- United States

- /

- Food

- /

- NYSE:DOLE

How Investors May Respond To Dole (DOLE) Expanding Sustainable Ripening Operations in Poland

Reviewed by Sasha Jovanovic

- Nature's Produce, a Polish importer and distributor, has begun construction of a new Central Distribution and Ripening Center in Ostrowiec, Poland, aiming to enhance the quality and shelf life of 'ready to eat' avocados, mangoes, and other tropical fruits through sustainable technologies.

- This investment is set to improve operational efficiency and strengthen the Dole brand's presence in the Polish fresh produce market, signaling a commitment to long-term growth in the region.

- We'll explore how the addition of a modern ripening facility in Poland could support Dole's European supply chain optimization narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dole Investment Narrative Recap

To be a Dole shareholder, you need to believe that rising demand for fresh produce and ongoing supply chain investments can help offset margin pressures from commodity cost swings, weather, and regulatory unpredictability. The announcement of a new Polish ripening facility is a positive step toward supply chain optimization but does not materially change the immediate focus on earnings volatility and margin risk, which remain the most pressing near-term factors for the business.

Among recent announcements, Dole's successful follow-on equity offering in September is especially relevant, as it provides added financial flexibility to fund initiatives like these infrastructure investments, potentially supporting operating efficiency in the face of market uncertainties. These developments align with a broader catalyst of operational improvement but should be weighed against rising capex and debt service obligations.

However, the greater efficiency potential comes with increasing exposure to sourcing challenges that investors should pay close attention to, especially if...

Read the full narrative on Dole (it's free!)

Dole's narrative projects $9.1 billion in revenue and $163.0 million in earnings by 2028. This requires 1.4% yearly revenue growth and a $49.1 million earnings increase from $113.9 million currently.

Uncover how Dole's forecasts yield a $17.83 fair value, a 37% upside to its current price.

Exploring Other Perspectives

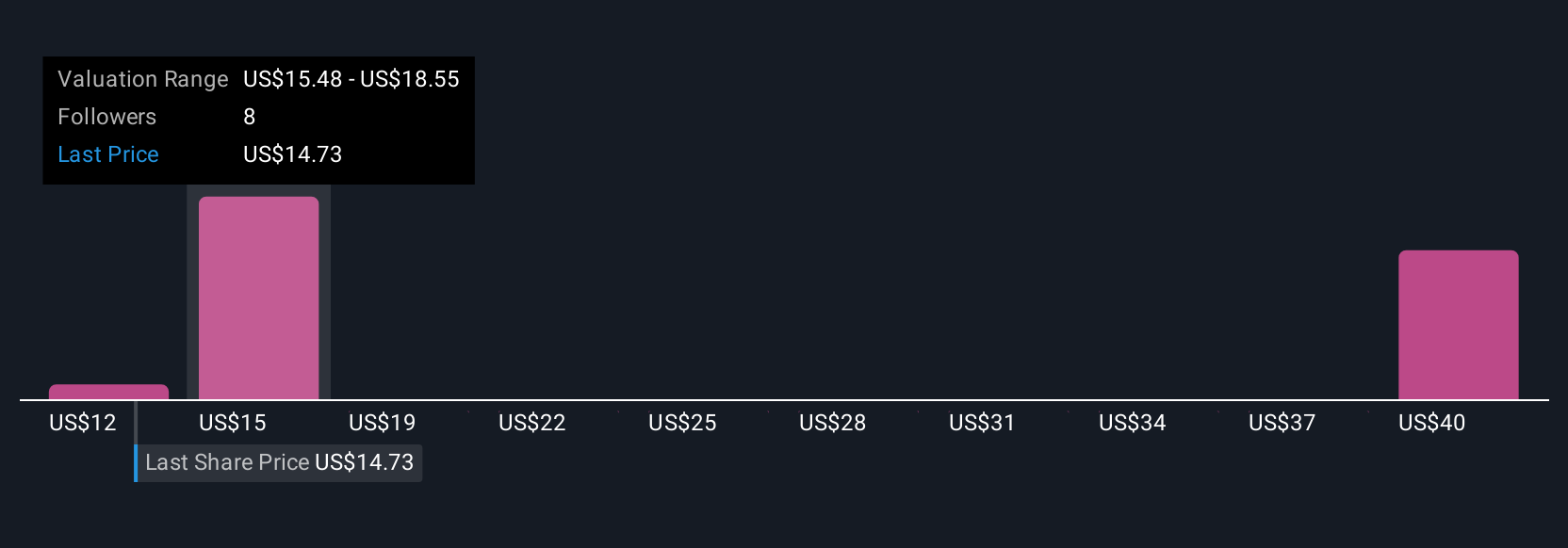

Simply Wall St Community members submitted three fair value estimates for Dole, spanning US$12.41 to US$41.88 per share. While opinions differ widely, many highlight ongoing cost inflation and weather-related uncertainty as challenges for consistent profitability, inviting you to compare these diverse outlooks with your own expectations.

Explore 3 other fair value estimates on Dole - why the stock might be worth just $12.41!

Build Your Own Dole Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dole research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dole research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dole's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOLE

Dole

Engages in sourcing, processing, marketing, and distribution of fresh fruit and vegetables worldwide.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives