expansion, which are shaping both market optimism and ongoing questions about longer-term risks and returns.

- Based on our six-point checklist, Dole achieves a valuation score of 6 out of 6, suggesting the stock may be undervalued by several important yardsticks. We’ll break down these methods one by one, but keep reading for a different perspective on how to approach Dole's potential value.

Find out why Dole's -19.5% return over the last year is lagging behind its peers.

Approach 1: Dole Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s expected future cash flows and then discounting those amounts back to their value in today’s dollars. This helps estimate what the business would be worth if you owned all its future earnings now. The DCF model is a cornerstone of intrinsic valuation.

For Dole, the most recent Free Cash Flow stands at $64.2 million. Analysts forecast substantial growth, with future Free Cash Flow expected to reach $178.2 million by 2027. Further projections, some based on estimates rather than direct analyst input, suggest Free Cash Flow could reach $240.5 million by 2035. All these values are calculated in dollars and consider long-term growth assumptions in the food sector.

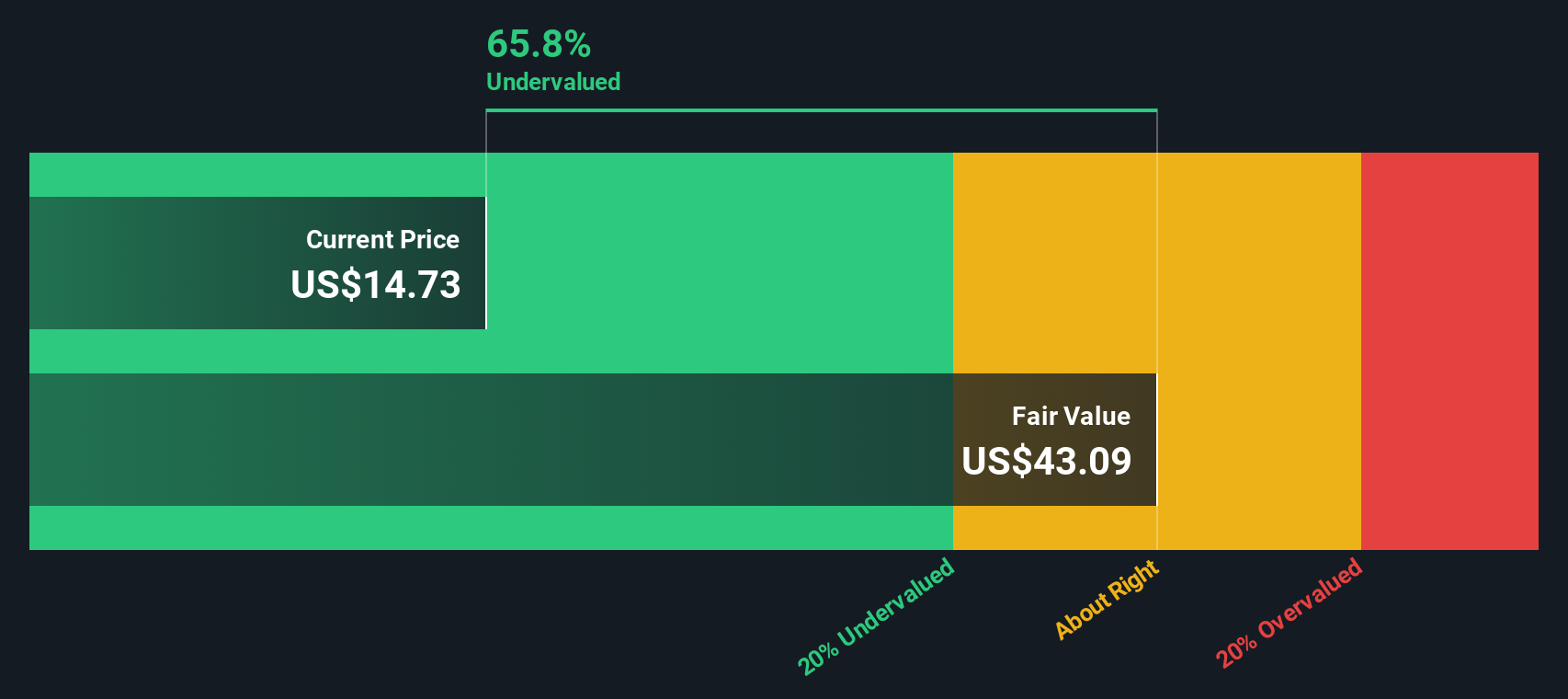

Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Dole is $42.14 per share. This implies the stock is trading at a 68.8% discount to its DCF-based value, suggesting it may be significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dole is undervalued by 68.8%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: Dole Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like Dole because it directly links the company’s share price to its actual earnings. For investors, this makes the PE ratio a clear snapshot of how much they are paying today for each dollar the business earns.

It’s important to remember that the “right” PE ratio is shaped both by how fast a company is expected to grow its earnings and how much risk investors perceive. High-growth, stable companies usually justify higher PE ratios, while slow-growth or riskier firms tend to trade at lower valuations.

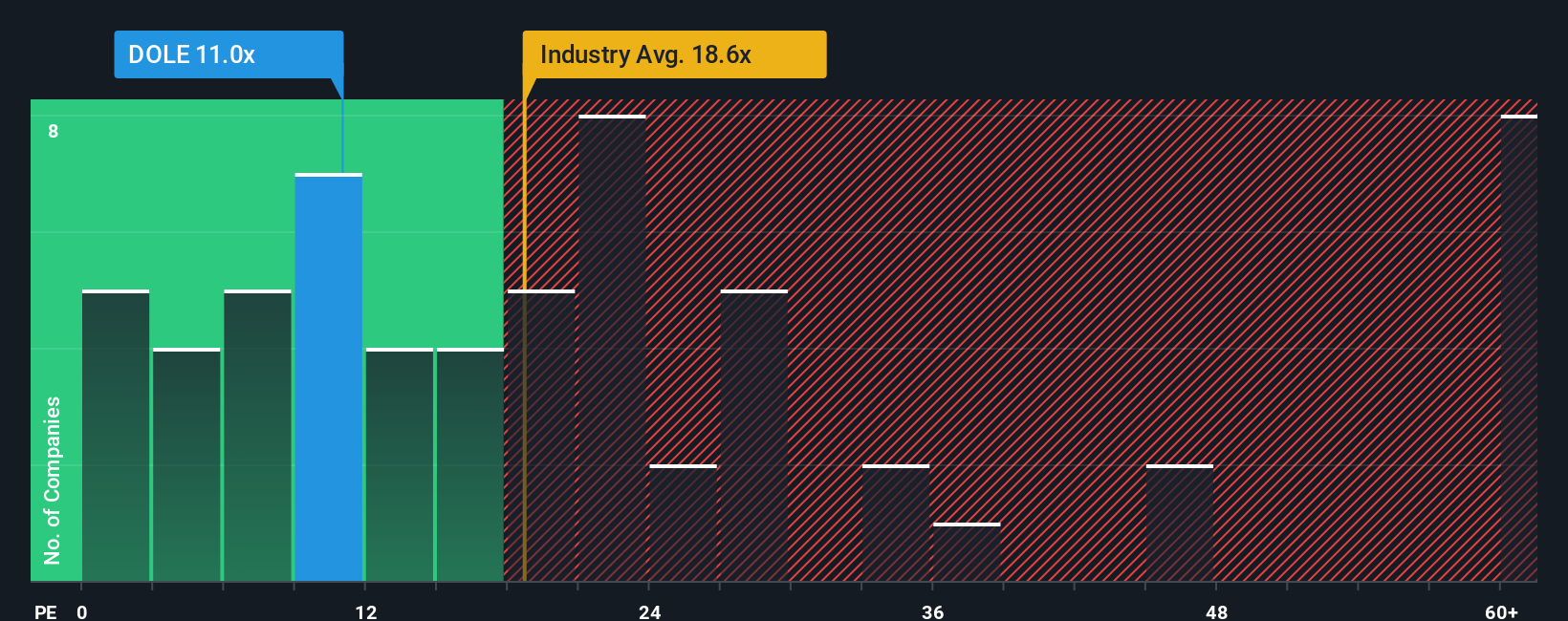

Dole currently trades at a PE of 11.0x. This compares favorably to the industry average PE of 18.6x and its peer group, which averages an even higher 56.6x. On the surface, Dole appears meaningfully cheaper than its direct competitors and the wider food sector.

To move beyond these broad comparisons, Simply Wall St’s proprietary Fair Ratio calculates the optimal PE for Dole based on its unique growth outlook, profit margins, industry profile, company size, and risk factors. This approach provides a more nuanced view, rather than relying solely on industry averages or peer multiples, which may not capture the full picture. For Dole, the Fair Ratio is 16.8x, notably higher than its current multiple.

Since Dole’s actual PE of 11.0x is significantly below its Fair Ratio, this suggests the stock could be undervalued on an earnings basis, with the market potentially underestimating the company’s strengths or future growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dole Narrative

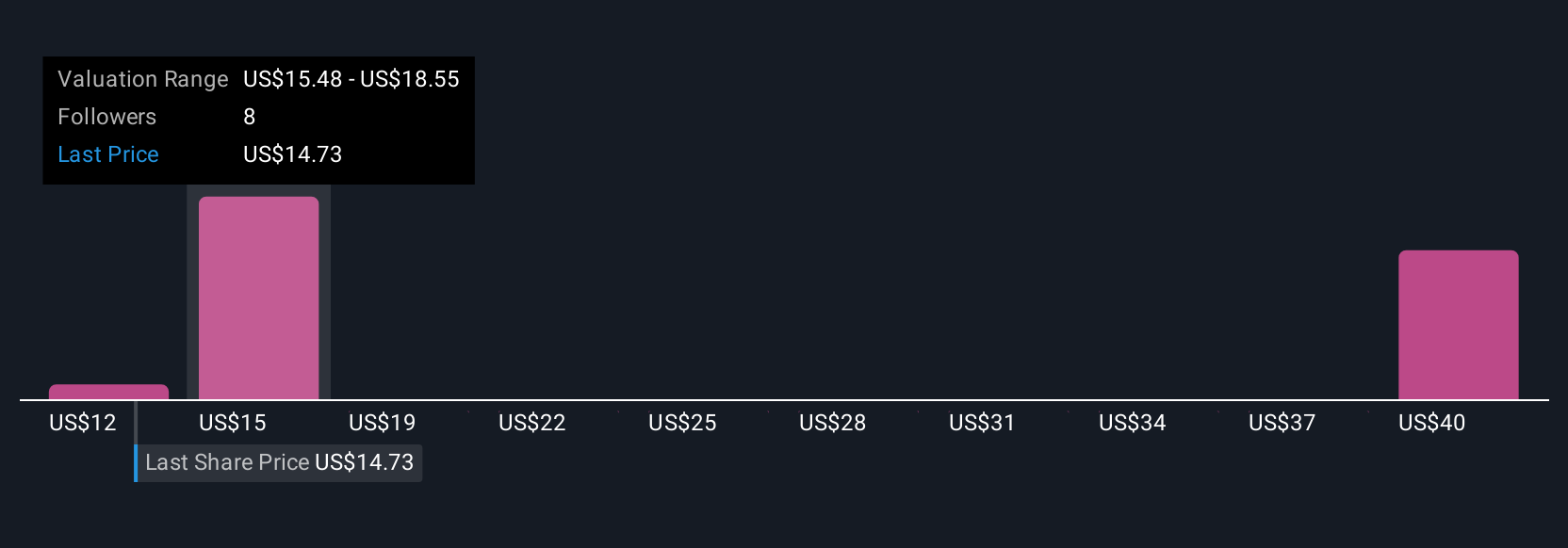

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story behind the numbers, where you bring together your perspective on a company’s future—your assumptions for fair value, future revenue, earnings, and margins—to create a forecast and measure what you believe Dole is truly worth.

Narratives connect Dole’s business story with a financial outlook and synthesize these into an actionable fair value. This makes them much more dynamic and relevant than static numbers alone. Narratives are easy to use and available to all investors on the Simply Wall St Community page, where millions share and explore their views on any stock, including Dole.

With Narratives, investors can compare their own fair value estimates to the current market price and decide for themselves if now is the right time to buy, hold, or sell. Importantly, these Narratives update automatically whenever there’s fresh news, new earnings results, or a major business development, keeping your analysis relevant and timely.

For example, one Dole Narrative based on strong demand and global expansion sees fair value at $21.50. Another factoring in climate and trade risks sees fair value at just $14.00. Your personal Narrative can be anywhere in between, so you are empowered to invest with confidence according to your research and beliefs.

Do you think there's more to the story for Dole? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOLE

Dole

Engages in sourcing, processing, marketing, and distribution of fresh fruit and vegetables worldwide.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives